| « Back to article | Print this article |

Housing prices have begun to drop!

The residential property market across India headed south in the beginning of 2008 and almost hit its nadir in the latter part of the year.

However, 2009 may tell a different story. Says PropEquity, a New Delhi-based real estate research firm, in a study that sales increased marginally in the first quarter of calendar year 2009, especially in the newly-launched projects.

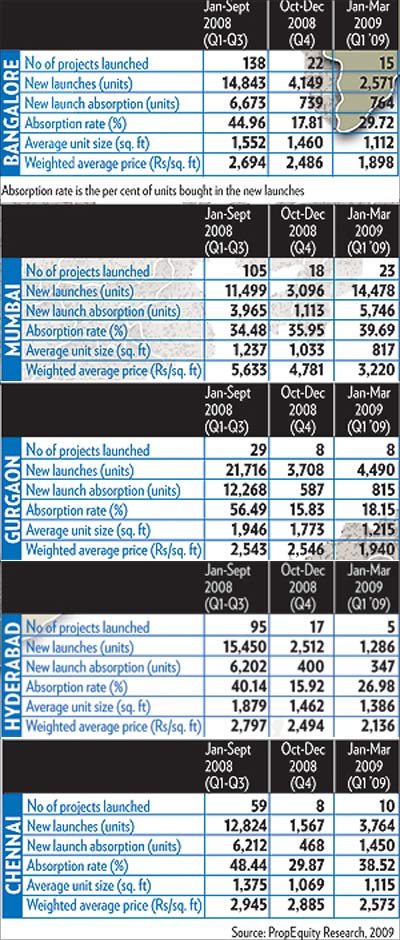

Says Samir Jasuja, founder and CEO, PropEquity: "Our attempt has been to cover all new launches. Over 90 per cent of all launches have been covered in the cities researched. We are tracking over 3,000 developers across India and over 8,000 projects in these cities." Mumbai, Banga-lore, Chennai, Hyderabad and Gurgaon were covered in the study.

However, this throws up questions on the feasibility and sustainability of the trend.

Text: Pankaj Anup Toppo, Outlook Money

Housing prices have begun to drop!

Figures tell the story

There was a slight increase in absorption levels during January-March 2009 compared to that in October-December 2008 (see Road to Recovery?). Along with reduction in prices, the total area sold per unit has also come down.

So, what has led developers to reduce prices now? To answer this question, let's look at the developments in 2008.

Housing prices have begun to drop!

A bit of history

Sentiments in the real estate market changed around mid-January 2008, when the Sensex crashed. Real estate prices started going down and so did sales volume.

Says Pranay Vakil, chairman, Knight Frank India, a real estate consultancy, "There was a huge fall in transactions."

By mid-2008, sales fell to almost 10 per cent of what they were in 2007. Volumes did not pick up even during the Diwali season, the period when offtake increases.

On the one hand, sales touched abysmally low levels, on the other, private equity funds became cautious about lending to developers.

"It was like a noose tightening around their neck," says Vakil. The only way out for developers was to come up with innovative ways to woo customers and do some introspection at the strategy level.

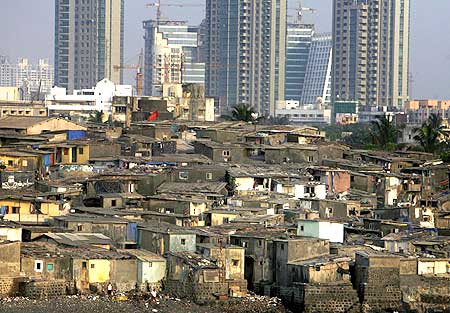

At that time, most developers catered only to luxury housing. "In places like Mumbai, there was no availability of 1-bedroom apartments," says Vakil.

Around the same time, two government initiatives in Mumbai and Delhi, offering houses through Maharashtra Housing and Area Development Authority (MHADA) and Delhi Development Authority (DDA), respectively, at a substantial discount to the market rate, generated huge response.

Housing prices have begun to drop!

This showed that there can be demand even in turbulent times, provided the price is right. "This was the time when developers started thinking about pricing and sizing of units," says Vakil.

Subsequently, developers came up with the affordable housing plank, which has seen reasonable success.

Says Aashiesh Agarwaal, real estate analyst, Edelweiss Securities, a financial services company: "Developers have adjusted their product mix so that it appeals to the masses. The market also required lower-priced products."

Sustainable trend?

Sales in new project launches has picked up marginally. But whether the trend is sustainable remains a question.

"It could be sustainable, if the pricing and sizing are right," says Vakil.

Housing prices have begun to drop!

However, Pankaj Kapoor, founder and CEO, Liases Foras, a Mumbai-based real estate research firm, feels the trend is not sustainable in the long run. "Most of the new projects have been launched in areas that are largely unapproachable, especially in Mumbai," says Kapoor.

He further says that 90 per cent of the buyers of these projects are investors.

The fate of new buyers

Though some buyers saw an opportunity in cheaper prices, will the deal be really feasible for them? Considering the liquidity crunch that developers faced last year, it's difficult to say whether they would get over the problem this year.

So have these buyers moved into the market a bit too early? Do they run the risk of getting stuck with delayed projects?

Housing prices have begun to drop!

Says Agarwaal: "The economy is showing initial signs of recovery. If it sustains, there won't be much of a problem completing the projects on time. But, if that does not happen, then homebuyers could well be in for a rough time."

Aditya Verma, vice-president and business head, Makaan.com, a realty portal, is more direct. "This [getting into these projects] could be a real danger," he says.

For Vakil, delays are common to all developers -- whether it's a leading one or a newcomer.

"Projects are getting delayed across the country, regardless of the developer. It's almost like delays have been taken for granted. In fact, people are surprised if a project gets completed on time."

What about earlier projects?

While new launches are finding takers, even if they are few in number, what is happening to projects launched earlier?

Some developers have started reworking the unit size and some others are offering discounts. "Developers have not cut prices drastically for old projects that are still under construction," says Agarwaal.

Housing prices have begun to drop!

This means that there is room for negotiation, in case you are interested in any of the projects.

Says Verma: "In the sub-Rs 30 lakh category, there's not too much room for negotiation as there is a huge demand for them. In the Rs 30 lakh-75 lakh price bracket, you can negotiate in the range of 5-15 per cent.

However, there are few takers for the Rs 75 lakh-plus category. These will continue to languish even if the developer offers discounts of over 15 per cent. In some cases, these properties are being split and then sold off."

Price movement

The crucial question here is which way will prices move in the next 12 months. Says Vakil: "Capital values will not go up. In some pockets, they will even correct. But transactions and volumes will increase."

Housing prices have begun to drop!

Verma offers a more micro view. He says: "In Mumbai, Bangalore and Pune, prices have corrected by around 22-28 per cent and there is little room for prices to go down further.

However, in Delhi and Kolkata, prices could go down by another 10 per cent over the next 2-3 months."

How much can you afford?

The interest in affordable housing in apparent, according to a recent study by Edelweiss Securities. While the figures below are for Mumbai respondents, the preference for affordable housing is a trend seen across major markets:

14%: Less that Rs 15 lakh (Rs 1.5 million)

43%: Rs 15-30 lakh (Rs 1.5-3 million)

32%: Rs 30-45 lakh (Rs 3-4.5 million)

8%: Rs 45 lakh-Rs 1 crore (Rs 4.5-10 million)

3%: More than Rs 1crore (Rs 10 million)