| « Back to article | Print this article |

India's most admired business leaders

From the License Raj to the post-liberalisation era, Indian business has travelled a long way. During this journey, several men and women have radically changed the business scenario in India and elsewhere. From services to manufacturing, Indian companies are leaving their mark in various continents.

From followers, many Indian companies are now leaders in their respective fields. Here is a list of those brilliant men and women who, in the past 20 years, have shaped the course of India Inc:

Please take the poll at the end of the slide show and select the person you feel is India's top business leader. If you have a name that is not in the list, please feel free to write your thoughts in the message board below.

Ratan Naval Tata

Chairman, Tata Group

In 1991, he took over as group chairman from J R D Tata, pushing out the old guard and ushering in younger managers.

Under his guidance, Tata Consultancy Services went public and Tata Motors was listed on the New York Stock Exchange. In 1998, Tata Motors introduced his brainchild, the Tata Indica.

On January 31, 2007, Tata Sons successfully acquired Corus Group, an Anglo-Dutch steel and aluminium producer. The merger created the fifth largest steel producing entity in the world. On March 26, 2008, Tata Motors bought Jaguar & Land Rover from Ford Motor Company.

Ratan Tata's dream was to manufacture a car costing Rs 100,000. He realised his dream by unveiling the Nano in New Delhi Auto Expo on January 10, 2008. It was finally launched on March 23, 2009.

Click on NEXT for more

India's most admired business leaders

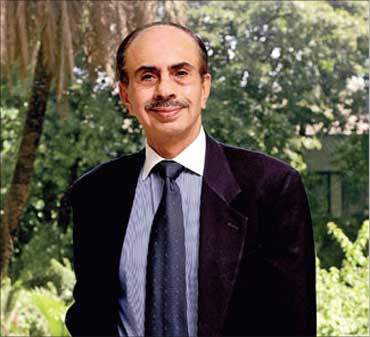

Adi Godrej

Chairman & Managing Director, Godrej Group

He took the Godrej Group to great height even during controlled economy era.

An industrialist and a philanthropist, Godrej modernised and systematised management structures and implemented process improvements.

After India's economy was opened up, Godrej restructured the company's policies to meet the challenges of globalisation.

In the early 2000s, the Group completed a 10-year restructuring process through which each business became a stand-alone company with a CEO/COO from outside the Godrej family.

Godrej, a major supporter of the World Wildlife Fund in India, has developed a green business campus in the Vikhroli township of Mumbai, which includes a 150-acre mangrove forest and a school for the children of company employees.

Click on NEXT to read more...

India's most admired business leaders

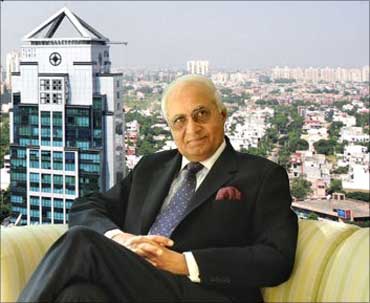

Kushal Pal Singh

Chairman & CEO, DLF Ltd

Gurgaon became a world-famous outsourcing destination in span of a decade because of K P Singh's world-class earthquake-proof office buildings, apartments, shopping malls and leisure facilities.

In 2008 he became the world's richest real estate tycoon.

In 1960, he joined American Universal Electric Company and soon after its merger with DLF Universal Limited in 1979, he took over as the managing sirector of this new company.

DLF has an estimated land bank of 10,255 acres.

Click on NEXT to read more...

India's most admired business leaders

Chanda Kochhar

MD & CEO, ICICI Bank

In May 2009, Chanda Kochhar took over the reins of the bank from K V Kamath.

Kochhar has also consistently figured in Fortune's list of 'Most Powerful Women in Business' since 2005.

In 2009, she debuted at number 20 in the Forbes 'World's 100 Most Powerful Women list'.

Click on NEXT to read more...

India's most admired business leaders

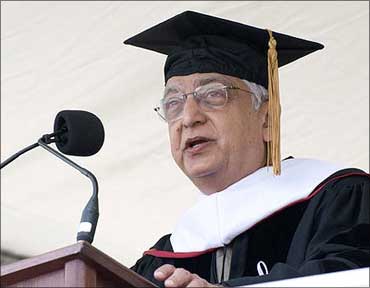

Azim Hashim Premji

Chairman, Wipro Limited

At the age of 21 he took over the family business -- Western India Vegetable Product Company -- when his father, M H Premji, suddenly passed away in 1966.

The Western India Vegetable Product later became Wipro Products Ltd, Wipro Technologies and Wipro Corporation.

Under Premji's leadership Wipro embarked on an ambitious phase of expansion and diversification. The Company began manufacturing light bulbs with General Electric and other consumer products including soaps, baby care products, shampoos, powder

In the 1980s Wipro entered the IT field, taking advantage of the expulsion of IBM from the Indian market in 1975.

Premji is known for his modesty and frugality in spite of his wealth. He drives a Toyota Corolla, flies economy class prefers to stay in company guest houses.

Premji has been recognised by Business Week as one of the greatest entrepreneurs globally.

In 2009, he was awarded an honorary doctorate from Wesleyan University in Middletown, Connecticut, for his outstanding philanthropic work.

Click on NEXT to read more...

India's most admired business leaders

Yogesh Chander Deveshwar

Chairman & CEO, ITC Limited

In 1994 Deveshwar rejoined ITC and was appointed whole time director and vice chairman of the company. He took over as chairman of ITC in January 1996.

He is the person who dreamt of making ITC Limited into India's largest fast moving consumer goods company.

Click on NEXT to read more...

India's most admired business leaders

Nagavara Ramarao Narayana Murthy

Founder & chief mentor, Infosys

He was the CEO of the company for 21 years, from 1981 to 2002. After stepping down as CEO in 2002, he has broadened his scope of activities to social services as well as promoting India globally.

Murthy started a new venture capital fund called Catamaran Venture Fund with the money he got by selling 800,000 Infosys shares worth Rs 174 crore (Rs 1.74 billion).

His wife, Sudha Murthy, also helped him set up his VC fund by giving him Rs 430 crore (Rs 4.3 billion) which she got by selling quarter of her stake in Infosys.

Murthy siad, "I want Infosys to be a place where people of different genders, nationalities, races and religious beliefs work together in an environment of intense competition but utmost harmony, courtesy and dignity to add more and more value to our customers day after day."

Click on NEXT to read more...

India's most admired business leaders

Kiran Mazumdar-Shaw

Chairman & Managing Director, Biocon Ltd

She founded Biocon India with a capital of Rs 10,000 in 1978. The initial operation was to extract an enzyme from papaya.

Her application for loans was turned down by banks on two counts - biotechnology was then a new word and the company lacked assets.

Over the years, the company grew under her leadership and is today the biggest biopharmaceutical firm in India.

Click on NEXT to read more...

India's most admired business leaders

Sunil Bharti Mittal

Chairman & Managing Director, Bharti Enterprises

A first generation entrepreneur, Mittal started his first business -- to make crankshafts for local bicycle manufacturers -- in April 1976 at the age of 18, with a capital investment of Rs 20,000 borrowed from his father.

In 1980 he sold his bicycle parts and yarn factories and moved to Mumbai. In 1984, he started assembling push-button phones in India.

In 1992, he successfully bid for one of the four mobile phone network licences auctioned in India. His plans were finally approved by the government in 1994 and he launched services in Delhi in 1995.

Bharti Cellular Limited offered services under the brand name AirTel. In November 2006, he struck a joint venture deal with Wal-Mart, the US retail giant, to start a number of retail stores across India.

In July 2006, he attracted many key executives from Reliance ADAG, NIS Sparta and created Bharti Comtel.

Mittal, failed in his bid to buy South African telecom giant MTN, but was successful in buying Zain Telecom of Kuwait.

Click on NEXT to read more...

India's most admired business leaders

Subramanian Ramadorai

Vice-chairman, Tata Consultancy Services

Beginning his career with TCS as a junior engineer, he rose through the ranks and eventually was charged with setting up TCS' operations in the United States in 1979 in New York City.

Ramadorai spearheaded TCS' quality initiatives, taking sixteen of its Development Centers to SEI's CMM Level 5, the highest and most prestigious performance assessment issued by the Software Engineering Institute.

Click on NEXT to read more...

India's most admired business leaders

Mukesh Dhirubhai Ambani

Chairman, Reliance Industries

As of July 2010, Mukesh Ambani was the richest man in Asia and the fourth richest man in the world with a personal wealth of $29.0 billion.

He joined Reliance Industries in 1981. He directed and led the creation of the world's largest grassroots petroleum refinery at Jamnagar with a current capacity of 660,000 barrels per day (33 million tonnes per year) integrated with petrochemicals, power generation, port and related infrastructure.

In August 2010 Reliance announced a $392 million stake in an American natural gas interest located in central and northeast Pennsylvania.

Reliance has also purchased significant stakes in the shale gas assets of Atlas Energy Inc and Pioneer Natural Resources.

Click on NEXT to read more...

India's most admired business leaders

Naina Lal Kidwai

Group general manager & Country Head, HSBC Group

At HSBC she has held positions as chief executive officer and deputy chief executive officer of HSBC Bank in India and managing director aof HSBC Securities and Capital Markets India Private Limited.

She became the group's country head in 2009.

Kidwai has repeatedly ranked in the Fortune global list of Top Women in Business, 12th in the Wall Street Journal 2006 Global Listing of Women to Watch ad listed by Time magazine as one of their 15 Global Influentials 2002.

Click on NEXT to read more...

India's most admired business leaders

Aditya Puri

MD, HDFC Bank

Puri has been the managing director of the bank since September 1994.

He has about 36 years of banking experience in India and abroad.

Prior to joining HDFC Bank, Puri was the CEO of Citibank, Malaysia from 1992 to 1994.

Puri in an interview once said, he always finds time for golf and family. He spends just an hour each day on planning. The rest of the time in bugging people to do their jobs.

Click on NEXT to read more...

India's most admired business leaders

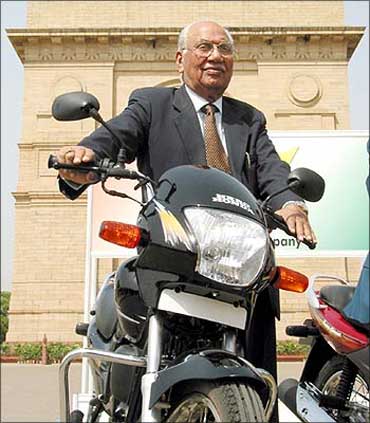

Brijmohan Lall Munjal

Chairman, Hero Group

In 1944, when he was 20, Munjal along with elder brothers Dayanand, Satyanand and younger brother Om Prakash came from Kamalia (now in Pakistan) and settled in Amritsar.

The brothers initially started a business by supplying components to manufacturers of bicycles in and around Amritsar.

After the partition in 1947 the Munjal family completely shifted their base from Pakistan to Ludhiana.

Slowly they expanded their distribution network and by early 1950s they were supplying components of bicycles throughout India.

In 1954, Hero Cycles Ltd moved up the value chain by making a shift from supplying to manufacturing. In 1984, the Hero Group started a joint venture with Japan's Honda Group, to manufacture motorbikes.

Click on NEXT to read more...

India's most admired business leaders

Om Prakash Bhatt

Chairman, SBI

He was appointed chairman of SBI in June 2006.

The five-year term of Bhatt will expire in March 2011. His will be the longest serving chairman of SBI in recent past.

Starting his career as a probationary officer in SBI in 1972, Bhatt held several key assignments in the bank.

He served as managing director of State Bank of Travancore from January 2005 to April 2006.

Click on NEXT to read more...

India's most admired business leaders

Anil Agarwal

Founder & chairman, Vedanta Resources Corporation

He founded Sterlite Industries in 1976 and then in 1986 established Vedanta Resources bringing together a variety of businesses owned by the Agarwal family.

Then followed a spate of acquisitions both in India and overseas -- and with it came the controversies, since many of them, such as Bharat Aluminium and Hindustan Zinc, involved public sector undertakings over which there was much resistance, mainly political.

Recently he acquired up to 60 per cent of British energy giant Cairn's Indian arm -- which is into oil and gas exploration -- for around a whopping $9.5 billion.

The Indian government, however, rejected his bauxite-mining project in Orissa, citing environmental issues on August 24, 2010.

Click on NEXT to read more...

India's most admired business leaders

Kumar Mangalam Birla

Chairman, Aditya Birla Group

A chartered accountant, Birla earned an MBA from London Business School, where he is also an Honorary Fellow.

He served as the Chairman of Securities and Exchange Board of India's Committee on Corporate Governance, and as chairman of Sebi's Committee on Insider Trading.

He has authored the nation's First Report on Corporate Governance.

On the academic front, Birla is the Chancellor of BITS, Pilani, Hyderabad, Goa and Dubai.

He is a director of the G D Birla Medical Research and Education foundation.

Click on NEXT to read more...

India's most admired business leaders

Anil Dhirubhai Ambani

Chairman, Reliance Anil Dhirubhai Ambani Group

Ambani joined Reliance in 1983 as co-chief executive officer and is credited with having pioneered many financial innovations in the Indian capital markets.

One of his major achievements in the entertainment industry is the takeover of Adlabs, the movie production to distribution to multiplex company that owns India's only dome theatre and the joint venture worth $825 million with Steven Spielberg.

Ambani was in talks with Everton officials over a deal to takeover the club. Before this he was also on the brink of buying Newcastle United.

Click on NEXT to read more...

India's most admired business leaders

Vijay Mallya

Chairman, United Breweries Group & Kingfisher Airlines

Mallya took over as chairman of United Breweries Group in 1984.

In May 2007, United Breweries Group announced the all-cash acquisition of scotch whisky maker Whyte & Mackay for pound 595 million (approximately Rs 6000 crore).

In 2005, Mallya established Kingfisher Airlines, which later bought a 26 per cent stake in Air Deccan, a low cost Indian airline. Mallya later rebranded it as Kingfisher Red.

In 2007, Mallya and the Mol family from The Netherlands bought the Spyker F1 team for euro 88 million. The team changed its name to Force India F1 from the 2008 Season.

Mallya's United Breweries sponsors the East Bengal and Mohun Bagan football clubs in Kolkata.

He also was part of the consortium that acquired Queens Park Rangers FC, as part of the Bernie Ecclestone, Flavio Briatore and Lakshmi Mittal.

Mallya also owns the Royal Challengers Bangalore team in the Indian Premier League.

Mallya entered politics in 2000 and replaced Subramanian Swamy as the president of the Janata Party. He is a Member of Parliament in Rajya Sabha.

In 2004, he placed the winning bid of pound 175,000 for the sword of Tipu Sultan at an auction in London, and brought it back to India.

In March 2009, Mallya successfully bid for the belongings of Mahatma Gandhi at $1.8 million, in a New York auction.

Click on NEXT to read more...

India's most admired business leaders

Anand Mahindra

Vice chairman & MD, Mahindra & Mahindra Ltd

In the summer of 1991, he was appointed deputy managing director of Mahindra & Mahindra Ltd.

In April 1997, he was appointed managing director and in January 2003 given the additional responsibility of vice chairman.

Mahindra was a co-promoter of Kotak Mahindra Finance, which in 2003 was converted into a bank.

Mahindra is the co-founder of the Harvard Business School Association of India.

In 2009, Tech Mahindra, successfully acquires Satyam Computer.

Click on NEXT to read more...

India's most admired business leaders

Shiv Nadar

Chairman & chief strategy officer, HCL Technologies

Along with Ajai Chowdhry (chairman, HCL Infosystems), Arjun Malhotra (CEO and chairman, Headstrong), Subhash Arora, Yogesh Vaidya and D S Puri, he started Microcomp to sell teledigital calculators in the Indian market under the brand name Televista.

HCL was founded later in 1976 with an investment of Rs 187,000 from the 6 founders and Uttar Pradesh government was added as 26 per cent equity partner.

Nadar took HCL Technologies public in 1999.

His partnernship with Singapore Telecom to address the now-booming Indian Telecom market was unsuccessful as well as his attempts in the granite and aquaculture business.

Click on NEXT to take the poll...

India's most admired business leaders

Take the poll and tell us who, according to you, is the best business leader in India.