| « Back to article | Print this article |

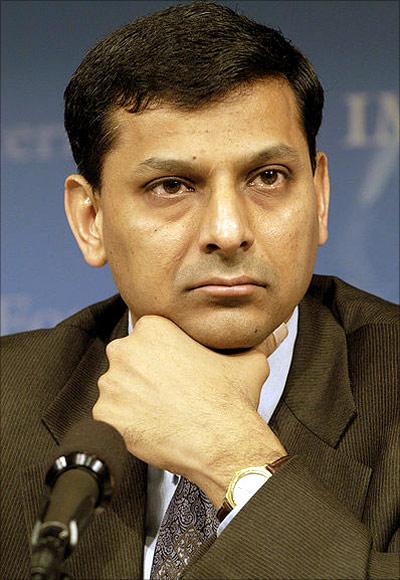

I am independent, don't fear being fired: Rajan

"The expectations are high. Clearly, I am not a superman. There is a little bit of euphoria in India," says Raghuram Rajan.

India's new Reserve Bank Governor Raghuram Rajan, who was in Washington last week for the first time in his new avatar for the fall World Bank/International Monetary Fund meetings, said he's not beholden to the Finance Ministry or Finance Minister P Chidambaram nor does he go around with the fear of being fired.

Rajan, who was accorded rock star status in DC, with think tanks and academic institutions like the Peterson Institute of International Economics and the Johns Hopkins School of Advanced International Studies inviting him to speak to standing room audiences - far in excess of what Chidambaram was able to draw at the Carnegie Endowment for International Peace - also took strong exception to a recent global study that had ranked the RBI as one of the least independent central banks in the world.

Click NEXT to read more...

I am independent, don't fear being fired: Rajan

He said, “The problems with all these rankings is that they are based on explicit measures, which don’t capture the true relationship between a central bank and its government. How many years do you appoint a central bank governor for? Who has the right to fire them, etc, etc?”

Rajan argued, “Now, if the US bank hears the constant barrage of complaints of low levels of employment, high levels of unemployment, and in that circumstance decides to put a lower weight on inflation and a great weight on growth, is it independent or not independent?”

“My sense is that it is responding to the political needs, (and) it is not this automation, which is focused only on inflation - it is moving away from what most economists say that the central bank should be focused on, get inflation right and growth will take care of itself. That’s the mantra, but it is being a little more –what do you say - pliant or more realistic. I don’t know what you would call it.”

Click NEXT to read more…

I am independent, don't fear being fired: Rajan

Rajan noted that “we have similar discussions between the Central Bank and the Finance Ministry. We both have the same objective - growth with low inflation, but the weights on it as well as the time horizons may differ over time. And, we have a healthy dialogue.”

“They tell us what they would like to see and we tell them what we would like to see and we negotiate to a set of outcomes which respect both the need for growth as well as the need to curb inflation,” he added.

Rajan acknowledged, “And sometimes, there is disagreement and the fact that occasionally…lot is made out of the fact that the Finance Minister or the Central Bank Governor may speak out. (But) That’s healthy because it shows that they are not in such close communion that they have no differences in opinion.”

He said, “The fact that the Finance Minister may get angry or the Finance Minister may push back in public suggest they have healthy differences. So, there is a dialogue and I don’t think we see everything the same way and we agree on many occasions to differ, but differ respectfully.”

Click NEXT to read more…

I am independent, don't fear being fired: Rajan

Thus, Rajan said to the question as to whether the RBI is independent, “We are as independent as anybody else.”

“Yes, I can be fired tomorrow, but do I have the fear of being fired everyday, and do I carry it around? No. No Central Bank Governor in history has been fired…maybe long time ago, but to my view, this is not a normal occurrence and any finance minister would think long and hard before he exercises that power.”

Rajan reitated, “So, in that sense, I feel independent - as independent as I need to be.”

He also said that while 'there's a little bit of euphoria' surrounding his recent appointment and the national and international media has gone gah-gah over his new avatar, he was no superman.

“Expectations are high. Clearly, I am not a superman. There is a little bit of euphoria in India,” and added, “I have a wife and two kids.”

“We can do more what a central bank in an industrial country can do. But we can in some ways do less. On where we can do more, clearly there are a lot of low hanging fruit in the financial sector.”

In this regard, Rajan acknowledged, more reforms, particularly in this sector, “can be incredibly positive for growth going forward.”

“I think, with the financial sector reforms, couples with the real sector reforms, the growth turn around should be on its way," he said.