| « Back to article | Print this article |

Indian companies that face a cash crunch

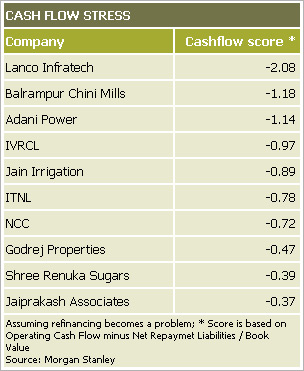

With growth rates slowing and global concerns not abating, the Street is increasingly becoming worried about rising stress levels for corporate India.

Earlier, Credit Suisse had come up with a report on the risks faced by the banking sector due to its exposure to highly-leveraged corporate houses.

Today, Morgan Stanley's team of analysts, led by Ridham Desai, put out a report indicating a list of companies which could face balance sheet stress, based on their quantitative analysis.

Based on its proprietary Altman Z-score and cash flow tests, the brokerage says 20 companies appear stressed on the cash flow measure.

Hathway

Altman's Z Score: 1.78

A Z score below 1.8 implies an increased probability of financial stress.

Source: Morgan Stanley Research

Click NEXT to read more...

Indian companies that face a cash crunch

Adani Ports and SEZ

Altman's Z Score: 1.71

When they combined the results of the Z-score and cash flow stress tests, five companies have these in common -- Adani Enterprises, Adani Power, Jaiprakash, ITNL and Lanco.

Click NEXT to read more...

Indian companies that face a cash crunch

Shree Renuka Sugars

Altman's Z Score: 1.68

Altman Z-scores measure the risk of bankruptcy; the cash flow stress test is to assess refinancing risk.

Click NEXT to read more...

Indian companies that face a cash crunch

Great Eastern Shipping

Altman's Z Score: 1.68

The analysts have assumed refinancing will not be available and, hence, any loans taken by the companies will need to be financed out of operating cash flows.

Click NEXT to read more...

Indian companies that face a cash crunch

Educomp Solutions

Altman's Z Score: 1.59

The study is based on 2011-12 numbers and Morgan Stanley's own FY13 estimates.

Click NEXT to read more...

Indian companies that face a cash crunch

Adani Enterprises

Altman's Z Score: 1.53

Of the 104 stocks under Morgan Stanley's coverage, 17 companies which had an Altman Z-score of 1.8 are seen to be at financial risk.

Click NEXT to read more...

Indian companies that face a cash crunch

Bharti Airtel

Altman's Z Score: 1.53

Another seven are considered borderline cases. These include: Tata Power, Indiabulls Real Estate, DLF, JSW Steel, Hindalco, Reliance Infrastructure and NTPC.

Click NEXT to read more...

Indian companies that face a cash crunch

Jaiprakash Associates

Altman's Z Score: 1.48

Most of these stocks underperformed over the past 12 months, but mere underperformance does not mean that all the potential pain is priced in. "And, hence, these tests still should be of use," says the report.

Click NEXT to read more...

Indian companies that face a cash crunch

JSW Energy

Altman's Z Score: 1.43

Over the past five years, several Indian business houses have borrowed substantial amounts of money to fund projects and acquisitions.

Click NEXT to read more...

Indian companies that face a cash crunch

Cox and Kings

Altman's Z Score:1.41

With economic growth slowing and interest rates remaining high, corporate India is finding it very hard to generate adequate cash flows to service their pile of debt.

Click NEXT to read more...

Indian companies that face a cash crunch

ITNL

Altman's Z Score: 1.39

Most companies which have borrowed heavily in the past have a very poor interest coverage ratio, which indicates their low ability to repay debt.

Click NEXT to read more...

Indian companies that face a cash crunch

IRB

Altman's Z Score: 1.36

However, the situation could change. "Balance sheet stress is a cyclical thing in stock picking – it comes to the fore in a rising rate and slowing growth environment. The market's preference for quality will shift if rates soften further and growth bottoms out," the anlysts note.

Click NEXT to read more...

Indian companies that face a cash crunch

Aditya Birla Nuvo

Altman's Z Score: 1.29

Morgan Stanley's stress test analysis does not throw up any new name or sector.

Click NEXT to read more...

Indian companies that face a cash crunch

Power Grid

Altman's Z Score: 1.11

However, it does reiterate the severe stress that not only corporate India faces but also the banking system.

Click NEXT to read more...

Indian companies that face a cash crunch

Lanco Infratech

Altman's Z Score:0.88

At the sector level, it says: "Not surprisingly, real estate, utilities, industrials and telecoms appear to carry maximum financial and cash flow risks, based on our metrics."

Click NEXT to read more...

Indian companies that face a cash crunch

Indiabulls Power

Altman's Z Score: 0.64

All these sectors have been at the centre of either scams or policy logjam.

Click NEXT to read more...

Indian companies that face a cash crunch

Adani Power

Altman's Z Score: 0.52