| « Back to article | Print this article |

Mallya finally talks of selling his businesses

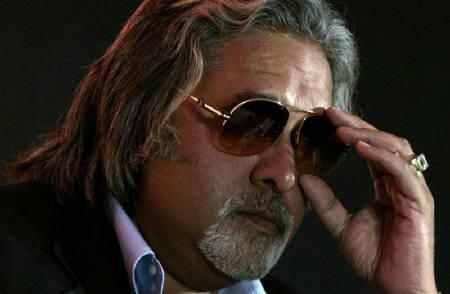

Vijay Mallya, billionaire chairman of UB Group, is in a tough situation, with his Kingfisher Airlines in a tight corner and the possibility of ceding control over his flagship, United Spirits, to Diageo.

In a conversation with Business Standard after an eventful annual general meeting of Kingfisher, he clears the air on many aspects.

Click NEXT for the edited excerpts:

Mallya finally talks of selling his businesses

Will it not be a setback if you have to cede control to Diageo in United Spirits?

First, please understand that negotiations with Diageo are on and there is no certainty of the transaction going through.

Having said that, I am a businessman and my businesses are for sale at the right price.

However, one must also understand that running an alcohol beverages business in India across 28 cities is not an easy task for a relatively new player.

They will require me to run their business effectively and control of the business is one aspect of that.

Click NEXT to read further. . .

Mallya finally talks of selling his businesses

What options are you exploring in these negotiations?

When Scottish & Newcastle acquired stake in United Breweries, there was enormous wealth created and it continues to do so in the joint venture with Heineken.

I will be driving the talks with Diageo with the same focus.

If you go back in history, I acquired Berger Paints and exited with a hefty premium.

There are enough such examples in the past 31 years of my life with the UB Group and it will continue.

Click NEXT to read further. . .

Mallya finally talks of selling his businesses

What are the next steps you are initiating in weaning KFA out of the high debt issues it is under?

First, we are doing all we can to recapitalise the airline.

During the past eight-months of this financial year, the promoters have infused Rs 1,154 crore (Rs 11.54 billion) into it.

This is a concrete indication that we are fully committed to this business, despite tough working conditions.

Now, with the government of India officially notifying the foreign direct investment move in civil aviation, we are indeed engaged with a few strategic global aviation players, as well as some Indian investors.

It has been hardly around a week since the decision was notified and things will play out. We have 40-aircraft under our rolls and we will eventually scale up operations.

Click NEXT to read further. . .

Mallya finally talks of selling his businesses

On hindsight, was venturing into civil aviation a costly mistake, given that the problems of Kingfisher are starting to affect other UB Group companies?

There have been many external factors which affected the operations as we were expanding.

The price of oil doubled from $40 a barrel and the rupee depreciated.

We had also ordered a certain number of aircraft from Airbus and due to these external factors, we could not just cancel the order.