| « Back to article | Print this article |

Export growth: China does a better job than India

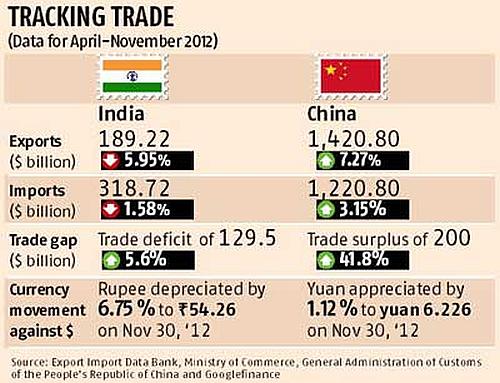

Despite the rupee losing value against the dollar, Indian exports fell in April-November (year-on-year) by nearly 6 per cent. Experts say this is because our product-mix largely veers towards the low end of the manufacturing chain.

China, on the other hand, managed to retain export competitiveness and registered a 7 per cent growth in exports during the same period, despite the yuan rising against the dollar.

The rupee has depreciated by 6.75 per cent against the dollar between March 30 and November 30. It stood at a record low of Rs 57.06 on July 22 in this period.

The Chinese yuan appreciated steadily to a peak of 6.39 against the dollar till July 25; then, it depreciated to close at yuan 6.226 (a rise of 1.1 per cent as compared with yuan 6.297 on March 30).

However, China's exports lagged the target of double-digit growth its government had set, due to slackening demand in advanced economies.

India's exports in this financial year would also find it difficult to touch the $300 billion of 2011-12, let alone the target of $360 billion for 2012-13, say analysts.

The difference

Ajay Sahai, director general, Federation of Indian Export Organisations, said, "More than cross-currency movements, what has been affecting external trade out of India and China is the product profile of the commodities they trade in. China mainly exports electronics and machinery products. India ships out goods at the lower end of the manufacturing chain such as gems and jewellery, textiles and leather products, where competition is more intense."

Among India's top export commodities, outbound shipments of engineering and gems and jewellery items - two of the largest export revenue generating sectors in the country - contracted 5.3 per cent and 10 per cent, respectively.

Those of cotton yarn, jute, readymade garments and handicrafts shrunk 11 per cent, 14 per cent, 8 per cent and 65 per cent, respectively, during April-November.

Click NEXT to read more...

Export growth: China does a better job than India

Engineering goods do not sound low-end manufacturing products but India did not, in the segment, export very high value-added items, experts said.

Sahai says any benefits that might have accrued to exporters on account of the depreciating rupee was nullified by wage increases in the manufacturing sector.

"All products exported out of India are manufactured in labour-intensive sectors. The wage increases blunted the advantages of a depreciating rupee," he said.

Comparisons

Cumulatively, between April and November, exports fell 5.95 per cent to $189.2 billion, while imports fell only 1.6 per cent, to $318.7 billion.

Data from the General Administration of Customs (China) show exports from China increased 7.3 per cent to $1,421 billion between April and November. Its largest export markets are the European Union, the US, Hong Kong, Japan and South Korea.

China largely exports office machines and data processing equipment, telecommunications equipment, electrical machinery, apparel and clothing.

Sridhar Venkiteswaran, executive director, Avalon Consulting, said the EU and the US feature among India and China's top trading partners. External trade out of both countries have been affected by the recession in the EU.

"But while China exports more value-added products, with the bulk of manufacturing of electronic products for companies like Apple having shifted there, India, even in engineering goods, is near the bottom of the manufacturing chain," he said.

All this means when globally the markets contract, despite favourable currency movement for exporters, India is unable to maintain export growth, Venkiteswaran said.

Click NEXT to read more...

Export growth: China does a better job than India

In the first half of 2012, in fact, the US had overtaken the EU as China's largest export destination. While China's exports to the EU declined 0.8 per cent to $163.1 billion in the first half of the financial year, shipments to the US went up 13.6 per cent to $165.3 billion.

Similarly, in India, while the EU share in India's exports have declined to 16.25 per cent in April-September from 17.2 per cent in the corresponding period last year, that of the US rose to 13.9 per cent from 11.35 per cent.

Venkiteswaran also said the decline in India's exports have come on an artificially inflated base. For, last year, there were extraordinary exports to tax havens like the Cayman Islands, because of round-tripping.

China detail

But even in China, growth in external trade has moderated sharply from the yearly 20 per cent seen during the years before 2008, when the global financial meltdown sharpened due to collapse of the US financial services icon, Lehman Brothers.

China had set for itself a target to grow both exports and imports by 10 per cent in 2012, a number unlikely to be met.

Between January and November, while exports out of China had increased by 7.4 per cent to $1,850.9 billion, imports had gone up four per cent to $1,649.7 billion.

The shortfall in terms of the target of exports has happened due to contraction in demand because of recession in EU and recovery remaining patchy in the United States.

China's trade surplus, however, has shot up 41.8 per cent in April-November to $200 billion as compared to $141 billion recorded in the corresponding period in 2011.

India's trade deficit, meanwhile, increased to $129.5 bn, higher by 5.6 per cent than the $122.6 bn between April and November last year.