Andy Mukherjee

Investors would have much preferred a gritty, honest appraisal of the tough trade-offs.

Investors tuned in to Indian Finance Minister P Chidambaram’s Budget speech on Monday expecting realism. They got treated to a magic show instead.

Not only will the budget deficit this year be lower than the government’s target, but Mr Chidambaram assured investors it would fall further in the fiscal year that starts in April to 4.1 per cent of gross domestic product (GDP), from 4.6 per cent this year.

This mirage of fiscal consolidation is the result of a well-known trick. Mr Chidambaram himself has demonstrated the sleight of hand more than once before.

The assumptions for revenue growth that went into the forecast are so wildly optimistic that investors will discard them as unbelievable anyway. India’s next government will come up with its own – hopefully more realistic – projections for tax and privatisation proceeds by July.

…

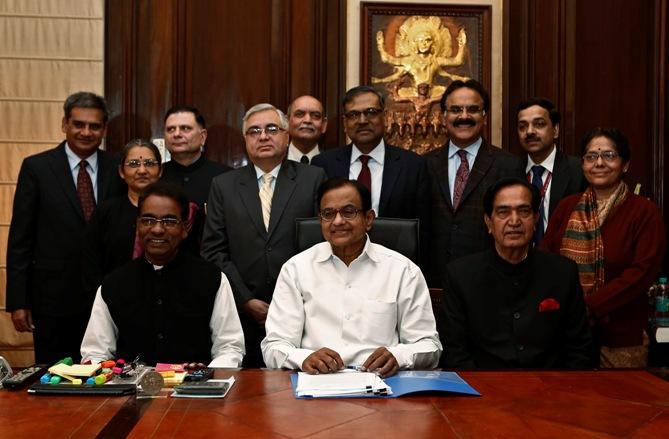

Budget: A magic show from Chidambaram

Image: Finance Minister Palaniappan Chidambaram (C) sits with his staff before making the final touches to the interim budget for 2014/15 in New Delhi.Photographs: Adnan Abidi/Reuters

Besides, even if Mr Chidambaram’s deficit reduction scenario proved accurate, it could actually mean self-defeating austerity. Hitting the target would require a severe compression in public spending which, if attempted, could stall the sputtering economy.

Even then, the deficit target might remain elusive because tax collections would also decline. At the same time, the next government will have to shoulder the burden of an extra one per cent of GDP in subsidies deferred from this year.

But the truly disappointing part of Mr Chidambaram’s performance was its utter pointlessness: the finance minister didn’t really have to act as an illusionist.

Investors who not long ago cheered his reform plans would have much preferred a gritty, honest appraisal of the tough trade-offs that face an economy mired in stagflation and a confident, bold strategy to break out of a largely self-inflicted middle-income trap.

What’s more, Mr Chidambaram could have found it in him to be imaginative. After all, it’s very unlikely that his government will return to power after this year’s general election. That means he wouldn’t have to follow through on any tough promises.

…

Budget: A magic show from Chidambaram

Image: Raghuram Rajan.Photographs: Courtesy, IMF

Rather than propose anything new, the finance minister used his bully pulpit in Parliament to preach to the central bank, asking it to “strike a balance between price stability and growth”.

This was a thinly veiled attack on Reserve Bank Governor Raghuram Rajan’s plan to turn the Indian monetary authority into an inflation-targeting central bank.

The attack makes little sense. After all, Mr Rajan’s painful reversal of his predecessor’s premature interest rate cuts has managed to bring retail inflation down to below 10 per cent.

Consumer expectations of future price gains are still not well anchored, which is why Mr Rajan wants to install a credible monetary policy regime. And he’s right. As the US Federal Reserve removes the worldwide glut of cheap dollars, high-inflation emerging economies are sitting ducks for episodes of capital outflows such as the one that saw the rupee plunge last summer.

But the growth-inflation trade-off wasn’t the only one Mr Chidambaram missed. He pointed out that in recent years India’s investment rate hadn’t fallen as fast as the savings rate.

…

Budget: A magic show from Chidambaram

Photographs: Reuters

That’s no reason, though, for the government to pat itself on its back. The difference between the two rates, after all, is the country’s current account balance. It’s only because domestic financial savings collapsed, with households getting spooked by high inflation and moving their money into gold, that the current account deficit widened precipitously, creating a large vulnerability to fickle global capital flows.

The authorities were woefully late in waking up to the gap, and only did so when the currency and bond markets gave them the unpleasant message that financing the shortfall was going to be a severe challenge given the rising global cost of capital.

It was surprising, therefore, that Mr Chidambaram made light of the current account deficit in his speech. He said that when it comes to financing the deficit, “there is no room for any aversion to foreign investment” regardless of whether it is equity or debt.

But debt-creating hot money inflows induce financial crises with unfailing regularity in emerging markets. Foreign direct investment, which is largely in the form of equity, doesn’t have the same destabilising effect.

…

Budget: A magic show from Chidambaram

Photographs: Reuters

To say the nature of capital inflows doesn’t matter for India is pure hubris. Believing it will simply keep the financial system forever at the mercy of hot money.

Lowering that vulnerability means competing for multinational corporations’ investment dollars. But India’s investment climate is not improving. The tax regime has become unpredictable. On such “doing business” issues, the Budget had precious little to say.

Mr Chidambaram blew what might well be his last chance to engage in economic statesmanship. He blamed anaemic global growth since 2008 for the economy’s poor performance without answering why a slow recovery in world output should, instead of leading to a shallow, easily corrected downturn, spawn a full-blown balance sheet crisis in India.

And a balance sheet crisis it certainly is. Company bosses who until just a few years ago were at the forefront of capacity addition in the economy are so stretched that one of them – a businessman-turned-lawmaker – recently let loose a pepper spray assault on fellow parliamentarians.

…

Budget: A magic show from Chidambaram

Image: SBI headquarters, MumbaiPhotographs: Manjulkumar/Wikimedia Commons

The shocking act was his angry response to the proposed redrawing of the boundaries of his home state, a move that could leave his heavily indebted company, once the country’s largest non-state power producer, poorer than it already is.

But the malaise is not restricted to company balance sheets. It has permeated into state-owned banks, which own a majority of the country’s financial assets. Even so, Mr Chidambaram decided not to grapple with the trade-off between a smaller fiscal deficit and the urgent need to boost loss-absorbing equity at government-controlled banks.

Moody’s Investors Service estimates they will need $4 billion to $6 billion in extra capital in the coming year. In his Budget, the finance minister allocated a fraction of that amount. Maybe Mr Chidambaram is optimistic banks will be able to raise money on their own from the market.

But no amount of magic will produce such a happy outcome — it will take a miracle. Investors who were hoping for something more honest and prosaic have good reasons to be disappointed.

The writer is the Asia economics columnist at Reuters Breakingviews in Singapore. These views are his own.

article