| « Back to article | Print this article |

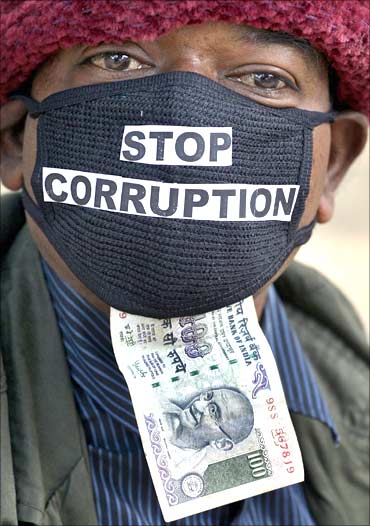

Corruption, inflation major concerns: Survey

Corruption and inflation were major concerns among Indian investors, according to a survey done by ValueNotes on behalf of JP Morgan Asset Management in December.

However, investors were less worried about the global economy, keeping the overall confidence high, the survey showed.

"Even as Indian investors appear less worried about the global economy, domestic concerns have resurfaced.

"Worries over inflation are still dominant, but corruption has emerged as a major issue," said Arun Jethmalani, managing director, ValueNotes.

"This has kept investors' confidence down and is impacting fresh investments," he added.

Click NEXT to read further. . .

Major concerns for India? Corruption, inflation

The survey was conducted in Mumbai, Delhi/NCR, Kolkata, Chennai, Ahmedabad, Bengaluru, Pune and Hyderabad.

Inflation remained the biggest concern over the four quarters ended December 31, 2010, among retail investors (19 per cent), companies (63 per cent ) and advisors (48 per cent).

Corruption emerged as the new confidence killer with 19 per cent retail investors, eight per cent companies and 16 per cent advisors saying it was the most negative economic indicator in the current scenario, the survey showed.

Click NEXT to read further. . .

Major concerns for India? Corruption, inflation

Overall, the JP Morgan Asset Management -- ValueNotes Investment Confidence Index -- stood at 146.3 for the December 2010 quarter, up 0.9 points from the September 2010 quarter.

The retail ICI ranked highest at 159.5, followed by the advisor confidence index (147.2) and the corporate confidence index (132.2).

A significant percentage of retail investors (47 per cent) and their advisors (44 per cent) indicated interest in markets outside India.

Click NEXT to read further. . .