Photographs: B Mathur/Reuters

Recommending an end to all cesses and surcharges on taxes, and free pricing of fertiliser and fuel ahead of the Union Budget for 2009-10, the Economic Survey on Thursday suggested aggressive divestment and financial sector reforms to bring the economy back to high growth track.

The Survey, tabled in Parliament by Finance Minister Pranab Mukherjee, also sought reduced role for government and end of state monopoly in areas like Railways, coal and nuclear power while seeking up to 49 per cent Foreign Direct Investment in defence and insurance.

Bring in sweeping tax reforms: Survey

The Survey, tabled in Parliament on Thursday, also called for reviewing commodities transaction tax, which was proposed in the Budget for 2008-09 but not notified.

"Review and phasing out of surcharges, cesses and transaction taxes (such as CTT, STT, FBT). Incentivise states to do the same with respect to stamp duties," the survey said. The Survey also asked for rationalising the dividend distribution tax so that dividend is taxed in the hands of receiver.

Surcharge at a rate of 10 per cent is levied on those earning at least Rs 10 lakh (Rs 1 million) per annum and corporate income tax. Industry is demanding removal of the surcharges to make calculation of corporate taxes simple and increase disposable income of people.

Education cess is levied at the rate 3 per cent on taxes. Besides, cess at the rate of Rs 2 per litre is levied on petrol and diesel to fund national highways, rural development and state roads.

Survey wants decontrol of petrol, diesel prices. Read on...

Decontrol petrol, diesel prices: Survey

Image: An employee fills a car with petrol at a gas station in Jammu.Photographs: Mukesh Gupta/Reuters

It is high time that petrol and diesel prices were decontrolled taking advantage of low inflation and global crude prices, the Economic Survey said, while criticising the government for its "imperfect" handling of oil price hike.

The Survey made suggestions for sweeping reforms in the energy sector, including limiting subsidised cooking gas to domestic consumers to 6-8 cylinders per year.

Coming a day after the government announced an ad-hoc increase in petrol price by Rs 4 a litre and diesel by Rs 2 per litre that effectively buried all hopes of freeing auto fuel prices, the pre-Budget Survey said the entire rise in raw material price should be passed on to consumers.

The doubling of international crude oil prices to $70 a barrel since December had warranted Rs 5.82 a litre increase in petrol and Rs 3.62 per litre hike in diesel rates.

The message was clear, "Decontrol petrol and diesel prices", with the Survey saying that "as long as the domestic prices remain below the cost of import, demand would continue to grow accentuating the negative impact. . ."

"At times higher inflation and on other occasions political imperatives have prevented a better alignment of fuel and fertiliser and food prices with the border/market prices."

In practice, the issues of prices were addressed somewhat "imperfectly" through a sharing formula that represented a mix of government subsidy, taxation of rents and some pass through, the Survey decried.

Rising food prices could undermine inclusive growth: Survey

Image: A vendor arranges vegetables at a market in Siliguri.Photographs: Rupak De Chowdhuri/Reuters

High domestic food prices are still a cause for concern despite India hugely benefiting from a slump in global oil and commodity prices that pushed inflation into negative zone, the Economic Survey said on Thursday.

"The continued food inflation, though moderating of late, could undermine inclusive growth, in particular, the effort to combat poverty," said the pre-Budget Economic Survey tabled in Parliament.

For the week ended June 13 inflation stood at (-)1.14 per cent against (-)1.61 per cent in the previous week.

It, however, warned that some financial investors could be at play behind sharp rise in oil prices despite build up of inventories and forecasts of lower global demand. This along with rise in commodity prices could put strain on the economy.

Domestic food price inflation as measured by the WPI food sub-index, it said, remains much higher than overall inflation.

Survey for lifting ban on farm futures

Image: A worker sifts wheat at a grain market in Chandigarh.Photographs: Ajay Verma/Reuters

The government should lift the ban on futures trading on rice, sugar, tur and urad and decontrol sugar sector, saying the resultant price discovery would help farmers and other stakeholders, the Economic Survey said.

"Lift the remaining ban on futures contracts to restore price discovery and price risk management. Its effectiveness depends on the wider participation of all the stakeholders categories," said the Survey for 2008-09.

Expressing concern over declining investment in farm sector and a low growth of 1.6 per cent in 2008-09, the Survey said India's dependence on import of pulses, edible oils and other commodities had also put pressure on the economy by way of rising prices.

As part of measures to control inflation, the Centre had imposed ban on futures trading on rice, tur and urad in early 2007, while the trading in sugar has been suspended from May 26 till December this year.

The Survey, however, emphasised on improving productivity to ease demand-supply situation. "The agriculture sector faces challenges on various front. On the supply side, the yield of most crops has not improved significantly and in some cases fluctuated downwards. There is clearly a need for renewed focus on improving productivity," the Survey said.

Govt must raise Rs 25,000 crore from divestment every year

Image: An employee works inside Maruti Suzuki's newly launched petrol engine plant on the outskirts of New Delhi.Photographs: Vijay Mathur/Reuters

The government should sell a minimum 10 per cent stake in all unlisted public sector enterprises and "auction" those that can't be revived, the Economic Survey said, while recommending a divestment target of Rs 25,000 crore (Rs 250 billion) annually.

"Revitalise the divestment programme and plan to generate at least Rs 25,000 crore per year," said the Survey tabled in Parliament on Thursday.

The prescription coincides with government declaring divestment as one of its top most priorities for mobilisation of resources, particularly, as it is free from the pressures of the Left parties that had obstructed the process in the last five years.

Asking the government to sell a minimum of 10 per cent equity in all profit-making unlisted PSUs, it said: "Complete the process of selling 5-10 per cent equity in previously identified profit making non-Navratnas."

Bring all financial market regulations under Sebi: Survey

Image: The Bombay Stock Exchange is lit up during Diwali.Photographs: Arko Datta/Reuters

All financial market regulations should be brought under the Securities and Exchange Board of India, the Economic Survey said on Thursday.

"Bring all financial market regulations under Sebi with a view to (encouraging) integrated development," the Survey said, while listing the potential policy decisions for the government in the financial market arena.

At the same time, the Survey also suggested broadening the long-term debt markets by liberalising the investment norms for insurance and pension funds and said that the government could consider a guarantee mechanism for credit enhancement of long-term infrastructure debt.

According to the Survey, the global financial crisis adversely impacted the Indian capital market during 2008.

"Having regard to these trends, the regulatory measures initiated during the year were aimed at ensuring the soundness and stability of the Indian capital market," said the Survey.

"The global crisis also meant that the economy experienced extreme volatility in terms of fluctuations in stock market prices, exchange rates and inflation level during a short duration necessitating reversal of policy to deal with emergent situations," the Survey noted.

Delink licence from spectrum, auction 3G

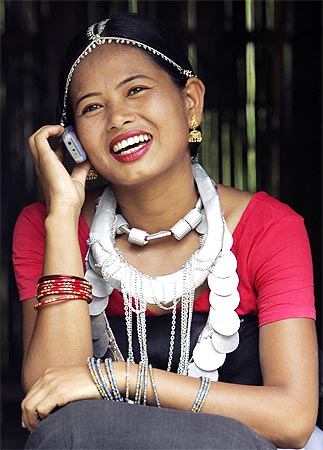

Image: A girl from the Dhimal tribe, one of India's smallest tribal communities, talks on her mobile phonePhotographs: Rupak De Chowdhuri/Reuters

Suggesting delinking of spectrum from telecom licences, the Economic Survey for the year 2008-09 has suggested auctioning radio frequencies for the forthcoming 3G mobile services.

"Auction 3G spectrum," the Survey, tabled in Parliament, said, adding that "the auctioned spectrum must be freely tradable, with capital gains on spectrum to be fixed under the Income Tax Act."

The government is eyeing huge revenue from the auction of 3G spectrum and is likely to fix a reserve price of Rs 4,040 crore (Rs 40.40 billion) for pan-Indian spectrum. Going by this, the government will get nearly Rs 30,000 crore (Rs 300 billion) from auctioning spectrum.

Giving suggestions on auction price, the Survey, which is a pointer to future economic policies, said the price can be fixed or be charged per unit of bandwidth per annum, or a combination of two.

58 million jobs opportunities expected in 2007-12 period: Survey

Image: Employees at a Indian call centre.Photographs: Sherwin Crasto/Reuters

Nearly 58 million jobs are expected to be created in the five years from 2007 to 2012 with the non-agriculture sector boosting employment during that period, the Economic Survey said.

In the Eleventh Five-Year Plan period (2007-12), employment opportunities would surpass the projection of about 45 million, in turn helping to bring down unemployment in the country to below five per cent, according to the Pre-Budget Economic Survey tabled in Parliament.

Eco Survey for another stimulus package

Image: A jobseeker, with a sign strapped to his back, tries to attract the attention of potential employersPhotographs: Mark Blinch/Reuters.

Ahead of the Budget 2009-10, the Economic Survey on Thursday suggested tax cuts and increase in government expenditure as part of another stimulus package to help the economy overcome the global shock.

"The uncertainty surrounding the macroeconomic developments world over in 2009-10 and the need for minimising the second round impact of the global shock calls for a continued fiscal policy stimuli," said the Economic Survey for 2008-09 tabled in Parliament.

The survey said the next round of stimulus could include both tax cuts and increase in government expenditure.

"Within the proposed fiscal expansion, the mix of expenditure and tax cuts would be critical in the context of its impact on overall macroeconomic fundamentals like growth, interest rates and exchange rate," the survey said.

The survey said stimulus packages given so far were selective to address the affected sectors and promote investments that would not only boost demand in the short run but yield long-run growth dividends.

The three stimulus packages provided by the government have cut excise duty by 6 per cent, service tax by 2 per cent and raised planned expenditure, resulting in widening of fiscal deficit to over 6 per cent in 2008-09.

Cut customs duties, pay attention to infrastructure

Image: The Bandra-Worli sea link.Photographs: Sahil Salvi

The government should cut customs duties and streamline export promotion schemes and pay special attention to infrastructure to overcome the contracting exports on account of recession in India's major trading partners, the Economic Survey said.

The Economic Survey cautioned that the global meltdown, particularly in the US and EU, is expected to impact the country's export growth in 2009-10.

"With import demand falling from our major trading partners, India's exports of goods and services (are) expected to be impacted," the pre-Budget Economic Survey tabled in Parliament said.

India's exports, after registering a healthy growth rate of over 30 per cent in the first half of 2008-09, turned negative in October 2008. Overseas shipments declined by 29.2 per cent in May -- contracting for the eighth month in a row -- over the same month last year.

In the last fiscal, exports grew by a meagre 3.4 per cent to $168.7 billion.

article