Photographs: Reuters Rajesh Bhayani & Sharleen Dsouza in Mumbai

Currently on an India visit, David Lamb, managing director - lifestyle and jewellery, World Gold Council, spoke to Rajesh Bhayani and Sharleen D'souza on trends in designs and consumer preference. Edited excerpts:

What are the key trends in jewellery designs in India and how are they different from global trends?

Some of the leading, most cutting-edge, designs in India take inspiration from Indian culture and history and there is big difference in understanding the richness of gold against other luxury goods.

For me, the most exciting designs are the ones which are complete modern re-interpretations of the traditional.

For example, the Taj collection from Tanishq, that is a 21st century take on established imagery. It's kind of a modern reworking of Indian traditions. This is contrary to India's hunger for Western ideas in other sphere of life.

And, emerging trends in global markets?

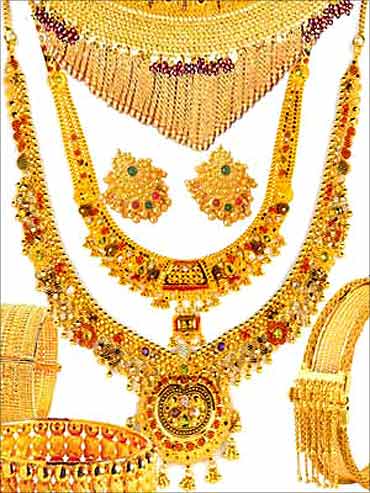

Traditionally, a lot of gold in India is bought in jewellery sets because the market here is dominated by the wedding, occasions and by the rituals.

In the West, we see a huge move towards individual pieces that have enormous impact, which are known as statement pieces. In particular, two categories, a cuff and you will see one enormous bangle, that is, bracelets.

...

'Gold industry should look into branded segment'

Image: Preferences are changing in the West.Photographs: Reuters

One logical response is to make things smaller and lighter. However, consumers in the West are looking for an individual piece that will make a statement and are bigger in size.

The preference in Western markets are also changing from low carat gold jewellery to higher, that is, 18-carat gold.

What has been the impact of changing designs and rising gold prices on the watch industry?

Watch companies thought that in 2008-09, the time of economic recession, they would have to make their watches smaller.

But actually consumers want them to be bigger. Rolex's day date is now super-sized and the bracelets are solid because people are looking at bigger pieces, where the sheer intrinsic value of gold makes a bigger statement.

The interesting trend that is alive overseas is to move away from always being a matched set towards individual pieces that become an investment asset for a lifetime.

...

'Gold industry should look into branded segment'

Image: Branded jewellery increases sense of lifestyle.Photographs: Reuters

There was a separation between the health of the Indian and Chinese market and the difficulties faced by the US market. The Indian manufactures are in a better business and are in a better market.

In the US market, young consumers are shifting to silver and it has a very strong price story. It is very good for the jewellery market, as the jewellery consumer has options to explore.

Initially, young consumers show an interest in silver but later these consumers upgrade to gold. At $1,430 an ounce, it is difficult to make pieces that a 25-year-old woman can buy on a regular basis. So, silver will be the way she gets educated into self-purchase of jewellery.

What do buyers' prefer, branded jewellery or unbranded? A branded one will be sold at a premium, which adds to cost, when prices are so high.

I would encourage the Indian gold industry to look into the branded segment. It increases the sense of a lifestyle that goes with a purchase, because the Indian market is driven by the intrinsic value of the raw material and improves the lifestyle.

...

'Gold industry should look into branded segment'

Image: Consumers happy to buy gold when prices are rising.Photographs: Reuters

So, according to you, high costs of gold are a not a big challenge, except at the lower end?

In a survey we conducted on over 1,500 women in India, 79 per cent say they will buy gold jewellery in the next 12 months. Consumers are happy to buy when prices are growing, in a good change.

The escalation in gold prices that has been seen over the last 10 years is a consumer strength, not a challenge.

Only the numbers of consumers in China are a tad higher then that in India. In the US, retail margins are much higher than India. Here, making charges are too low, along with other costs.

How do you see demand for jewellery face a challenge compared to gold demand for investment in India?

Our research from last year suggests there is really no tension between the two because those who buy jewellery also understand the physical and literal worth.

article