| « Back to article | Print this article |

22 hotspots for investment, Indian cities slip

Indian cities have slipped to the bottom of the investment destinations list, according to the "Emerging Trends in Real Estate Asia Pacific 2013 Report" jointly published by the Urban Land Institute (ULI) and PricewaterhouseCoopers (PwC).

Several second-tier cities have emerged as favoured investment and development destinations.

Real estate investor sentiment in the Asia Pacific property sector remains relatively positive, despite continuing global economic uncertainty, according to Emerging Trends in Real Estate Asia Pacific 2013, a real estate forecast jointly published by the Urban Land Institute (ULI) and PricewaterhouseCoopers (PwC).

However, while steady economic growth, rising incomes, and stable or increasing property values are contributing to an overall sense of optimism, the outlook is tempered by concerns among investors that prime assets in key real estate markets in the Asia Pacific region are becoming overpriced.

This report is based on the opinions of more than 400 respondents which include real estate developers, investors, property company representative, lenders, brokers and consultants.

Here's a list of the 22 hotspots for investment in the Asia pacific region...

22 hotspots for investment, Indian cities slip

Jakarta, Indonesia (Rank 1)

Score: 6.01

Topping the rankings for both investment and development for the first time, Jakarta is described as a "surprising" choice, says the report.

Jakarta is considered as the most favorable emerging market in the region by real estate professionals, with business transactions generally easier and more transparent than in other markets.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Shanghai, China (Rank 2)

Score: 5.83

Shanghai's office market and retail market have proved mainstays for foreign funds looking to invest in Chinese real estate.

The city's relatively user-friendly business environment, growing volume of institutional grade properties and historic market performance make it a good investment choice.

However, prices are considered to be relatively high, the market has become saturated.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Singapore (Rank 3)

Score: 5.78

Singapore retains its popularity among real estate investors who see the market as a safe haven offering solid returns.

However, the city's office market has recently run out of steam with significant amounts of new Grade A office space drawing tenants away from existing buildings, a problem which is compounded by a shrinking head count in the local financial sector.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Sydney, Australia(Rank 4)

Score: 5.69

Sydney has seen a limited amount of new supply of commercial space in recent years, although a significant amount of office and retail space is in the pipeline for 2015.

A shortage of institutional grade property has continued to suppress sales volumes and kept prices buoyant, driving up total returns for office assets.

Australia has absorbed more international real estate investment over the past year than any other country in the Asia Pacific region.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

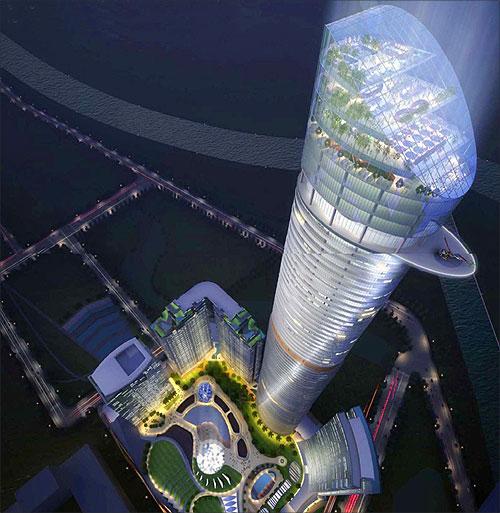

Kuala Lumpur, Malaysia (Rank 5)

Score: 5.60

Kuala Lumpur offers a stable market with good opportunities for opportunistic returns.

While property sales slowed noticeably in most Asian markets during the third quarter of 2012, Kuala Lumpur was the exception.

The city's long-term prospects for the commercial property are strong, due to the success of the government's Economic Transformation Programme in attracting foreign investment.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Bangkok, Thailand (Rank 6)

Score: 5.67

Bangkok's potential lies in the tourism and hospitality sector. Health tourism continues to be a big draw, with large numbers of foreign patients, especially from the Middle East, attracted to low-cost/high-value medical facilities.

Consumer demand is expected to attract a significant number of international retail chains over the near term, which in turn will boost rents across the retail sector.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Beijing, China (Rank 7)

Score: 5.65

Beijing's office sector has seen significant price rise in the past three years.

The prices in the Central Business District have increased by at least 45 percent over the past two years while rents have risen 6.6 percent per quarter for the past 10 quarters, according to consultants Savills.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

China–secondary cities

Score: 5.60

The interest in China's second and third-tier cites has grown quickly in recent years. Chongqing, Tianjin and Shenyang have become especially popular destinations.

In these cities, investors have the opportunity to pick up prime city-centre sites that will have long-lasting value as core assets.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Taipei (Rank 9)

Score: 5.58

In the commercial sector, sales rose 78 percent year-on-year in the first half of 2012, according to Savills.

Retail sales, have gone up on the back of growing tourism from mainland China.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Melbourne (Rank 10)

Score: 5.56

Melbourne market continues to show strength, with foreign funds being major buyers.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

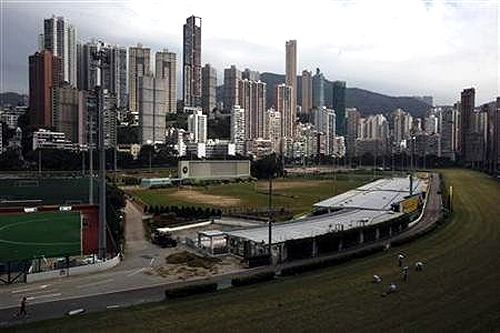

Hong Kong (Rank 11)

Score: 5.56

Prices in the residential sector have risen by 20 per cent this year. Hong Kong housing prices are now the world's highest.

Hong Kong's retail sector has been booming for several years as a result of the large numbers of mainland Chinese tourists come to the city. Local rents have been rising 35 per cent annually.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Manila, Philippines (Rank 12)

Score: 5.52

Markets in Manila have performed well in the past couple of years as a result of the growing economy, a transparent and business friendly government.

A large casino development is underway in Manila boosting development. This is set to attract more tourists to the city.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Tokyo, Japan (Rank 13)

Score: 5.42

Tokyo's lacklustre performance comes as a surprise, given its current function as something of a magnet for foreign investors looking to invest both in core assets.

Investments have been helped by copious liquidity, cheap loans, and a wide yield spread that gives good returns on a cash-on-cash basis.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Seoul, South Korea (Rank 14)

Score: 5.39

While South Korea remains the biggest real estate market in Asia outside Japan, China, and Australia, foreign investors have long had problems getting a foothold.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Guangzhou, China (Rank 15)

Score: 5.30

Guangzhou has been the slowest of cities to develop and rents remain low compared to other urban areas in China.

The market is considered to have good long term prospects.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Shenzhen, China (Rank 16)

Score: 5.24

The city continues to receive investment as it moves from a textile base to build light manufacturing industries.

The office market continues to thrive with prices rising more than 50 per cent since 2009.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Auckland, New Zealand (Rank 17)

Score: 5.07

In Auckland, interest rates are low, which is a big advantage. The local market has some interesting assets.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Ho Chi Minh City, Vietnam (Rank 18)

Score: 5.02

Vietnam's realty rankings have plunged this year due to its economic problems. However, residential, hospitality and manufacturing sectors are key sectors.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Bangalore, India (Rank 19)

Score: 5.01

Though Bangalore's rank has slipped, it remains a mature and stable market with its fortunes tied closely to the information technology industry.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Mumbai, India (Rank 20)

Score: 4.94

Though Mumbai has suffered from an undersupply in all property sectors, now there is an oversupply of realty properties. It remains one of the biggest realty hotspots in India.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

New Delhi (Rank 21)

Score: 4.86

New Delhi and its satellite zones may be set for a comeback as many Mumbai-based financial investors are looking to invest in Delhi.

The Delhi masterplan alone will see almost 32,000 acres allocated for residential development.

Click NEXT to read more...

22 hotspots for investment, Indian cities slip

Osaka, Tokyo (Rank 22)

Score: 4.82

An investment hotspot during 2008, Osaka has slipped to the bottom of the rankings. However, prospects for tier-2 cities are gaining momentum.

Click NEXT to read more...