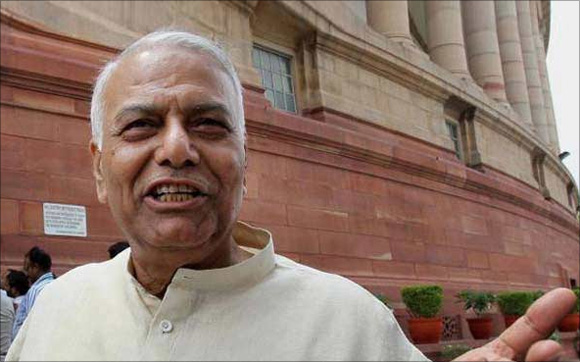

Warning about hard days ahead, Yashwant Sinha, former Union finance minister and chairman of Parliament’s standing committee on finance, says the government should shun populist measures and take tough decisions to rein in the fiscal deficit.

In an interview with Sanjay Jog & Abhijit Lele, he was sceptical about foreign visits by the finance minister to attract investments. Excerpts:

How does the Indian economy look?

There is no way we can take liberties and the economy also continues to remain healthy. Four years of high fiscal deficit and an unsustainable current account deficit for last year have created the current challenges.

The world is watching us. The situation is like a human body losing immunity; so, when germs attack, conditions deteriorate. This was the situation in 1991 and is today, too.

Without attending to the basic loss of immunity, you cannot improve the situation. Parliament’s standing committee on finance will meet in the third week of July to review the state of the economy.

The rupee has lost considerable value against the dollar in recent weeks. How does the current situation compare with events just before the crisis in 1991?

Every time the rupee loses value, there is a tendency to fight to preserve that level. That only provides temporary advantage but the basic ailment remains intact.

The Gulf war hit the economy seriously prior to 1991. Today, the moderation of quantitative easing (QE) in the US or developments relating to it are having an impact on us.

We do badly when the US economy is not doing well and we face more when it is doing better.

...

The rupee is under attack. Should the government and the Reserve Bank take direct steps?

The huge current account deficit has been met with hot money from abroad. They (foreign institutional or other investors) will go to markets which offer better returns. FII selling will happen in stock as well as debt segments.

RBI and government cannot fight the market. They can intervene to cut out the volatility. They should not fight the market; you end up spending reserves but do not get the intended results.

Instead, the government should initiate long-term steps to restore immunity. It is a cardinal mistake to depend on the charity of strangers. Currently, both the finance minister and commerce minister are in the US for attracting investments.

Investors will see the prospects for long-term profitability. Once they see stable conditions, they will make investments. Stability, long-term profitability and a business-conducive business environment are a must to convince investors.

...

The government has sent ministers abroad to drum up investments. Would such steps work to salvage the situation?

No number of trips are going to be effective to attract investments. It is a crisis of confidence.

What is going to be the effect of the food security ordinance on fiscal health?

Prime Minister Manmohan Singh has no commitment for economic reforms. He has been party to populist measures that have only added to the fiscal mess.

There are no barriers to stop the populism of the government.

...

What is needed to tackle deficits and improve the economy’s health?

Hard decisions are needed like sticking to the FRBM (fiscal responsibility) Act and to reduce the fiscal deficit rapidly to three per cent of GDP and maintain it at that level. It is also necessary to ensure spending is done for productive purposes and not for consumption needs.

The government should make investments in infrastructure like ports, power, railways, roads. After the financial crisis in 2008, the government stepped up the spending but it was predominantly consumption-oriented.

It pushed the fiscal deficit substantially. During the five years of NDA rule, jobs were created and it was essentially due to investments in infrastructure and long-term projects. Take the government’s programme for providing food security, You can't make people sit and just get the food. Instead, let people earn by working on projects and then spend.

The role of markets is more dominant than in 1991. On the external front, we are in a very fragile state. On the external sector, two things are wrong. First, the size of short-term debt is high. Second, the repayments which become due for loans across maturities are also substantial.

Our foreign exchange reserves, though, are in better shape than in 1991. At the time of crisis in 1991, the government had many levers in hand to deal with the situation. Today, the market will determine (things) and not the government.