| « Back to article | Print this article |

Here's what is missing from India's FDI in retail debate

Derek Scissors makes a strong case for FDI in India's retail sector emphasising that farmers and urban consumers will benefit the most from this move.

A beleaguered Indian government tried last week to break out of its rut and boost what is finally recognised as a struggling Indian economy.

It did so with a bold and valuable decision to expand foreign participation in retail. Foreign companies will be able to wholly own single-brand stores and majority-own multi-brand stores.

There are a number of qualifiers to this long-awaited liberalisation, including the right for Indian states to say no, which several have already exercised loudly.

These state governments are making an error, as are the national opponents of the move.

Click NEXT to read on . . .

Here's what is missing from India's FDI in retail debate

Foreign competition in retail will hurt one group: uncompetitive domestic retailers.

Employment in domestic retail was estimated recently by the Indian government at just over 25 million. The dominant pattern is small, labour-intensive operations, and some of these will fall victim to foreign competition.

Others, of course, will respond and improve.

Click NEXT to read on . . .

Here's what is missing from India's FDI in retail debate

For almost everyone else in the country, foreign direct investment in retail means important gains.

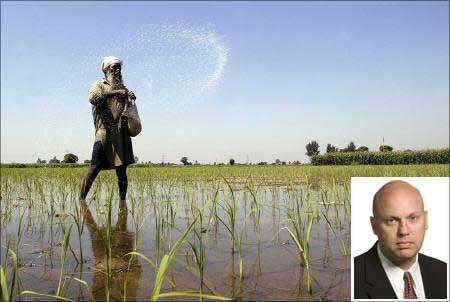

The two groups that will gain most are much bigger than domestic retailers: farmers and urban consumers.

Farmers will see far fewer of their products wasted on the way to market and, thus, higher income.

Click NEXT to read on . . .

Here's what is missing from India's FDI in retail debate

Urban consumers will see higher product quality and selection, boosting their purchasing power.

This is especially valuable given India's painful burst of food inflation.

There is another set of gains that is receiving less attention. Multinational retailers do not serve only local markets -- they have a great deal of experience and success in sourcing goods from developing economies for their developed economy outlets.

Click NEXT to read on . . .

Here's what is missing from India's FDI in retail debate

Wal-Mart in China is the classic example of this, which could not be more relevant for India.

India is in the early stages of a demographic expansion that will be matched in history only by the one China is soon to complete.

In creating productive jobs for the tens of millions of new entrants to the labour market, exports are indispensable.

Click NEXT to read on . . .

Here's what is missing from India's FDI in retail debate

Majority control over their operations will completely change the incentives and scale at which foreign retailers will operate in India, making exports vastly more attractive.

With this control, foreign retailers can potentially generate tens of billions in annual exports, thus directly boosting employment.

If permitted, they will also drive the creation of commercially valuable infrastructure -- roads, container terminals, and so on -- that will benefit all exporters, indirectly boosting employment.

Click NEXT to read on . . .

Here's what is missing from India's FDI in retail debate

This is the kind of infrastructure India desperately needs, not politically motivated government projects that contribute little or nothing when the construction work is done.

To be prosperous in a time of unprecedented demographic expansion, India must be willing to change, and all change involves both winners and losers.

In the case of foreign participation in retail, the winners will dramatically outnumber the losers -- even more so when exports are included in the discussion.

Derek Scissors, Ph.D. is Research Fellow in Asia Economic Policy in the Asian Studies Center at The Heritage Foundation.