| « Back to article | Print this article |

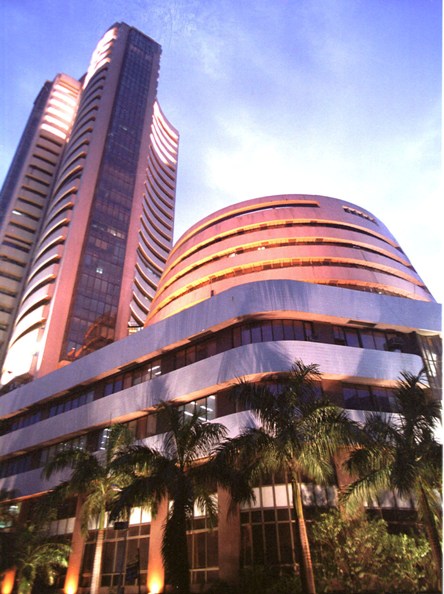

Markets end flat ahead of Dec F&O expiry

Benchmark share indices ended flat, amid a range bound trading session, as investors booked profits in late trades unwilling to carry over positions ahead of the Christmas holiday tomorrow followed by expiry of December derivative contracts on Thursday.

The 30-share Sensex ended down 68 points at 21,033 after touching an intra-day low of 21,010 and the 50-share Niftyended down 16 points at 6,268 after hitting an intra-day low of 6,262.

The rupee has been range bound since early trades and was currently up at 61.87 post the governor's comments late Monday that the central bank had decided to keep rates on hold even before November inflation data. The rupee had closed at 61.95 on Monday.

In Asia , shares in Japan surged to end at a 6-year closing after breaching the 16,000 mark in intra-day trades after Prime Minister Shinzo Abe unveiled the largest ever budget today with increased spending of $922 billion.

The Nikkei ended up 0.12% at 15,889. Among other key indices in the region, Shanghai Composite, Hang Seng and Straits Times were up 0.1-1.1% each.

Shares in Europe were trading higher on the back of encouraging economic data from the US.

The CAC-40, DAX and FTSE-100 were up 0.2-0.9% each.

The BSE Metal index along with Bankex were among the top losers in the sectoral indices while Capital Goods and Consumer Durable indices were among the gainers.

HDFC Bank and HDFC ended down 1.2% each contributing the most to Sensex losses.

Sesa Sterlite ended down 2.3% after the Central Bureau of Investigation (CBI) said it started an investigation into possible irregularities in its stake buy in Hindustan Zinc Ltd.

IT majors Infosys and TCS ended mrginally up on the back of improving business environment in the US.

Other Sensex gainers include, L&T, ICICI Bank and Bajaj Auto among others.

According to market experts it is time to book profits in both L&T and BHEL as both the engineering majors have gained significantly over the past few weeks.

Index heavyweight Reliance Industries continued its upward trend and ended marginally up post the gas price hike.

Among other shares, Century Textiles and Industries rallied 13% to end at Rs 302, extending it’s nearly 6% gain in past two days, on back of heavy volumes on the bourses.

GMR Infrastructure ended tad higher at Rs 23.95 on reports that the company is planning to sell its entire 40% stake in Istanbul’s Sabiha Gökçen International Airport for Euro 225 million (Rs 1,900 crore) to Malaysia Airport Holdings Berhad.

Alstom T&D India gained 4.3% to end at Rs 199, extending its 4% gain in past two trading sessions, after the company said it has received two orders worth Rs 298 crore for supplying equipment for power stations in Himachal Pradesh.

UltraTech Cement ended up 1.6% at Rs 1,795 after the company said the Competition Commission of India has approved the company’s proposal to acquire two plants of Jaypee Cement Corporation in Gujarat.

In the broader market, the BSE Mid-cap index ended up 0.5% and the Small-cap index ended up just over 1%.

Market breadth was positive with 1,444 gainers and 1033 losers on the BSE.