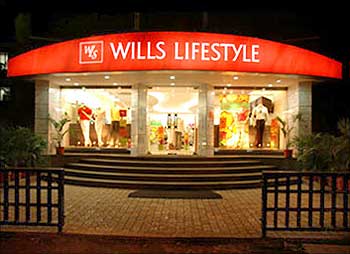

Photographs: Wills Lifestyle website Bhupesh Bhandari & Sayantani Kar in New Delhi

ITC entered the apparel retail market in 2000 with Wills Lifestyle. Cigarettes, it knew, was no longer a sunrise business and it needed to diversify into areas where strong brand values can be created.

Apparel fitted the bill. The market had begun to show signs of explosive growth as disposable incomes were climbing rapidly.

To begin with, Wills Lifestyle had a range of formals for men and a line of western wear for the working woman. Over the years, the company has added new lines of evening wear, sportswear, designer wear, fragrances and accessories.

But the business, which comes under ITC's fast-moving consumer goods division (2008-09 turnover Rs 18,129 crore or Rs 181.29 billion, inclusive of taxes), is small ten years later. Atul Chand, chief executive of ITC's lifestyle retail business division, indicates that the turnover of Wills Lifestyle could be around Rs 200 crore (Rs 2 billion):

"We have 10 per cent of the premium apparel retail market which is around Rs 2,000 crore (Rs 20 billion) in size." Another Rs 150 to 200 crore comes from its value-for-money brand, John Players, which retails from 225 stores in the country.

Chand's division -- Wills Lifestyle plus John Players -- thus contributes a little over 2 per cent of ITC's FMCG business. All told, the branded apparel market in the country is worth Rs 10,000 crore (Rs 100 billion) per annum -- ITC's share is therefore not more than 4 per cent. IDFC-SSKI managing director feels the small size of the business could work against it.

"There could be a lack of focus because of the business being a small portion of the company," says he.

How Wills Lifestyle strikes a chord with customers

Image: Inside a Wills Lifestyle store.It may not be big, but is it profitable? Chand does not share numbers. "What we have done has improved the profitability of our business," says he.

This could mean anything. But some other numbers illustrate a related point. Chand has 100,000 sq ft of retail space for Wills Lifestyle, which fetches him Rs 200 crore (Rs 2 billion) in sale.

He, in other words, sells Rs 20,000 per sq ft per annum or a tad over Rs 1,650 per sq ft per month. Value retailers are at around Rs 400 per sq ft per month at the moment, while other lifestyle retailers are stuck at around Rs 1,000 per sq ft.

The readymade apparel market, it so happens, is highly fragmented. Madura Garments (Van Heusen, Louis Philippe, Allen Solly and so on) of the Aditya Birla Group leads the pack in the premium end, according to analysts, with a market share of 12 per cent. ITC, with a ten per cent market share, hasn't done too badly.

What it also means is that the market is extremely competitive and Chand has to keep the buzz around the brand alive at all times to tackle the rivals.

What has compounded his problem is that rivals like Madura Garments now offer a complete wardrobe like Wills Lifestyle.

"We are present in all the addressable markets that exist," says Madura Garments chief operating officer Shital Kumar Mehta. With his original USP gone, Chand has his task cut out.

How Wills Lifestyle strikes a chord with customers

Image: Models clad in Wills Lifestyle clothes.Banking on fashion

In 2006, Wills Lifestyle became the title sponsor of the India Fashion Week. Though it is a B2B event, it has, claims Chand, improved the visibility and recognition of his brand, and shored up its premium equity. More important, this has given him access to the country's top designers.

Wills Lifestyle sells designer wear priced between Rs 4,000 and Rs 10,000 from its stores. "This is the largest initiative ever to popular designer wear," says he. "We have sold over 100,000 pieces so far."

For this season, Chand has tied up with eight top designers: JJ Vallaya, Rajesh Pratap Singh, Ranna Gill, Rina Dhaka, Rohit Bal, Rohit Gandhi & Rahul Khanna, Satya Paul and Shantanu & Nikhil. Some of them make the clothes they supply, while others get them done by contract manufacturers.

Of course, the designs they put up at the Wills Lifestyle stores cannot be retailed anywhere else.

But what's in it for these designers? Don't the low prices (designer wear at exclusive outlets can cost four to five times more) erode their brand equity? It gives them access to several prosperous non-metro markets where they do not have a presence, argues Chand.

Affordable designer wear is one way Chand has been able to build bridges with women. Almost 35 per cent of sale at Wills Lifestyle is women's wear -- western and fusion --, though 50 per cent of the shoppers are women. Women's wear, to be sure, is a tough business.

Many companies have burnt their fingers in it. Analysts say this is because they are extremely value-conscious buyers. Raymond, for instance, had started the Be: stores exclusively for women. The stores have since been shut.

How Wills Lifestyle strikes a chord with customers

Image: A Wills Lifestyle loyalty card.To strengthen Wills Lifestyle's portfolio of women's wear, Chand has tied-up with Ricardo Rami Studio of Milan for a whole new line. It will be priced between Rs 2,000 and Rs 3,000 -- in the gap between designer wear and the Wills Lifestyle line.

Some rivals insist that women's wear is still a small category. The readymade apparel market is still largely dominated by men. "The branded women's wear market is still a nascent one. We will expand there as the market grows in the next five years or more. We will rev up our presence then," says Mehta.

Chand admits that women's wear is far more complex than men's wear: "This is due to multiple factors -- many players, a large unorganised segment, usage of diverse fabric bases, wide palette of colours, especially in prints, different silhouettes, styling and accessories."

"Success in this segment depends on getting the right consumer insights, creating a recipe for differentiation and engaging with the consumer through appropriate communication and retail experience", he adds.

Also, much of what Chand has done recently -- the introduction of designer wear and the Ricardo Rami line -- comes with a price tag of Rs 2,000 and above. But the sweet spot at which most sales are congregated, according to Chand, is Rs 1,500 to Rs 2,000.

Fast forward

To keep the excitement going in the popular segment, Chand has decided to refresh the lines every two months. Most other retailers prepare for two seasons in a year -- summer and fall. Wills Lifestyle, in a way, could have as many as six in a year.

The insight here was that, on an average, a customer walks into a Wills Lifestyle store every two months. "So, we need o give something new every time the customer comes to us," says Chand.

This is an attempt to lock in customers. According to Chand, Wills Lifestyle scores high on brand loyalty. Its loyalty programme has 80,000 members who account for as much as 55 per cent of total sales. Chand claims this is the highest in the industry. In addition, 50 per cent of the designer wear is bought by existing customers.

How Wills Lifestyle strikes a chord with customers

Image: Models pose for Will Lifestyle apparels.Line upgrade every two months requires the company to have a very efficient supply chain: Smaller stocks need to be sent to the stores, smaller orders need to be sent to the production lines.

It also means that Wills Lifestyle may have to resort to end-of-season sale more frequently than rivals. Regular sale announcements can take the shine off a premium brand. But that does not seem to bother Chand.

"End-of-season sale is the norm in the industry. All top international brands do it regularly," says he.

To exercise better control over the supply chain, ITC has kept all production in-house, except knits (T-shirts and so on). This goes against the conventional wisdom in the industry. Most retailers outsource production to third-party suppliers to keep their costs low.

Chand admits that this has raised his costs a bit but adds that it has given him a better grip over his supply chain. A contractor perhaps would find it difficult to execute orders that can be changed every two months.

Chand also says that when exports were booming, several contractors were so full with orders that supplies to local retailers were badly hit. Its own production facility at Bangalore is Wills Lifestyle's way to ensure that its racks do not ever run empty.

Growth plans

In the last 10 years, Wills Lifestyle has opened 50 stores in 30 cities. This cannot be called rapid expansion by any stretch of imagination.

One reason could be high real estate prices and the lack of high-street locations for the stores. But things could change now with commercial real estate prices on the decline.

Chand says that he has pared real estate costs by 30 per cent in the last one year. (Store rentals vary from 8 per cent to 15 per cent of turnover, depending on the catchment -- high street vis- -vis mall and Tier 1 city vis-a-vis Tier 2 city.)

How Wills Lifestyle strikes a chord with customers

Image: A model clad in Wills Lifestyle clothes walks the ramp.In the next three years, Chand wants to double the number of stores to 100. Over the next six months, he hopes to open two every month in Tier 2 cities like Nagpur, Indore, Nashik and Jaipur.

Also on the drawing board are five or six high-end flagship/concept stores in different cities which will offer bespoke services. He has opened a boutique store in the ITC Maurya in New Delhi. Chand says he will open such stores in other ITC hotels -- Bangalore could be the next.

For the existing stores, Wills Lifestyle has begun to work with FRCH, a US-based retail design firm, to improve their look and feel. Elemental Design of the United Kingdom is helping the stores in display and presentation of products. For customer service and engagement, it has hired the services of The Friedman Group.

Rivals say Wills Lifestyle has shut quite a few stores in the recent past -- a clear indication that it didn't get its retail strategy right. Wills Lifestyle has, Chand admits, shut eight stores in the last five years. But he says this was more realignment than downsizing.

"The retail scenario has always been dynamic with the constant emergence of new market places and shopping catchments, and the recent development of modern formats," says he.

Clearly, the challenges are many.

article