| « Back to article | Print this article |

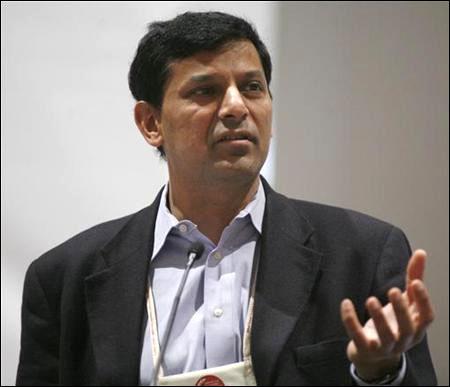

Inflation limiting RBI's ability to boost growth, says Rajan

Reserve Bank of India Governor Raghuram Rajan said the challenge of containing inflation is limiting the central bank's ability to boost economic growth, while urging the government to continue with fiscal consolidation to support the economy.

The comments were included in the foreword of the central bank's financial stability report published on Monday, which comes after the RBI surprised investors by keeping interest rates unchanged this month after raising them by a total of 50 basis points in September and in October.

Click NEXT to read further. . .

Inflation limiting RBI's ability to boost growth, says Rajan

Analysts say the RBI could resume tightening monetary policy by early next year should inflation remain high, even as the economy is growing below the decade low of 5 percent posted in the fiscal year ending in March.

The report also reiterated the RBI's previously stated concerns about the level of bad assets in the banking sector, while noting a corporate ‘failure’ could trigger contagion in the interlinked banking system.

"The outlook for the economy has improved, with export growth regaining momentum, but growth is still weak," Rajan wrote.

Click NEXT to read further. . .

Inflation limiting RBI's ability to boost growth, says Rajan

"The challenges of containing inflationary pressures limit what monetary policy can do."

The RBI report also called the "fall in domestic savings and relatively high fiscal deficit" as other key concerns for the Indian economy.

The government is expected to slash spending to meet a fiscal deficit target of 4.8 percent of gross domestic product for the year ending in March.

Rajan urged the government to continue to push through policy reforms and fiscal consolidation, while noting the prospect of a divided verdict in general elections due by May was creating investor uncertainty.

"Policy certainty is something investors look for in the current environment," Rajan wrote in his foreword.

"A stable new government would be positive for the economy," he added.

© Copyright 2024 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.