| « Back to article | Print this article |

'We now know how to avoid a Great Depression'

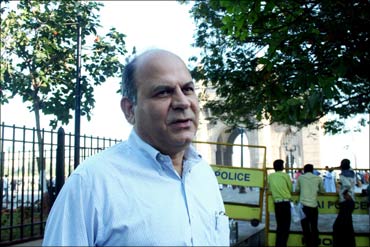

"Don't hold your breath," says Liaquat Ahamed, the 57-year-old author of Pulitzer Prize-winning book, Lords of Finance: The Bankers Who Broke The World, when asked about his second book Bank Wars.

"It's not even started. I shouldn't even be talking about it. Well, I started it because I got the title. I take a long time to write," he adds for good measure.

Ahamed, who began writing the Lords of Finance in 2004, finished it -- fortuitously -- just a week before the collapse of Lehman Brothers in the middle of September 2008.

Incidentally, the book delves with actions (or rather inactions) -- that led to the Great Economic Depression of 1929 -- of four powerful central bankers -- Montagu Norman of the Bank of England, Emile Moreau of the Banque de France, Hjalmar Schacht of Germany's Reichsbank and Benjamin Strong of the Federal Reserve Bank of New York -- in post World War-I era that was characterised by hyperinflation, drop in industrial output, huge rise in unemployment and on the ideological front with the rise of Nazism and Fascism in Germany and Italy, respectively.

Ahamed says that while he was writing the book he could see the same sequence of events being replayed in the United States in the 2008 economic meltdown that led to the Great Depression of 1929.

Only this time around, the US Federal Reserve swung into action to contain the contagion swiftly by loosening its purse strings liberally.

Ahamed spoke to Rediff.com on a wide range of issues related to his book, the Great Economic Depression of 1929, why the economic meltdown of 2008 did not reach the Indian shores, and why he thinks spending dollops of money to save investment banks in the US following Lehman's collapse helped stem the crisis from spiralling.

Click NEXT to read on . . .

'We now know how to avoid a Great Depression'

Tell us about your book, The Lords of Finance: The Bankers Who Broke The World?

It's the story of the lead up to the Great Depression and it's told through multiple biographies of some of the key participants. In particular, the four major central bankers of the world: The head of the New York Fed, the head of the Bank of England, the head of the Reichsbank and the head of the Banque De France.

It's really a way to try to humanise economic policy making which is (laughs) not a very acceptable thing and, secondly, to humanise the story of the lead up to the Great Depression.

And the reason that I chose to do it that way was threefold: one, by turning the spotlight on some of the key decision makers rather than what was happening in the economy was a way of highlighting the fact that the Great Depression was the result of bad economic policy decisions not some inextricable forces.

Secondly, each one of them came from a different country; and, thirdly, one of the hardest things to do when you are writing history is to make it exciting by not knowing how the story ends.

And by telling the story through some of the people involved you keep up the uncertainty of the moment.

Click NEXT to read on . . .

'We now know how to avoid a Great Depression'

Were you surprised with the Pulitzer?

Well, everyone is surprised; there are lots of people competing for it so and they don't give you any warning; like a lot of book prizes will give you who is on their long list or shortlist. . . in this case they keep it a complete secret.

They only tell you that we are going to announce a winner and the two runners up will have their names on their web site on such and such date and such and such time.

My agent went out to the web site and then called me.

Pulitzer for writing a book that deal with the world of economists?

Yeah. Although it's supposed to be a history book it's, well, that was very nice actually.

The title of your Pulitzer Prize winning book, Lords of Finance: The Bankers Who Broke The World, makes these bankers sound like buccaneers. What made you choose this title?

Precisely for that reason (laughs).

They weren't quite buccaneers but look I was trying to put in the sub-title the fact that this (Great Depression) was the result of very bad decisions by, in my case, the central bankers, not commercial bankers. Lords of Finance: The Central Bankers Who Broke The World didn't ring quite the same way (laughs) so The Bankers Who Broke The World is catchy (laughs).

You are a journalist; you should appreciate that (laughs).

Click NEXT to read on . . .

'We now know how to avoid a Great Depression'

In hindsight do you think the Great Depression could have been avoided?

Oh, it was very simple! First of all, we managed to avoid the lead up to this crisis (the economic meltdown of 2008) and the lead up to the Great Depression was exactly the same as the lead up to what happened in 2008.

We managed to avoid a Great Depression this time and it could have happened in the 1929 if they (the four central bankers in England, US, Germany and France) have done what we did now (post collapse of Lehman Brothers) as well by injecting money into the banks, not allowing them to go under, by cutting interest rates to the bone and easing monetary policy, by giving fiscal stimulus they would have easily avoided the Great Depression.

But the four central bankers didn't do this?

The people who ran the world economy in those days didn't understand what they were doing. In that sense, we have learned enormous amount because we now know how to avoid a Great Depression.

We don't understand how to prevent the crisis from happening. It's like saying we don't know how to stop you from having a heart attack, but when you have a heart attack we now know what to do to make sure you don't die.

Click NEXT to read on . . .

'We now know how to avoid a Great Depression'

Did you see the 2008 crisis? Were there enough alarm bells ringing about the impending crash in the housing and financial markets?

I started writing this book in 2004 and I was writing about the late 1920s ... and then I pick up the newspaper and I could see the same sequence of events being replayed in front of my very eyes.

I didn't know if the word financial system was actually going to collapse, but I could see many of the same things. The same bubble, the same easy credit, the same, sort of, speculative atmosphere, the same bankers paying themselves excessively large bonuses that happened then and that happened this time too.

So it was eerily similar.

In 1929 it were the four banks and this time around it was one central bank in the US. If you could see it coming why didn't the central bank in the US see it coming?

I think the bankers this time persuaded themselves that they knew exactly how to control this piece of machinery (the complicated derivative instruments and the overleveraging of assets in the system).

If you look back and think about what happened before 2008 you will see we've had series of crises. 1994 was Mexico, 1997 was Asia, 1998 was Russia and Long Term Capital, 2000 was the tech bubble burst and each time central bankers had managed to avoid a complete breakdown.

<P>Click <STRONG>NEXT </STRONG>to read on . . . </P>

<P><iframe hspace=0 vspace=0 scrolling=no src="http://badges.pages.rediff.com/promote/best-of-business/68709?orientation=16" frameborder=0 width=462 height=60 allowtransparency='true'></iframe><a href='http://pages.rediff.com/best-of-business/68709'><img src=https://imworld.rediff.com/pagesrediff/pix/blank.gif width=0 height=0 target=_blank border=0 /></a>

'We now know how to avoid a Great Depression'

I think they never said there would be a crisis I think what they said is if there is a crisis they know what to do.

Well, that created a sort of sense of complacency and they didn't realise that when there is a really bad crisis all those tools weren't going to work. Because all that central bankers could do was lend money.

And what was needed this time was massive injection of government money to stabilise the situation.

Give us a sense of what you and many in the US went through when Lehman Brothers collapsed? What were your fears then?

I had then just ended my manuscript a week before (the collapse of Lehman). I was relieved (laughs loudly) and I am not going to say I was cheering because this will be good for my book because I wasn't.

But going back to that time Lehman collapsed at the end of about a six-month period of constant banks going under since March that year including Freddie Mac and Fannie Mae. We then got the run on Lehman.

In the meanwhile there have been problems in Europe so you opened up the paper with a sense of trepidation thinking what is going to be next. All of us had our savings in the stock market and were watching those savings sort of decline by the day.

There was a terrible sense of fear.

I think what was even more worrying from my point of view was not when Lehman collapsed. Because when this happened the US Fed injected all sorts of money into the system, they guaranteed the commercial paper market.

Click NEXT to read on . . .

'We now know how to avoid a Great Depression'

I mean they did everything that we required them to do and there was still a run on Citibank. And a month after Lehman it looked as if Citibank might go under.

At that point you said to yourself, 'look, they did everything and it was still going on.' And that I think was a scary moment and not the collapse of Lehman.

Luckily what happened was that they took over a large chunk of Citibank and guaranteed it and slowly Citibank turned around.

But from October 2008 to February 2009 it looked like touch and go.

Were you thinking of a doomsday scenario in these four to five months?

Oh, yeah! Because it still kept going. You got looking as if Citibank might go under, you got Bank of America as it might go under. Then we were seriously talking about the government in the US nationalising the whole banking system. These were the most incredible sequence of events.

They had a debate in February 2009 when the new (Obama) administration took charge and there were people within the administration who were in favour of nationalising the banks and there were other people like (Tim) Geithner and a fellow called Lee Sachs who said that it would be a disaster.

It was again touch and go and they could have done that.

What they ended up doing was the stress test, which, in effect, was a way of shining a spotlight on a situation illustrating to public that the situation wasn't as unstable as everyone said.

Click NEXT to read on . . .

'We now know how to avoid a Great Depression'

How did India manage to keep herself safe through this meltdown?

The international contagion occurred in two ways. First of all foreign banks had put a lot of money in these AAA assets; Indian banks did not. Indian banks had more than enough lending opportunities in their own country.

The people who really bought these (assets like collateralised debt obligations et al) were European banks who did not have much of lending business.

Secondly, the banks that were exposed particularly to wholesale sources of funding, rather than retail sources of funding, saw a run on them.

Indian banks, by and large, had much more stable sources of funding.

Quantitative Easing I is over and done with. Now we are into the next phase of Quantitative Easing, referred to as QE II. Who do you think will ultimately pay the price for all kinds of money being injected into the system?

QE I was necessary because the banks weren't comfortable in lending each other so the US Fed stepped in and said we will take reserves from you and lend it to him (another bank) and it was way of the Fed blowing up its balance sheet by acting as an intermediary.

When someone does something like this there is no price if you like.

It's a good thing to do because it makes sure that if you don't trust him, the Federal Reserve said, 'I trust him, I know his book, so I stand guarantee for you and it worked extremely well'.

QE II is not particularly revolutionary. What they were doing was I mean how do central banks operate? They operate by changing the size of their balance sheets to affect interest rates in very broad terms.

Usually they affect only short-term interest rates. QE II essentially said that short-term interest rates are zero so we would change the size of our balance sheet to affect long-term interest rates. I don't understand why everyone is making such a fuss about QE II. It was exactly the right thing to do; it was a form of insurance policy.

In retrospect, I think it was unnecessary because by then the US was beginning the recovery.

Click NEXT to read on . . .

'We now know how to avoid a Great Depression'

In retrospect can you tell about lessons not learnt from the Great Depression and all other financial crises that we witnessed at the fag end of the 20th century?

One lesson not learnt from financial crises is how to avoid a bubble. And, secondly, how to ensure that the banking system is stable and that when a bubble bursts it doesn't cause the whole western financial system to collapse.

Now, we don't know the answer to how to prevent a bubble because the psychological forces that cause these bubbles are so strong that no central bank can do very much about it.

For the second one we have got a way to stabilise commercial banks by increasing the capital but what is still a major source of instability is the primary way they stabilise the banking system after the Great Depression was through deposit insurance.

Banks are inherently very fragile institutions and deposit insurance stabilised the banking system. The problem is with the growth of wholesale banking; the banking system is so large that no government is in a position to insure all failed deposits.

But when a crisis hits that becomes a major source of problem and I don't quite know how they are going to figure that one out.

It's not even started. I shouldn't even be talking about it. Well, I started it because I got the title. Don't hold your breath. I take a long time to write.

My shareholders have forbid me to even think about making another movie.