| « Back to article | Print this article |

How mobile TV market is trying to make it big in India

Technologys for mobile TV has course found its way to India. Players in the mobile TV market are trying out various revenue streams before cheap and fast data pipelines open up.

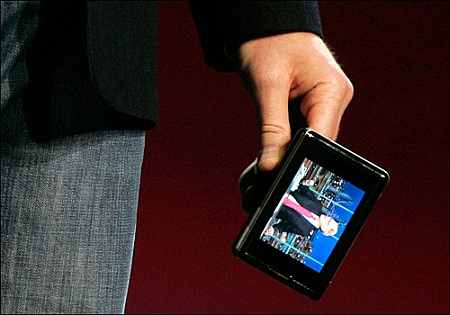

India happens to be the third largest television household market. The country also has the second largest cell phone user base in the world. Mobile television would seem like the natural progression. Right?

Well, from the looks of it, it is still some time for the two to come together. The technologies for mobile TV have of course found their way to India, but the jury is still out on which business model to bet on. As a result most of the players are trying to straddle more than one revenue model.

It is difficult to get a fix on the size of the market. "That is because the nomenclature can encompass anything from TV content hosted on websites to over-the-top mobile deliveries," says Kiran Kulkarni, managing director of Geodesic.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Indians surf the internet more on handheld devices than desktops. Industry observers put the number of mobile phone internet users at around 80 million with another 10 million users accessing the internet through handheld devices such as tablets and e-readers.

Analysts put sticky mobile TV subscribers at 8 per cent of this 90 million universe of mobile internet users. Ernst & Young Partner Devendra Parulekar says, "Advertisers are still staying away from the mobile TV platform because the stickiness of viewers as with say, renewals and repeat purchases in DTH, is still absent."

Observers point out the average annual spend of each customer to be anywhere between Rs 300-900 (data costs and subscription costs). The ecosystem, then, is generating not more than Rs 450 crore (Rs 4.5 billion).

Click NEXT to read more...

How mobile TV market is trying to make it big in India

The opportunity is immense. A global survey commissioned by new media delivery specialist Vidiator has found that India is leading the way in monetising mobile content with 50 per cent of the people having paid for mobile video content.

This compares to just 26 per cent in the UK and 47 per cent in Malaysia. When will mobile TV find its feet in India?

It should have been sooner. Indian households mostly have single TVs, making it a ripe market for the cell phone to become the second screen for TV consumption.

But coming in the way of players like Apalya, Zenga, Mundu and Ditto are low bandwidth, which results in poor quality image and slow streaming and inconsistent load times, and the issue of revenue sharing with telecom partners who tend to grab a bigger share of the pie.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

The early entrants tied up with the mobile operators as part of the mobile value-added services, sharing their revenues from subscriptions with network operators and content providers. A few bundled their applications in the new-generation handsets.

Now they are looking for ways to circumvent the telecom operator altogether. Some of them are trying what is called over-the-top delivery through providers that bypass cable packages and provide content directly through web browsers.

But it is far from being a clear winner, with its own set of problems. The biggest threat in this case comes from the internet itself, from free channels such as YouTube.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

The playing field

The good news is, the broadcasters are warming up to the potential of mobile TV and are trying to get their act together. The imminent wave of 4G and LTE (long-term evolution or LTE is part of the GSM evolution strategy beyond 3G) appears too irresistible for them.

Take Zee Entertainment's Ditto TV, which has built a business model that side steps the telecom operators altogether. It has taken on board Siemens to put together its over-the-top delivery model.

Users will have to subscribe to this service separately, while paying their operators for the resultant data traffic. "We were the first to launch an Indian satellite channel, the first to launch DTH. Now we want to talk to a different audience-the young people-for our new media drive," says Punit Goenka, managing director and chief executive officer, Zee Entertainment.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Interestingly, Zee says it doesn't want to brand its mobile TV offering as a Zee product. "It will allow Ditto TV to carry off a new language for the youth," says Goenka. Frontpage teaser ads in newspapers cheekily declared that readers could watch television everywhere if they were bored of 'doing it on the couch'.

It will also put the fellow broadcasters at ease who might then be more open to joining the Zee platform for the mobile TV service. "If we brand it as Zee then it defeats its role as a distribution platform," says Vishal Malhotra, business head (new media), Zee Entertainment Enterprises.

With the over-the-top model, Zee hopes to build a profitable platform of mobile TV distribution. "We haven't tied up with any mobile operators because there is no revenue to be made there. If I get 10-50 paise per channel per viewer, there is not much left for my content partners and us," says Malhotra.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Operators pocket 60-70 per cent of revenues in services bundled with their networks. Ernst & Young's Parulekar says, "When telecom operator ARPUs (average revenue per user) are rock-bottom, you can't fault them much for they have to worry about their profitability too. India is the only market where just 20-30 per cent of revenues trickle down to mobile TV players."

Pallab Mitra, head (new product development, consumer VAS) and additional vice-president at Tata Docomo, says, "Operators have to spend on feeder systems and servers to stream the content. We are the ones who are responsible for facilitating the selection and use of mobile TV by the end consumers. There is also the capital investment to increase the data bandwidth allowing mobile TV streaming."

But the operator-agnostic model is not the easiest to pull off. Vamshi Reddy, founder-MD of Apalya Technologies, points out the biggest one.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

"The operator already owns a ready customer base. When we tie up with them, the operator can market the service and bring in these customers without us spending on it."

Apalya started services on low-end networks, providing the backend for most operator-branded mob-ile TV services, and kept pace with high-end deliveries when smartphones and 3G took off. It offers over 200 channels and has strea-med Indian Premier League matches.

Reddy points out that now most operators don't charge for data ferrying and only for a mobile TV pack every month, making it more affordable. "You can't look at mobile TV as a standalone product, but have to work with the entire ecosystem which has original equipment manufacturers, telecom partners and content providers. That is how you can make it more affordable for the end consumer," says Reddy.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Mitra of Tata Docomo says, "Mobile TV still largely acts as a catch-up platform for a quick update on news or an important game or a few minutes of TV on the move. It will also take off because in the communal TV-viewing environment in India, it affords privacy. That is why our satchet packs for daily and weekly viewing are more popular than monthly or yearly ones."

Mitra also points out that operator-based mobile TV packs don't have to go through any separate online payments or retail recharge route since services are bundled together.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Sustainability factor

Reddy says the business is sustainable even with operators pocketing a large part of the revenue. With most content providers (read television channels), it has revenue-share agreements and for events such as cricket matches, it is often done on a minimum revenue commitment.

Popular TV networks also charge a minimum guarantee fee (minimum revenue assurance). However, even though it has been in the mobile TV business for about six years, it broke even only last quarter.

Malhotra says Ditto's over-the-top model will work because of the audience on its radar. They are not only young but also affluent. Beaming its feeds to the metros and large cities, Ditto TV will bank on people watching their mobile TV either for a short span (15 minutes or so) on regular 2G/3G networks when on the move or at homes, usually hooked up through unlimited wi-fi access to the internet.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Such usage -- and Zee has research data to prove the point -- will ensure the customer doesn't incur any additional data charges as it expects most of its customers to be on at least 1GB data plans on their mobile phones.

"We will be getting content from any broadcaster who can bring us audience aged 13-35 years. They are the ones who consume content this way. Older people still prefer larger screens," says Malhotra.

Ditto has already seen more than 1 lakh users download its applications, on handheld and desktop devices. Having undergone one renewal cycle since its February launch, it has seen 30 per cent of them pay for the services (there are also a few free-to-air channels available).

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Kulkarni of Geodesic, Zee's erstwhile mobile TV partner, says mobile TV adoption has been delayed because of the lack of payment options, apart from the expensive 3G rates, affecting all the players. Like Ditto, Geodesic's mobile TV brand, Mundu TV, launched a year ago, has rolled out pre-paid cards for subscribers that can be activated both on desktops and handheld devices to woo e-commerce-wary users.

"Only 3-4 per cent of one's customer base subscribe to paid channels. The rest watch free-to-air channels for now," he complains.

The payment options are also on Zee's mind and it is working on shaping up its e-commerce payment options to launch its video-on-demand services. It will even let users pay cash on delivery if they can't access a retail outlet easily.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Geodesic has a finger in all the business models for now. It is present in over-the-top deliveries with its pre-paid cards at retail stores, after Zee parted ways for a partner who could enable video-on-demand and e-commerce subscription. It is also toying with an ad-based direct-to-handset model which is still very nascent in India. What is a viable alternative to its prepaid cards is embedding its application in mobile handsets and other handheld devices (via OEM partnerships).

"The cost of acquiring the customer is very low and also such users don't migrate to another application easily since it is embedded in the product already," points out Kulkarni.

It will also enable Geodesic to embed ads in the applications which will be stored on the handsets, rather than take up additional streaming bandwidth of the user. Mundu TV enjoys margins of 22-25 per cent, after accounting for streaming, infrastructure and content costs.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Zenga is the other major player in OEM-embedded mobile TV services and also one of the oldest. It stores its content on the cloud to avoid hardware investment expenses in the backend. Offering its services for free, it mainly earns from partnering with handset manufacturers.

Players such as Zenga and Mundu have seen more traction in smaller cities and towns. Kulkarni points out, "Small towns face power cuts with inverters diverted to run fans etc. Also, in these households, there is no scope for personal television viewing, making live TV on mobile handsets more relevant."

He also says small and medium enterprises have been known to subscribe to such services for personal computers instead of investing in a TV set and concurrent connections for their employees.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Even though India often ranks among the top four downloader of video content, Parulekar says, even high-end 3G today is no match for high-speed broadband in the country.

"Broadband is affordable and also fast enough to support mobile TV streaming. 4G and LTE will change the scenario for wireless mobile TV because these would make data consumption comparable to wired broadband services in both speed and price," he says. No wonder most mobile TV players are also keen on tying up broadband players for reaching the viewer, including over-the-top players such as Ditto TV.

Parulekar reveals that over-the-top's main draw will eventually be video on demand since live TV can be streamed other ways too. "For channels, it makes sense to tie up with a distributor, the operator in this case, and bundle services so the consumer does not have to pay separately," he says.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Both Zee and Geodesic are getting into video content in earnest. If the established players such as Apalya and Zenga can lay claims to IPL match screenings, Zee is eyeing short-form youth serials co-produced with young producers for the platform.

For now, it will be wellness and cartoons. Its movie library will go live the moment it puts its online payment mechanisms in place.

Geodesic shows music concerts at joints such as Blue Frog and will integrate education content, the bulk of which is already digitised.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

Content is king

One of the major internet TV content hosts is YouTube, the popular video-sharing portal, owned by Google. Google India managing director Rajan Anandan says, "India has more than 50 million mobile internet users, and that number is set to go up to 300 million in a few years' time. What is important is to have enough content for them to be available on the web. We need 100 times more video content on the net, so I welcome any player who enters mobile TV."

Zee had not been able to monetise its erstwhile online TV portal, mypopcorn.com. However, its rival, Star India is readying a comeback with its version, called Star Player.

Sanjay Gupta, COO of Star India, says, "4G and LTE will roll out in the next 12-18 months. We have to be prepared for it. We too are working on it and will be launching a service this year, having spoken about it earlier. It can be accessed via the web but can be used on multiple devices, including a smart TV," he adds.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

For Gupta, mobile TV options will drive viewers to use more number of devices. "Indians consume just 2.5 hours of TV content per day on an avera#8805 in the US, it is five hours. Either through one's own or shared platforms, we have to push for multiplicity of devices," Gupta notes.

What is more critical for Star India is to get its 12,000 hours of content it makes every year to an audience beyond India.

"Today, not all of our channels reach all the overseas markets, save for Star Plus which reaches 65 countries. The other vernacular channels could now reach these markets too," Gupta says. On its part, Ditto will capitalise on Zee's international audience.

Click NEXT to read more...

How mobile TV market is trying to make it big in India

With broadcasters in the race with technology providers to provide mobile TV, what will separate the boys from the men will be the kind of investment one can rustle up. While Zee, with its healthy balance sheet, can invest in the business without much trouble, others like Apalya have got venture capital to support them.

But the ecosystem is still lopsided, driving some players to avoid bundling services with distributor partners. This might hike the bills for users and end up discouraging them further. As a result, for now, all the players are focusing on sharpening their user experience while dabbling in the available revenue models.

It will be still some time before a model emerges the winner. Till then the audience will be waiting.