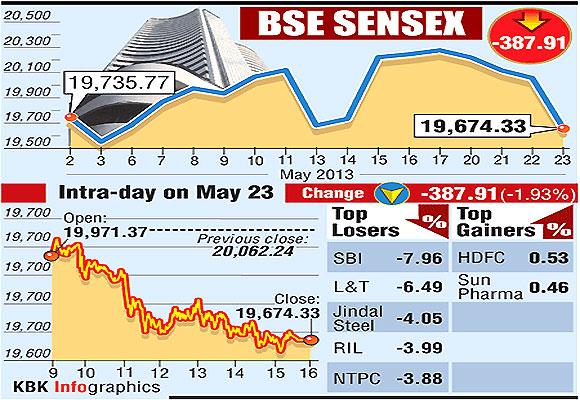

The Nifty posted its biggest percentage fall in a year on Thursday, as the prospect of an end to the US stimulus programme and a weak China manufacturing survey sparked concerns foreign investors would end their recent buying spree. The Sensex fell 388 points.

The biggest concerns focused on Federal Reserve Chairman Bernanke's comments suggesting bond purchases could be scaled back if the US economy improves, with falls magnified after State Bank of India slumped after disappointing quarterly earnings.

Click NEXT to see the four reasons...

4 reasons why Sensex sank below 20,000

Image: Federal Reserve Board Chairman Ben Bernanke.Photographs: Jason Reed/Reuters

Bernanke's Comments

A potential early wind-down of the US stimulus programme could hit Indian stocks badly, analysts have warned, as foreign institutional investors have been net buyers for 25 consecutive sessions, helping spark a rally since mid-April.

Still, analysts said prospects of the Reserve Bank of India cutting interest rates again in June after easing three times this year could help support shares.

"Indian markets were overbought and therefore we are seeing some correction. Some outflows are possible but it will be not be an exodus," said Paras Adenwala, MD & Principal Portfolio Manager, Capital Portfolio Advisors.

...

4 reasons why Sensex sank below 20,000

Image: People walk outside the Bombay Stock Exchange building.Photographs: Vivek Prakash/Reuters

The Nifty fell 2.09 percent or 127.45 points, to end at 5,967.05, marking its biggest daily percentage fall since May 8, 2012.

The Sensex fell 1.93 percent or 387.91 points, to end at 19,674.33, falling for a fourth consecutive session.

The NSE's volatility index, considered by some investors as a fear gauge, jumped as much as 8 percent to its highest level in eight months on worries about outflows even as Finance Minister P. Chidambaram said fears U.S. monetary stimulus programme reversal were unfounded.

...

4 reasons why Sensex sank below 20,000

Image: An employee pushes a car engine at a Geely Automobile assembly line in China.Photographs: Carlos Barria/Reuters

China Factory Activity Shrinks

China's factory activity shrank for the first time in seven months in May as new orders fell, a preliminary manufacturing survey showed, entrenching fears that its economic recovery has stalled and that a sharper cooldown may be imminent.

The final HSBC PMI stood at 50.4 in April.

The lack of vigour in the world's second-biggest economy implies its ability to meet the government's 7.5 percent growth target this year is increasingly difficult, analysts said, albeit it is still possible.

...

4 reasons why Sensex sank below 20,000

Image: People walk in front of a signboard displayed at the head office of State Bank of India in Mumbai.Photographs: Arko Datta/Reuters

Disappointing Results of Blue-Chips

Blue-chips led the index falls. ICICI Bank Ltd fell 3.1 percent and Reliance Industries Ltd lost 4.2 percent.

State Bank of India slumped 7.9 percent after posting its first quarterly net profit drop in two years and missing market estimates because of lower interest income and higher provisions for loan losses.

Larsen & Toubro Ltd fell 6.3 percent, adding to Wednesday's nearly 6 percent decline, on lingering disappointment over its January-March profit and outlook out on Wednesday.

...

4 reasons why Sensex sank below 20,000

Photographs: Reuters

Rupee's losing streak

The rupee posted a fifth day of falls to mark its longest losing streak in over three months as worries about a potential pullback in the US monetary stimulus programme and a weak manufacturing survey in China sparked a shift sway from riskier currencies.

Any pullback on US quantitative easing has the potential to hit Indian markets hard. Foreign investors have bought more than $5 billion of debt and stocks this month, marking a surge in inflows from previous months.

"The rupee was caught in the eye of the storm between Bernanke and Chinese PMI. The market recovered realising the fears were overdone. Expectation of large flows starting next week and exporter selling around 56 levels capped the losses," said Satyajit Kanjilal, chief executive at ForexServe.

article