| « Back to article | Print this article |

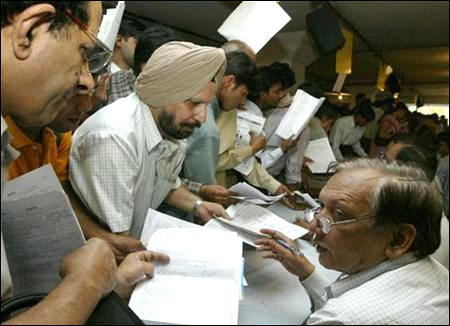

How DTC may bring relief on I-T rates

After the Direct Taxes Code Bill is approved by Parliament, it may bring with it major relief for personal income tax payers.

At a press conference on Monday, Finance Minister P Chidambaram said when the final version of the Bill was tabled in Parliament, the government would abide by the recommendations of the parliamentary standing committee on DTC.

The parliamentary panel, chaired by former finance minister Yashwant Sinha, had recommended the DTC increase income tax exemption limit to Rs 300,000 a year, against the Rs 200,000 proposed in the Bill.

Click NEXT to read further. . .

How DTC may bring relief on I-T rates

Currently, the exemption stands at Rs 200,000.

The panel also suggested a 10 per cent income tax rate be applicable for annual income of Rs 300,000 to Rs 10 lakh (Rs 1 million).

The DTC Bill had proposed this rate on income of Rs 200,000-500,000.

Currently, too, 10 per cent income tax is imposed on the Rs 2-5 lakh slab.

The panel also suggested 20 per cent income tax be paid by those earning Rs 10-20 lakh (Rs 1-2 million) a year.

Click NEXT to read further. . .

How DTC may bring relief on I-T rates

The Bill had proposed this rate for the Rs 500,000-10 lakh (Rs 1 million) segment (the current segment).

It also wanted the government to impose a peak rate of 30 per cent on annual income of more than Rs 20 lakh (Rs 2 million), against the Bill's provision of more than Rs 10 lakh (the current scenario).

Substantial changes in tax exemptions on long-term savings, medical insurance and social security contributions were also suggested by the committee.

It wanted the government to increase the long-term savings limit for exemption from Income Tax from Rs 100,000 to Rs 150,000.

Click NEXT to read further. . .

How DTC may bring relief on I-T rates

It recommended contribution to social security such as pension be exempted up to Rs 150,000 a year; medical insurance up to Rs 100,000; medical insurance for dependent parents up to Rs 50,000 and professional studies and education Rs 50,000.

The panel did not suggest any change in the corporate tax rates imposed.

The finance minister did not specify a date for the implementation of the DTC, which would replace the archaic Income Tax Act of 1961.

Initially, DTC was scheduled to be introduced from April 1.

However, the standing committee had submitted its report to Parliament only in March.

The government would now table the revised DTC Bill in Parliament.