| « Back to article | Print this article |

Hotel occupancy, room rates set to hit a new low

If the first quarter results are anything to go by, the hospitality industry may have to face gloomier times ahead.

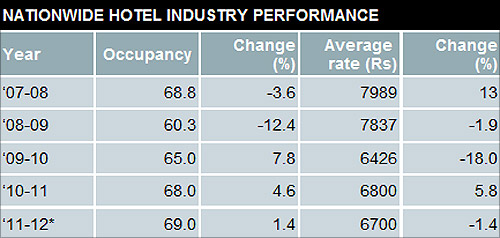

The average hotel room rates for 2012-13 are expected to fall five to 10 per cent and the occupancy is likely to come down five per cent, compared with the previous financial year, industry experts say.

This will take the occupancy and room rates of the hospitality industry closer to the levels during the economic crisis of 2008 and after.

Click NEXT to read more...

Hotel occupancy, room rates set to hit a new low

While occupancy this financial year could see the first fall in growth after 2008-09, room tariffs may touch the lowest so far in the past five years.

Contrary to the expectations that the year would be "a turning point" in the midst of an economic crisis, hotel companies are now faced with a tough situation.

"People are losing confidence in India. GDP (gross domestic product) projections have been revised. In 2008, we were coming off a peak. We are now seeing a gradual decline. It is a systemic shock," said Kaushik Vardharajan, managing director – consulting and valuation, HVS.

Click NEXT to read more...

Click NEXT to read more...

Hotel occupancy, room rates set to hit a new low

Hospitality major EIH, which operates the Oberoi and Trident brands of hotels and resorts, reported 38.83 per cent dip in net profit at Rs 9.45 crore for the quarter ended June 30, due to decline in sales.

"The hospitality industry's performance is directly related to economic growth and investor confidence. Unfortunately, the economies on which we depend are shrouded in uncertainty," said P R S Oberoi, chairman, Oberoi Group, at the company's annual general meeting.

Click NEXT to read more...

Hotel occupancy, room rates set to hit a new low

Another leading hospitality firm, Indian Hotels Co (IHC), which runs the Taj group of hotels, reported a net loss (after minority interest) of Rs 33.4 crore for the quarter ended June, compared with a loss of Rs 22.3 crore in the corresponding quarter last fiscal.

In the first quarter itself, hotels across segments have witnessed a fall in the occupancy levels by 10 per cent, which has deterred them from revising the average room rate.

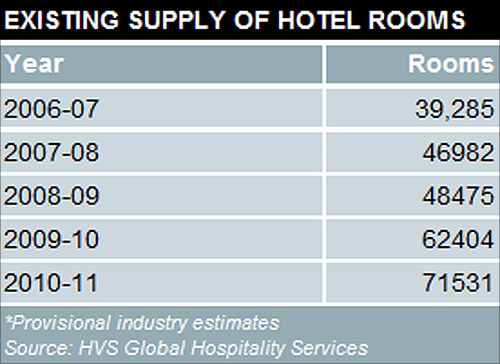

"The crisis is worse than in 2008-09. Not only is the economic sentiment low, but the additional inventory has also made things more difficult for hotels," said Arjun Sharma, managing director, Le Passage to India.

Click NEXT to read more...

Hotel occupancy, room rates set to hit a new low

In 2010-11, 9,127 branded rooms were added to the existing supply.

The additional supply has not met with a corresponding demand, thereby keeping the average tariffs at lower levels. An HVS study indicates that by 2015-16, 102,438 rooms will be added to the total inventory.

The supply pipeline is expected to further drag recovery for hotel businesses. As Oberoi puts it, "Due to the expanding presence of new international brands, supply has exceeded demand in the luxury segment in several cities. Multiple centres of economic activity within large metropolitan cities are creating a shift in demand."

Click NEXT to read more...

Hotel occupancy, room rates set to hit a new low

Meanwhile, the industry is pinning its hopes on third quarter bookings when the festive season kicks in.

"In the immediate near term, the supply demand mismatch will exist. The upcoming hospitality district near the Delhi airport and inventory getting added across metros will keep the average room rates subdued," said Jaideep Ghosh, partner, KPMG advisory services.

Click NEXT to read more...