| « Back to article | Print this article |

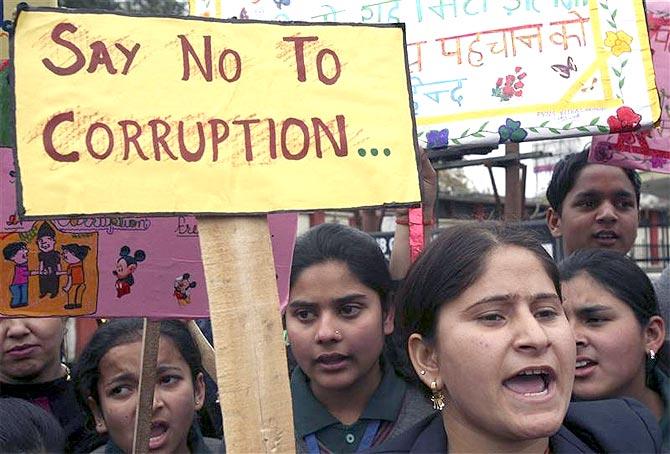

Fighting corruption? India Inc shows the way

It is clear that there is a positive correlation between reform, globalised operations, and transparency of a company.

For some time now, the loudest voices shaping public opinion in India have indicated that the country has a particular problem with corruption at the interface of the state and the private sector, and that a lack of reform has allowed India Inc to conceal many acts of wrongdoing.

While this may or may not be true, some perspective to these claims was provided by a report by the well-regarded corruption watchdog Transparency International that was released last week evaluating 100 emerging market multinationals, especially from the BRICS countries - Brazil, Russia, China and South Africa besides India.

The report’s executive summary said: “No company achieved a perfect score but companies from India are clearly ahead of the pack.”

Click NEXT to read more...

Fighting corruption? India Inc shows the way

It appears that in terms of disclosure and reporting, the building blocks of accountability, India is a standout performer in the emerging world.

China was the worst performer overall, by far - unsurprising, given its byzantine network of state and private ownership, and its completely opaque and controlled financial sector. Nine out of the 11 worst-rated companies were Chinese.

The report was met with some disbelief in certain circles; after all, it clearly contradicts the prevalent view about the burgeoning nature of corruption in India. However, it is important to see that the two things are not necessarily contradictory.

Just as the right to information led to greater knowledge of misbehaviour by the state, a clearer reporting regime allows better investigation of what companies are up to.

Click NEXT to read more...

Fighting corruption? India Inc shows the way

If viewed rationally, the report should, thus, somewhat defuse the panic around “unique levels” of corruption in India, revealing that the country and its private sector have relatively robust processes in place, allowing for the eventual revelation of corrupt practices.

The report evaluated transparency on several fronts - for example, in terms of clarity in related holdings by companies. The more opaque holding structures are, the easier it is to hide the proceeds of corruption.

Other ingredients in the index were the presence of anti-corruption programmes within the company in question and the transparency of its reporting on activities in other countries - necessary to correctly assess its tax burden.

It is clear that there is a positive correlation between reform, globalised operations, and transparency of a company.

Click NEXT to read more...

Fighting corruption? India Inc shows the way

Still, it is a matter of concern that the absolute level of disclosures is still poor - three-fourths are ranked below five, and 60 per cent do not disclose political contributions.

Fixing that is an important step forward in minimising the impact of corruption and the incidence of crony capitalism.

While Indian companies and regulations clearly appear to have done well in comparison with their global peers, much remains to be done.

Declarations of political contributions, and explicit reporting of country-by-country results – not just some information about the finances of subsidiaries elsewhere – would be a major step forward for India Inc.

As Indian companies spread their wings and begin to compete with developed country giants, they should set their standards for transparency even higher.