| « Back to article | Print this article |

'GST would be single biggest reform after 1991'

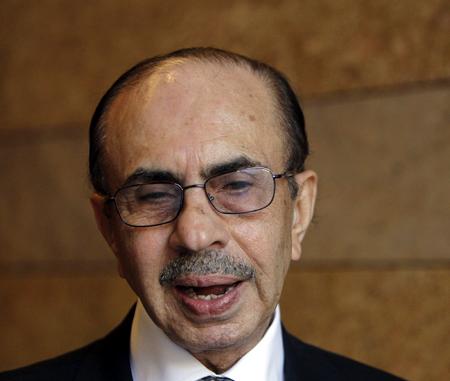

Adi Godrej, chairman of the Godrej Group, recently took charge as president of the Confederation of Indian Industry.

In an interview with Business Standard, industry's apprehensions over some of the Budget taxation proposals on stalled reforms and so on.

Edited excerpts:

Industry has been talking about the negative impact on investment sentiment of the Union budget proposals on retrospective amendments to the Income Tax Act and the General Anti-Avoidance Rule. Finance Minister Pranab Mukherjee has so far only said he may put some safeguards on GAAR. Is there a kind of standoff between the government and industry on these issues?

I don't think so.

We have made it very clear to the government that aside from any effect on taxation, these proposals have created a negative perception about India and that is not good. Overall, we need more investment, higher growth.

Click NEXT to read further. . .

'GST would be single biggest reform after 1991'

In our annual general meeting, where finance ministry officials also came, they said they'd understood some of the problems.

I am hoping the issues will get resolved.

Does resolving mean the proposals should be taken out?

Retrospective is bad. GAAR has to be carefully applied. If there is a clear tax evasion, something should be done.

Avoidance is a difficult term to define.

There are GAAR provisions in many countries; they must be sensible provisions. The GAAR provisions will create a lot of difficulties for investments in India.

What about the counter-question posed to industry -- do you want India to be a no-taxation country or a tax haven?

There can be zero tax situations if these have been provided for.

If you have a tax treaty with a country and because of that a lot of investment comes in and you benefit from this, it is wrong to complain that it was tax exemption.

That is the kind of incentive that brings the investment.

Click NEXT to read further. . .

'GST would be single biggest reform after 1991'

Former CII president Rahul Bajaj has spoken of draconian powers to tax officials. How do you view those comments?

Those (powers) are totally unacceptable.

It is against the Constitution, to my mind. We have taken it up with the finance minister.

What reforms did you emphasise at your meeting with Prime Minister Manmohan Singh on Wednesday?

Various kinds.

The most important reform, which will have a very strong positive effect on growth and the macroeconomic situation, is the goods and services tax.

GST is the biggest single reform after 1991. It can add 1.5 per cent to GDP.

Click NEXT to read further. . .

'GST would be single biggest reform after 1991'

States are not coming on board as they feel the finance ministry is not fulfilling its commitment on compensation to them for cut in central sales tax rates. Will CII take up this issue?

We have communicated some of the issues that states have. In fact, the meeting the finance minister had with the empowered committee of state finance ministers went very well and we understand GST is on track.

What is your premise on questioning the government's fiscal consolidation target? As you said in your presentation, fiscal deficit numbers are difficult to be met this year?

We are not questioning the target.

It will be difficult to meet but if you cut subsidies, it can be done.

It is a question of how you tackle it.

Cutting subsidies will also mean deregulating diesel and effectively deregulating petrol as well, which will also have inflationary impact. So, there are always pros and cons.

Click NEXT to read further. . .

'GST would be single biggest reform after 1991'

Traders have opposed foreign direct investment in multi-brand retail. How do you see consensus emerging on this issue?

Not all traders are against.

Modern retail has been here for many years and it has not affected the traditional kirana merchants.

They have grown.

We know, as we deal with both. Protection and vested interests are not the right way to go.

If India does not reform, then we will not add value.

We should look at what is good for India, by and large. Let me also tell you, for a company like ours, a fast moving consumer goods company, FDI in multi-brand retail might be negative.

But we should look at what is in India's interest, not in my company's interest.

Click NEXT to read further. . .

'GST would be single biggest reform after 1991'

You are in the manufacturing sector. FDI in multi-brand retail will impact the services sector.

If there is multi-brand modern retail, the bargaining power of manufacturers change. With smaller retailers, it is much better.

Our policies should be based on what is good for growth, not for vested interests.

After RBI cut the repo rate by 50 basis points, the data released by the government showed retail inflation in urban India in double digits. And, CII is now demanding further repo cuts by 100 basis points. Will such a step not fuel inflation?

The right way to tackle inflation is not monetary policy. Inflation is created by two things.

One is global commodity prices, on which we have very little control and monetary policy has no control on it.

Second, there are supply-side issues which are creating inflation. These should be tacked. This is especially on food products that are perishables.

Click NEXT to read further. . .

'GST would be single biggest reform after 1991'

Another issue you touched upon was reliability of the Index of Industrial Production data. In the recent IIP goof-up, consumer non-durables' production increase was bloated to over 40 per cent while the actual numbers were 11 per cent, and the IIP at 6.8 per cent against actual figures at 1.1 per cent.

Your company is also engaged in consumer non-durables. Do you think this kind of major goof-up impacts the decisions of investors?

That was some wrong input in sugar production. If you put in wrong data, clearly it will affect the investment decisions.

The government should be more particular about statistical calculations.

What makes you think the economy will grow by 7.4-7.6 per cent this financial year? The Asian Development Bank pegged it at seven per cent.

ADB has one rate, many analysts have another. If GST is brought in early, growth could be even higher. It depends on how the reform process goes.

This is our current estimate.

Does this factor in the effect of retrospective amendments (in tax laws)?

No. I don't want to be that precise, as the projections are also not precise.