Photographs: Assistants at the Microsoft stall sit in front of a billboard on the opening day of 'COM-IT 2008' an

The March quarter results of information technology companies were eagerly awaited. Demand for Indian IT services was bound to suffer as some large US banks failed and the financial sector faced a near collapse in the previous quarter.

This was followed by a new government coming to power in the United States and regulatory restrictions, in the form of outsourcing curbs, were anticipated. But the extent of damage to the Indian IT industry wasn't clear and the Q4FY09 results were expected to bring some much-needed clarity.

Infosys Technologies kicked off the results season on a sombre note. As we went to press, some other large IT companies such as Wipro, Tata Consultancy Services and HCL Technologies had also announced their quarterly performances.

Although the figures are varied, the challenges the companies faced during the quarter were similar -- their clients are mostly in a financial mess and have delayed finalisation of their IT budgets.

The ones who have done so have pushed down prices. That has put IT firms' margins under pressure. Along with this, foreign exchange volatility continued although the rupee's depreciation vis-a-vis the dollar contributed positively to the results.

We take a deeper look into the impact of these factors on IT companies. Read on. . .

Text: Kumar Gautam, Outlook Money

Indian IT companies to suffer some more

Image: S Ramadorai, CEO of Tata Consultancy Services, poses with a Ducati motorcycle. TCS has signed a multi-million dollar, multi-year deal with Ducati Motor Holding.Photographs: Punit Paranjpe/Reuters

Volumes down

The January-March period in 2009 was critical because it was the first quarter of the financial year for most US companies and decisions were to be taken on IT expenditure this period. But that didn't happen.

"The deal flow has materially come off and they [clients] are delaying projects they can do without," says Apurva Shah, head of research at the brokerage firm Prabhudas Liladhar. The result: an overall drop in volumes, which was reflected in the quarterly numbers.

Infosys reported a 1.8 per cent year-on-year (y-o-y) decline in revenues in dollar terms for Q4FY09. The revenue growth in rupees, however, was 24.1 per cent y-o-y.

On the other hand, TCS and Wipro reported positive growth in dollar revenues. HCL Tech saw an 18.2 per cent y-o-y increase in revenue, but a large portion of this came from its acquisition of UK-based tech firm Axon.

HCL Tech's management admits that if Axon's performance is excluded, the revenue growth would be negative.

The companies did well in terms of new deals. Infosys and TCS added over 35 new clients during the quarter while HCL Tech signed contracts worth over $1.5 billion in the last three quarters of FY09.

This, however, will not ensure a constant revenue stream. Says Pralay Kumar Das, IT analyst at brokerage firm BRICS Securities: "It's not about the new deals but about the deals ramping up. If clients are facing problems, they may choose not to ramp up deals in a particular quarter."

Indian IT companies to suffer some more

Image: A man speaks on a mobile in front of a billboard on the opening day of 'COM-IT 2008' an Infotech expo in Mumbai.Photographs: Arko Datta/Reuters

Pricing pressure

By the end of December 2008, it was becoming obvious that clients would seek discounts on prices. Although the December results didn't give any clarity on this, the March figures showed that IT firms managed well by increasing operational efficiency.

Infosys managed to up net profit in dollars by 2.6 per cent despite a fall in revenues. It was able to improve its operating margin despite pressure on pricing and offered more services instead of negotiating on prices. TCS, Wipro and HCL Tech also improved their operating margins.

Indian IT companies to suffer some more

Image: A bank employee exchanges South Korean won for US dollars.Photographs: Lee Jae-Won/Reuters

Currency movement

The fall in the rupee's value helped companies report healthy growth in rupee terms. For example, TCS reported 18.64 per cent growth in rupee revenues even as the corresponding dollar figure was minus 5.54 per cent.

HCL Tech, however, suffered due to the fall in the value of the rupee. Its decision two years back to hedge against the appreciating rupee is now dragging down its profits.

It reported forex loss of around Rs 200 crore in the March quarter, which brought down its net profit by 36 per cent to Rs 218 crore. The pain will continue. Says Deepak Purswani, IT analyst at the brokerage firm Sharekhan: "HCL Tech will show around $30 million-40 million forex losses per quarter in the next six to seven quarters."

Indian IT companies to suffer some more

Image: A computer screen is displayed at a stall at the 'COM-IT Infotech Expo.Photographs: Arko Datta/Reuters

New avenues

The banking and financial services industry has traditionally been the biggest client for Indian IT companies. Realising that the problems in that sector could continue, IT companies started diversifying into other defensive sectors.

HCL Tech, for example, generates around 9 per cent of its revenue from the energy, utilities and government-controlled sectors, a substantial jump from just 1.5 per cent in FY08. During the same time, revenue from financial services decreased from 28.3 per cent in March 2008 to 23.6 per cent in March 2009.

Infosys, too, is trying to gain ground in the domestic market. It now provides consultancy services to some state power corporations and will provide IT infrastructure and process support to the income tax department.

Indian IT companies to suffer some more

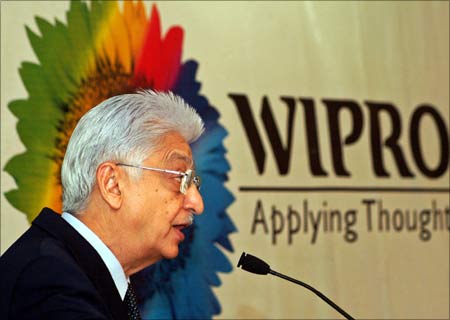

Image: Chairman of Wipro Ltd, Azim Premji, speaks during a news conference.Photographs: Jagadeesh Nv/Reuters

Market Call: Reasonable prices

IT stocks have taken a plunge ever since the economic downturn intensified in the West. They are now trading below 15 times trailing 12 months' (TTM) earnings. At these levels, however, they seem to have discounted the grim outlook for the coming quarters.

Infosys expects earnings per share (EPS) to fall to Rs 96.65-101.18 in FY10. Even if we take the lower end of this range, at present, the scrip is still trading at a multiple of 15, down from 23 a year ago.

Similarly, HCL Tech is currently trading at 11 times its TTM earnings. Although the company will record forex losses in the coming quarters, its core business remains profitable. Its current dividend yield is 7.1 per cent.

Most other IT stocks can also be viewed positively over the long term.

Indian IT companies to suffer some more

Image: George Paul, executive vice president of marketing, HCL Infosystems, speaks during a news conference in New Delhi in February, 2006.Photographs: Shilpa Anand/Reuters

Consistent business

Besides attractive valuations, their consistent business performance makes IT companies sound cases for investment. They have traditionally been cash-rich and this will give them some shelter in the current tough economic environment.

Indian IT companies are flexible enough to cut costs and improve efficiency. They can diversify further into more industries and geographies.

A large portion of their services is basic in nature and not discretionary. This will restrict any sharp fall in demand for services.

These factors keep the long-term growth prospects of the IT sector intact.

article