| « Back to article | Print this article |

How Delhi, Mumbai airports turned into money spinners

The airports run by leading private operators GMR and GVK, especially those in Delhi and Mumbai, are turning out to be cash cows for the government.

The hefty revenues the Airports Authority of India (AAI) earns from these companies is helping the government fund its ambitious plan of modernising airports across the country.

Click NEXT to read more…

How Delhi, Mumbai airports turned into money spinners

Also, the revenue shared by these operators has given the government the headroom to concentrate on supporting the ailing state-owned airline, Air India.

Now, the limited budgetary resources are not required to financially support AAI, which runs and is modernising all the other airports in the country.

Click NEXT to read more...

How Delhi, Mumbai airports turned into money spinners

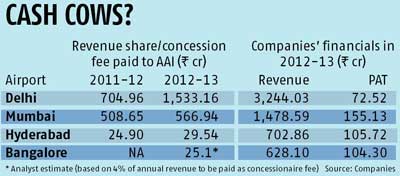

In 2012-13, as its revenue share from GMR-led Delhi International Airport Ltd, which runs the capital's airport, and the GVK group, the operator of the Mumbai airport, AAI received a little over Rs 2,100 crore (Rs 21 billion) - the most in a financial year since these airports were privatised.

According to analyst estimates, if the concession fees paid by the two other new and privately-run greenfield airports - GMR-run Hyderabad airport and the Bangalore airport, in which GVK has a strategic stake - are also taken into account, AAI could have made a bonanza of Rs 2,150 crore (Rs 21.50 billion) in the year.

Click NEXT to read more...

How Delhi, Mumbai airports turned into money spinners

The overall revenues of AAI, which holds 26 per cent each in the Delhi and Mumbai airports and 13 per cent each in the Hyderabad and Bangalore ones, rose 17.7 per cent in the year from that in 2011-12.

But, its increasing reliance on the Delhi and Mumbai airports is evident from the fact that the share of these two airports in the total went up from 20.6 per cent in 2011-12 to a little more than 30 per cent in 2012-13.

Besides, during this period, the revenue share paid by these two rose a staggering 73 per cent.

Click NEXT to read more...

How Delhi, Mumbai airports turned into money spinners

Under their agreement, DIAL has to share 45.99 per cent of its revenue with AAI every year, while the GVK group's Mumbai International Airport Ltd (MIAL) shares 38.7 per cent.

The model is a little different for the Bangalore and Hyderabad airports; it is not based on revenue sharing and entails a payment of four per cent of revenue as annual concession fees.

In 2012-13, these two airports together made a profit after tax (PAT) of only Rs 227 crore, a tenth of what they paid AAI.

Click NEXT to read more...

How Delhi, Mumbai airports turned into money spinners

The cash coming from these privately-run airports has helped AAI fund large airport modernisation projects on its own.

For instance, AAI invested Rs 2,325 crore (Rs 23.25 billion) and Rs 2,015 crore (Rs 20.15 billion) in modernising the airports in Kolkata and Chennai, respectively.

By the numbers, one of the two could have been fully financed by revenue shared together by the Delhi and Mumbai airports.

Click NEXT to read more...

How Delhi, Mumbai airports turned into money spinners

In 2012-13, AAI invested Rs 1,800 crore (Rs 18 billion) in developing the country's airport infrastructure.

That's less than the revenue it earned from the Delhi and Mumbai airports.

The large inflow from these two airports has also made it possible for the government to substantially reduce the budgetary support it would otherwise have had to give AAI for its airport modernisation exercise.

All it gave in 2013-14 was Rs 42 crore (Rs 420 million) for airports in the Northeast.