Photographs: Reuters

The Reserve Bank of India's move to pause its hawkish Monetary Policy stance is on expected lines as high interest rates affect the economic growth, bankers and analysts said.

Welcoming the policy stance, ICICI Bank chief Chanda Kochhar said the policy is a realistic assessment of the prevailing macroeconomic situation.

"This is a positive step as growth has been moderating and inflation, though still above comfort levels, has started showing signs of easing.

"The policy statement has addressed concerns on the interest rate side, by clearly indicating a likely reversal in the cycle with monetary policy actions being directed towards addressing growth related issues going forward," she said.

Bank of India chairman Alok K Misra said, "By keeping rates unchanged and not talking any liquidity enhancing measures, RBI has signalled it remains single-mindedly focused on inflation."

. . .

Experts welcome RBI decision to keep rates unchanged

Photographs: Reuters

He further said that Friday's pause will help anchor inflationary expectations. Given the overall macroeconomic environment, it should serve the economy well if RBI begins its easing process, he added.

"RBI's action is on expected lines. While a sharp decline in second quarter economic growth was pointing for a rate cut, sustained high level of core inflation is a strong argument against rate cut," Fitch Ratings director Devendra Kumar Pant said.

Another ratings major ICRA said the RBI kept the policy rate and the CRR unchanged in its mid-quarter policy review as inflationary pressures are yet to diminish particularly in the case of non-food manufactured products.

"...the guidance provided today was distinctly less hawkish, highlighting the increasing concerns regarding the moderation in economic growth," Naresh Takkar, MD and CEO of ICRA Ltd said.

"Strong rate-tightening steps taken by the RBI in the last few quarters have badly impacted the investment & consumption cycle.

. . .

Experts welcome RBI decision to keep rates unchanged

Photographs: Reuters

Immediately after the RBI policy review announcement, stock market showed mixed response. the BSE benchmark index Sensex pared its initial gains and ended at 15,491.35, down 345.12 points.

Commenting on RBI's move and its impact on the stock market, APE Securities senior director, research, Kislay Kanth said, "The decision by RBI to leave everything unchanged is moderately negative on the overall market sentiments, because much was anticipated from this meeting.

Only the recent interventions in the currency markets is a moderate positive and we believe that the RBI should be little more proactive than what we saw over the last few months".

"RBI left interest rates unchanged but admitted rather candidly that the interest rate cycle is likely to reverse in the future given the downside risks to growth.

"The monetary tightening cycle -- which spanned over 22 months with 13 rate hikes so far -- has hit economic growth hard," Rajrishi Singhal, head of policy and research, Dhanlaxmi Bank, said.

. . .

Experts welcome RBI decision to keep rates unchanged

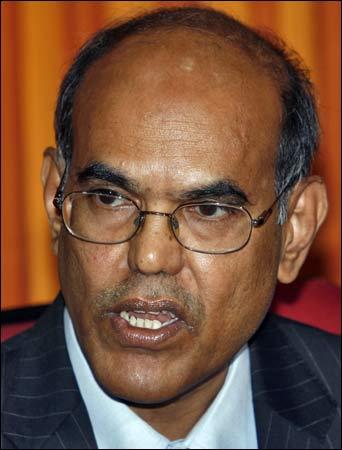

Image: Reserve Bank of India Governor D Subbarao.Photographs: Reuters

E&Y India National Leader for global financial services Ashvin Parekh said, "The prolonged period of high interest rates has finally has had an effect on inflation, giving RBI some room. However, it is too early to expect rate cuts as at 9.11 per cent, inflation still remains high."

Deutsche Bank India chief economist Taimur Baig, said, "It seems RBI is keen on addressing one concern at a time, and hence is refraining from cutting CRR on one hand to release liquidity and not touching the repo rate to maintain vigil on inflation on the other hand."

Baig said he, "expects to see a streamlined set of measures next year as a sharp slowdown in growth and inflation would be responded with interest rate cuts. Short of a major manifestation of systemic risks, we, therefore, do not expect the central bank to cut the CRR in a hurry. Rate cuts are expected only from mid-2012."

The central bank, in its mid-quarterly review on Friday, maintained repo rate (rate at which banks borrow from RBI) at 8.5 per cent, and reverse repo (rate at which the RBI borrows from banks) at 7.5 per cent.

The halt in rate increase comes after 13 hikes since March, 2010. The RBI has also decided to retain the cash reserve ratio (CRR), the amount banks need to park with the RBI, at 6 per cent.

article