Photographs: Mosab Omar/Reuters

India has been placed alongside the US and the UK as the least familiar and least favourable to sovereign wealth fund investment, a new survey has revealed.

According to the Sovereign Brands Survey, conducted by research and communications strategy consultants Hill & Knowlton and Penn Schoen Berland, Egypt, Germany, Brazil and China are among the most familiar and the most favourable.

Sovereign wealth fund: India least favourable

Image: Prime Minister Manmohan Singh addressing a news conference.Photographs: Richard Clement/Reuters

The survey looks at the factors on which SWFs intended to invest in their country or industries.

Stephen Davie, Hill & Knowlton's head of financial communications in the Middle East, said: "Despite being considered one of the least volatile forms of investment compared to other sources of capital, it is surprising that low familiarity still drives low fa vourability towards this type of funding.

Sovereign wealth fund: India least favourable

Image: A view of Jumeirah Beach Residence in Dubai, with the Palm Island Jumeirah in the background.Photographs: Steve Crisp/Reuters

The survey results show by working on their reputation and by increasing awareness of their SWFs is a key step for West Asian countries looking to open up significant investment opportunities."

The survey identified transparency as essential, 72 per cent citing this as very important, closely followed by accountability (68 per cent) and good governance (65 per cent).

Dubai did not score well on transparency with Western countries -- only 3 per cent of UK, 9 per cent of the US and 14 per cent of German respondents believing its SWFs to be transparent.

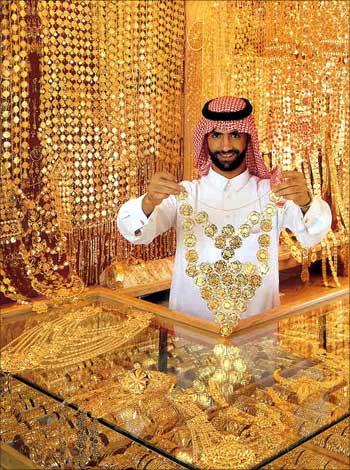

Sovereign wealth fund: India least favourable

Image: Mumbai.Asian countries had a more positive view with 29 per cent of Chinese and 30 per cent of Indian elites having confidence in Dubai's approach.

Nearly three quarters (73 per cent) of elites would approve of investment coming from Dubai, according to the Sovereign Brands Survey 2010, the most extensive study into

the attitudes of global broad elites to sovereign wealth as a concept, the reputation of host nations and sovereign wealth funds.

Sovereign wealth fund: India least favourable

Image: A child selling Indian flags.Photographs: Reuters

The study interviewed elites in 7 markets on their views of 19 host countries and their SWFs.

Nearly all (98 per cent) of the respondents felt the reputation of the country directly influences the reputation of SWFs.

It also identified that lack of familiarity with SWFs may lead to suspicion about the overall objectives of the funds.

The survey showed that knowledge of Dubai is still low.

Sovereign wealth fund: India least favourable

Most countries have a positive view of investment from Dubai, and when asked about the areas they would like to see Dubai investing, the respondents pointed to construction, leisure and finance."

Joel Levy, chief executive officer, Penn Schoen Berland, EMEA, said: "The economic downturn has created a real opportunity for sovereign wealth funds. SWF's images are largely determined by country reputation, and despite low familiarity and concerns over transparency, broad elites see SWFs as least likely to have contributed to the recent market turmoil.

"This puts sovereign wealth funds in a prime position to consider their positioning and reputation in contrast to other funds and asset classes.

article