| « Back to article | Print this article |

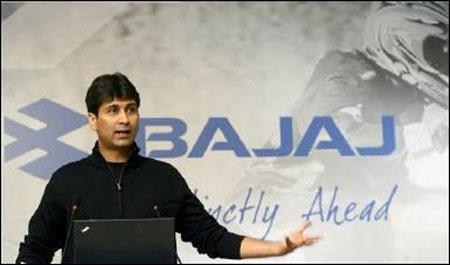

Our relationship with Renault-Nissan is an open book: Rajiv Bajaj

Rajiv Bajaj, the managing director of Bajaj Auto, the country's second-largest motorcycle manufacturer, holds a contrarian view on the economic slowdown. In an interview with Surajeet Das Gupta, he talks about his de-risking strategy, as well as his company's much-speculated relationship with Renault-Nissan, which many thought was over. Excerpts:

The motorcycle market has been on the decline this financial year. Are you worried, like most other players in the business?

I am certainly not going to jump on the gloom-and-doom bandwagon. Yes, the market is weak - negative by two to four per cent - but that is acceptable. The industry sells 750,000 to 800,000 motorbikes a month. If you cannot make money in such a big market, you are incompetent.

You had launched the RE 60 project at this year's auto expo. Has the project got delayed due to lack of permissions from the government?

We are holding various meetings with central government officials. We will shortly go for pilot production. Whether it will take the government three months or three years to give permission is anybody's guess. But we are de-risking. I cannot allow administrative failure to become a business defect.

We are preparing for international markets like Sri Lanka, Bangladesh, Africa, Egypt and Latin America. As a manufacturer, I can only innovate; if it benefits other markets before India, it will be unfortunate. We should be able to launch the product in four-five months. We will start with a manufacturing capacity of 200 RE 60s per day, or 5,000 units a month.

There is no clarity on your relationship with Renault. Is it, as a Nissan executive visiting India recently said, a closed chapter?

I don't know what to make of the comment. It is still an open book. We have provided them all the information on the project and do ask them once every month or two. They say we are discussing internally.

Did the Nano's failure change your mind on the need to work on a car?

First, the car business has poor profitability, unless you are differentiated (like BMW or Porsche). Second, Bajaj's marketing position is as an anti-car company. We would like people to give up cars and ride around on mobikes and scooters, three-wheelers and four-wheelers. It was with this aim that we started talking to Renault-Nissan. If it wanted to make a car, it would not come to us.

In November 2009, much before the Nano ran into trouble in the market, it had become clear that such a concept would not work. Also, the ultra-low-cost project was conceived in the same direction. I met Carlos Ghosn and told him I could not take this chance. I discussed with him the idea of the RE 60 and he gave his go-ahead.

What has Renault-Nissan's response to the RE 60 been?

I am still waiting. They said they would come back, and my team has been talking to them. I can merely speculate that they could be awaiting the quadricycle regulation in India. They have been fully supportive of the new segment at all SIAM meetings.

You already have the R60. Will you be open to the idea of Renault-Nissan selling the same product in India?

We can both sell the product, of course, after the vehicle goes through some minor modifications. The R60 is positioned as a commercial vehicle and does not aim to win a beauty contest. Renault might want to sell it as a personnel vehicle. In that case, we can jazz it up a little so that they can target young boys and girls.

Will you stick to mobikes or re-enter the scooter segment, which is growing fast?

In India, 70 per cent of sales volumes in two-wheelers come from mobikes. Globally, we sold four million motorcycles in a world market of 40 million. So, we are far from being a dominant player even in mobikes. At least in the home market we should be neck and neck with the leaders and have at least 20 or 30 per cent share in the foreign markets.

We are not what McDonald's is to burgers; that's what we want to be.

The mobike market is de-growing. Do you see the trend continuing in the next three to six months. And does that worry you?

Bajaj is having a good year, with Ebitda (operating earnings) margins of 20 per cent. As our interest cost is zero and depreciation is less than one per cent of sales, our profit before tax is also 20 per cent. We are holding on to volumes, our market share has moved up to 27 per cent and we do not offer discounts to push sales.

On the next three to six months, no one knows. We chase demand, not growth, because demand is a matter of fact; growth is a marketing man's speculation. Remember, a one per cent market share increase means 7,500 extra bikes a month, which is what Suzuki sells the whole month.

Unlike cars and trucks, where fixed costs are high, two-wheelers are like fast moving consumer goods - low fixed costs, so you don't need huge volumes to make money.

Your much-touted Bharat bike through the Boxer 150cc was a failure. What went wrong?

It did not go anywhere in the domestic market. But we had de-risked our strategy. We developed the Boxer as a platform from 100cc to 150cc and in Nigeria, the 100cc bike has 50 per cent market share. So, even if the 150cc bike failed in India, my platform did not.

The 150cc did very well in Egypt and Kenya, too. However, in India, a mobike with more power and torque at Rs 40,000 was not accepted, perhaps because consumers were worried about the fuel economy, with prices hitting over Rs 70 a litre.

However, since we don't make products for one market but build platforms for global markets, the failure of one variant in one market has no inimical impact upon our business.

Are you worried about Honda's aggression in the country?

It has had two great successes, the Activa and the Shine, two-three mediocre successes and five failed models.

We are not dismissive of them but don't expect me to shake in my boots, given these statistics. As far as Hero is concerned, I recognise they are the market leader for 10-12 years and I can't wish them away; they sell twice as many bikes as we do.

How is the relationship with European bike maker KTM going? Has it helped you in the international market?

We partnered KTM not for technology but for marketing, to markets like the US, Japan and Australia, which would have never happened in my lifetime if we went alone. We own 47 per cent in KTM and we are selling 100,000 bikes in the US, Japan and Australia.

Increasingly, we have started shipment from Chakan in India of the Duke 125cc to Europe; by July, it became a class leader in the 125cc segment in Europe, We also exported bikes from India to Japan.

Ratan Tata had said he was building the Nano because he did not find two-wheelers a safe vehicle in India. What is your response?

My response is that a two-wheeler is not an unsafe vehic#8804 it is a vulnerable vehicle because it gets run over by overloaded Tata trucks!