Food prices fell for the second consecutive week as food inflation remained in the negative zone at (-)2.90 per cent for the week ended December 31, 2011.

Food inflation, as measured by the Wholesale Price Index (WPI), stood at (-)3.36 per cent in the previous week. It was above 19 per cent in the corresponding week of 2010.

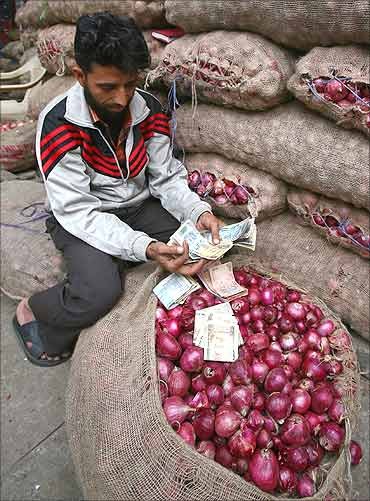

According to data released today, onions became cheaper by 74.77 per cent year-on-year during the week under review, while potato prices were down by 31.97 per cent. Prices of wheat also fell by 3.35 per cent.

Overall, vegetables became 49.03 per cent cheaper during the week ended December 31.

...

Food inflation in negative zone: What's cheaper, what's costlier?

The fall in the rate of price rise of food items since the first week of November is substantial, as it has plummeted from double-digit territory into the negative zone.

Experts feel that the decline in food inflation will be a major incentive for the Reserve Bank to look at the option of cuts in key interest rates at its next quarterly monetary policy review later this month.

However, other food products became more expensive on an annual basis, led by protein-based items.

Pulses were 14.72 per cent costlier during the week under review, while milk grew dearer by 10.79 per cent. Egg, meat and fish prices were up 15.22 per cent year-on-year.

Fruits also became 9 per cent more expensive on an annual basis, while cereal prices were up 2.03 per cent.

...

Food inflation in negative zone: What's cheaper, what's costlier?

Photographs: Mukesh Gupta/Reuters

Inflation in the overall primary articles category stood at 0.51 per cent during the week ended December 31, as against 0.10 per cent in the previous week.

Primary articles have over 20 per cent weight in the wholesale price index.

Inflation in the non-food segment, which includes fibres and oilseeds, was recorded at 1.29 per cent during the week under review, as against 0.85 per cent in the week ended December 24, 2011.

Fuel and power inflation stood at 14.45 per cent during the week ended December 31, as against 14.60 per cent in the previous week.

...

Food inflation in negative zone: What's cheaper, what's costlier?

Headline inflation, which also factors in manufactured items, has been above the 9 per cent-mark since December, 2010. It stood at 9.11 per cent in November, 2011.

The RBI has hiked interest rates 13 times since March, 2010, to tame demand and curb inflation.

In its second quarterly review of the monetary policy last month, the central bank had said it expects inflation to remain elevated till December on account of the demand-supply mismatch before moderating to 7 per cent by March, 2012.

...

Food inflation in negative zone: What's cheaper, what's costlier?

Photographs: Yuri Gripas/Reuters

Last week, when the government released the negative inflation figures, Finance Minister Pranab Mukherjee said, "There has been substantial improvement. Food inflation has turned negative for the first time in recent memory."

It was the first time in almost six years, for which data with base year 2004-05 is available, that food inflation has shown a decline on an annual basis.

It was almost 21 per cent in the corresponding week of 2010.

...

Food inflation in negative zone: What's cheaper, what's costlier?

Photographs: Ajay Verma/Reuters

According to the official data released on last Thursday, prices of wheat fell by 3.41 per cent.

Onions became cheaper by 73.74 per cent year-on-year during the week under review, while potato prices were down by 34.01 per cent. Overall, vegetables became 50.22 per cent cheaper during the week ended December 24.

Experts feel that the decline in food inflation will be a major incentive for the Reserve Bank to look at the option of key interest rate cuts at its next quarterly monetary policy review later this month.

...

Food inflation in negative zone: What's cheaper, what's costlier?

Low inflation does not mean that prices will remain low: it means that prices are rising at a slower pace than before. Negative inflation can also be termed as deflation.

Deflation occurs when the inflation rate falls below zero per cent. It happens when there is a slowdown of inflation, but there is still inflation.

Why does deflation happen?

A fall in spending -- it could be personal spending or a cut in government expenditure -- leads to deflation. The decline in the supply of money and credit thus leads to deflation.

So, if money-supply decreases; supply of other goods increases, demand for money rises, and the demand for other goods slips, it is deflation.

So, if money-supply decreases; supply of other goods increases, demand for money rises, and the demand for other goods slips, it is deflation.

...

Food inflation in negative zone: What's cheaper, what's costlier?

Image: A shopkeeper holds a garland made of Rs 20 notes.Photographs: Parivartan Sharma/Reuters

What are the consequences of deflation?

Deflation leads to a lower level of demand in the economy. It increases the real value of money. It also increases unemployment.

The main effect of deflation is that it gives people a huge incentive not to buy goods.

This means that if something costs Rs 100 today, it will cost only Rs 95 next week, thus making people hold off their purchases.

The good news is that gives people an incentive to save money.

But as fewer people buy, manufacturers are left with excess inventory.

That means they need to reduce their supply, which means they can either stop manufacturing, which causes factory closures and layoffs, or they can reduce prices even further.

But the latter causes even more deflation, leading to lower spending, leading to more deflation.

...

Food inflation in negative zone: What's cheaper, what's costlier?

Photographs: Jayanta Dey/Reuters

Is deflation good for you as prices may drop?

A fall in the prices may sound good for consumers. But it is not actually good. The lack in demand may push companies to further lower prices.

This can lead to a situation where the prices of product fall bellow the cost of manufacturing a product. This in turn forces the companies to cut production, slash jobs and shut down business till demand picks up. This worsens the situation.

article