| « Back to article | Print this article |

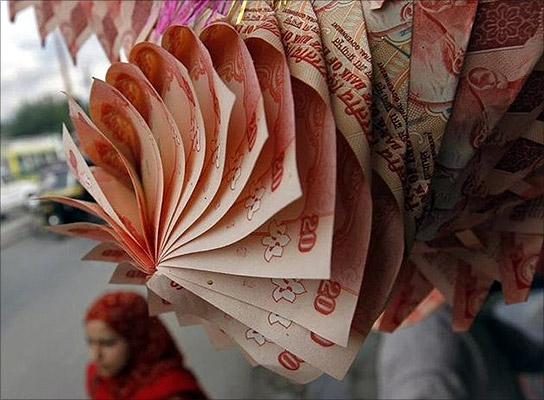

Rupee closes with a gain of 58 paise

The RBI's measures to address exchange rate volatility by curbing liquidity paid off with the rupee on Tuesday firming up 58 paise to end at 59.31 against the dollar, the biggest gain in more than a fortnight.

The rupee opened higher at 59.20 per dollar as against the previous close of 59.89 at the Interbank Foreign Exchange Market and firmed up to a high of 59.14 before ending at 59.31 per dollar, a net gain of 58 paise, or 0.97 per cent.

It moved in a range of 59.14 to 59.50 per dollar during the day.

On June 28, rupee had appreciated by 80 paise.

The Reserve Bank last night raised borrowing costs for banks and said it would sell bonds through open market operations to drain Rs 12,000 crore from the system.

The steps were aimed at restoring stability to the foreign exchange market, the central bank said. The rupee had touched an all-time low of 61.21 on July 8.

"For the rupee, this may provide some short-term relief as it shows policy makers' resolve to limit further sharp weakness in the currency," Dominic Bunning, FX Strategist, and Paul Mackel, Head of Asian Currency Research at HSBC, said in a report.

"However, the current account deficit and the ability to attract long-term foreign capital inflows are still major hurdles, as is external market volatility.

"Finance Minister P Chidambaram said last night's measures by the RBI have nothing to do with the upcoming monetary policy review and may not impact interest rates of banks.

The RBI's measures, he said, were aimed at checking excessive volatility and speculation in the forex market.

Last week, the RBI had asked oil companies to source all of their monthly needs of 8-8.5 billion dollars for import of oil from a single public sector bank.

It also barred banks from trading in currency futures and exchange-traded currency options market on their own.