| « Back to article | Print this article |

ITC cracks the code in foods, finally

As a business, ITC Foods is younger than many other established players around, having begun operations only a decade ago.

But the Bengaluru-headquartered division has shown why it cannot be taken for granted.

The division has crossed the Rs 3,000-crore-mark (Rs 30-billion) in terms of turnover, has cut its losses significantly and retains growth levels in excess of 25 per cent per annum.

Analysts estimate that within the next few quarters, ITC Foods is likely to break even.

They also say that in a couple of years, the division may touch the Rs 5,000-crore (Rs 50-billion) mark in terms of turnover.

So how has ITC cracked the code in foods?

Click NEXT to read further. . .

ITC cracks the code in foods, finally

That too at a time when rivals such as Hindustan Unilever, who have been around longer in foods, have struggled with the business.

Processed foods clubbed with ice-creams constitute just 6 per cent of HUL's Rs 22,116-crore (Rs 221.16-billion) turnover.

The answer, say experts, lies in the choice of food categories that ITC has opted to play in.

Besides being high-growth segments, ITC, says Anand Shah, FMCG analyst at brokerage Elara Capital, has preferred to step into areas where it can exploit back-end synergies well.

"Whether it is direct procurement from farmers using its e-choupal network or pushing products using its legacy distribution in cigarettes, ITC has got crucial elements of the marketing mix in place in foods," he says.

Click NEXT to read further. . .

ITC cracks the code in foods, finally

This point is endorsed by Chitranjan Dhar, chief executive officer, ITC Foods Division.

He says, "Besides cost-effective sourcing using e-choupal what lends competitive strength is the traceability of the commodity through identity-preserved procurement.

"This enables customised blending (which again is a strength honed from the practice of tobacco blending over the years) to support local tastes and preferences.

ITC's packaging business provides unique solutions and the division also draws upon the synergies of the group company in areas such as consumer insights, branding and efficient trade marketing and distribution.

"The foods business is also able to utilise knowledge from ITC's hotels business and its master chefs when formulating its products."

Click NEXT to read further. . .

ITC cracks the code in foods, finally

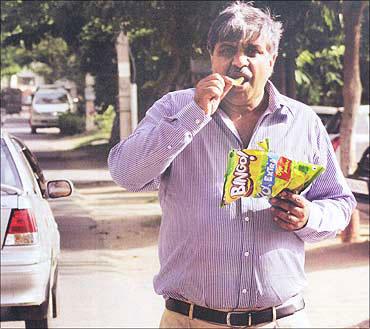

At the moment, ITC has seven brands in foods including Aashirvaad (staples and ready to eat), Bingo (snack foods), Sunfeast (Biscuits and Pasta), Yippee (instant noodles), Min-o and Candyman (Confectionery) and Kitchens of India (Ready to eat).

Of this, ITC has market leadership in staples and confectionery, is number two in instant noodles and ranks among the top three in biscuits, says Dhar.

In categories such as snacks, ITC has positioned itself as a player that offers differentiated products.

Click NEXT to read further. . .

ITC cracks the code in foods, finally

Dhar says, "We have enriched the snacks portfolio with the introduction of a new variant called Tangles where each bite disintegrates into multiple flavour-filled strands. In biscuits, two unique flavours Sunfeast Dark Fantasy Choco Fills and Sunfeast 'Dual' Dream Cream were launched."

This combined with its attempt at premiumising its portfolio have helped the division in logging better sales numbers.

Abneesh Roy, associate director, research, Edelweiss Capital, says, "Sales of value-added and premium products grew at a faster clip, leading to portfolio premiumisation and an enriched sales mix. Portfolio enrichment was driven by products such as Sunfeast Dark Fantasy Choco Fills and Sunfeast 'Dual' Dream Cream in biscuits. In staples, Aashirvaad multi-grain and Select brands continued to grow rapidly."

Click NEXT to read further. . .

ITC cracks the code in foods, finally

HUL hits back

The Mumbai-headquartered company, which is also the largest FMCG company in the country, has put in a place a blueprint to get its act together in foods.

In a recent announcement, HUL said that it was integrating its food services business called Unilever Food Solutions with its out-of-home division in a bid to enhance sales of its food brands.

An HUL spokesperson said, "Out of Home (OOH) Foods and Beverages consumption is a large and growing opportunity in India. In India, we operated in the B2B Institutional space through two separate divisions- Out of Home division for Beverages & Unilever Food Solutions for Foods.

These two divisions are being integrated into one OOH services organization in order to leverage the synergies & efficiencies of having a 'One Unilever' face to customers & a consolidated Go To Market organisation.

"But will it work? The HUL spokesperson says it will.