| « Back to article | Print this article |

Terrible Thursday: Rs 1.1 trillion lost in stocks

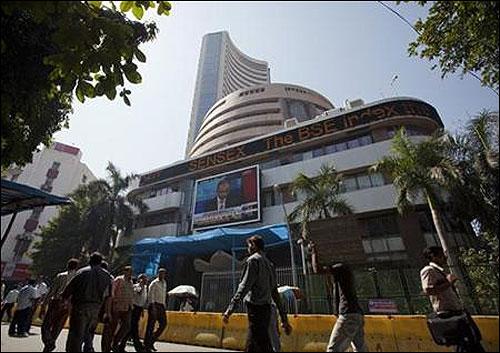

In a bad day for investors, Indian stocks on Thursday plunged to this year's lowest levels, wiping out over Rs 1.1 lakh crore wealth, while gold prices tanked to a seven-month low in a knee-jerk reaction to global sell-off.

Hit by heavy dollar demand, rupee also tanked by 40 paise to end at 54.47, its weakest level in over a month. Dollar demand from banks and importers during the day on the back of higher dollar in the overseas market affected the rupee value.

The BSE S&P Sensex suffered its biggest single day fall since May 2012 by plunging over 317 points to 19,325.36 – the calendar year's lowest level - after Asian and European stocks plunged reacting to the minutes of US Fed's January meeting that were released late on Wednesday.

Click NEXT to read more....

Complete coverage: Union Budget 2013-14

Budget Impact Live!

Terrible Thursday: Rs 1.1 trillion lost in stocks

The NSE Nifty also fell below 5,900-level to close at 2-month low of 5,852.25, down 90.80 points or 1.53 per cent.

The combined market capitalisation of Indian stocks fell by Rs 1.12 lakh crore from Rs 68.58 lakh crore yesterday to Rs 67.46 lakh crore today.

Prices of the precious metal fell below Rs 30,000 level in New Delhi for the first time in seven months due to hectic selling by stockists. Prices in Mumbai, Kolkata and Chennai markets fell in Rs 200-600 per 10 gram range.

Click NEXT to read more...

Terrible Thursday: Rs 1.1 trillion lost in stocks

The US dollar gained after minutes of US Federal Reserve's meeting showed many Fed officials are worried about the costs and risks associated with the $85 billion per month asset-purchase programme.

"Global stocks melted after the dollar rose. The rupee could again be under pressure tomorrow. Financial markets have seen low volumes in the past two days due to the ongoing strike as treasury teams were thinly staffed," said Srinivasa Raghavan, Executive Vice President, Treasury, Dhanlaxmi Bank.