Photographs: Munish Sharma/Reuters Jayshree Pyasi

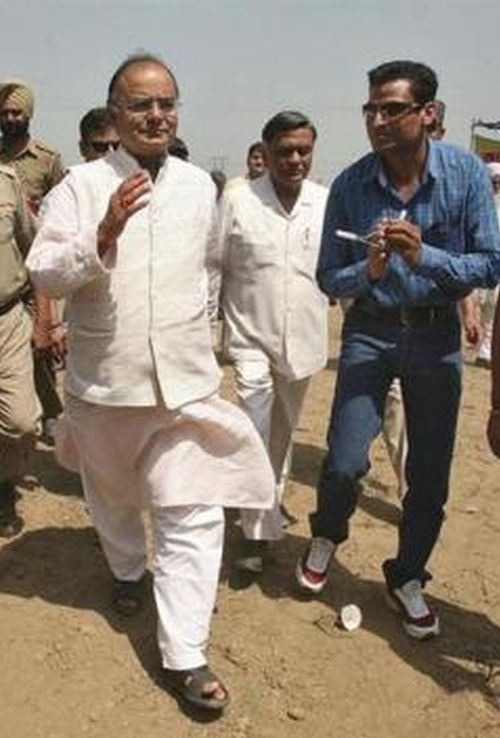

Capital market intermediaries, including stock exchanges and broking houses, are readying their wish list for new finance minister Arun Jaitley.

Further reduction in securities transaction tax (STT), rationalisation of stamp duty and major changes to the tax-saving scheme promoting direct investment in stocks are some demands.

Brokers have demanded that the buying limit for foreign exchanges in domestic bourses be raised.

...

Dalal Street readies wishlist for the new finance minister

Image: Marketmen want the new government to bring some reforms in the capital market.Photographs: Reuters

Market players have already initiated discussions with the Securities and Exchange Board of India (Sebi) on various reforms needed for development of the capital market.

After further discussions, various intermediaries are likely to send their demands to the finance ministry separately in the next few weeks.

...

Dalal Street readies wishlist for the new finance minister

Image: Investors expect the new government to scrap the Rajiv Gandhi Equity Savings Scheme.Photographs: Reuters

According to sources, stock exchanges and brokers have written to Sebi that the Rajiv Gandhi Equity Savings Scheme (RGESS) needs to be reworked or scrapped.

Industry experts have said the structure of the scheme, devised to encourage first-time investors towards direct equity investing, is complex.

They have instead sought tax breaks for investors who invest in equity exchange traded funds (ETFs).

...

Dalal Street readies wishlist for the new finance minister

Image: The Rajiv Gandhi Equity Savings Scheme is not so popular among investors.Photographs: Reuters

Two years since its introduction, RGESS has seen inflows of just Rs 60 crore (Rs 600 million) from investors.

It has seen an opening of around 40,000 new demat accounts, of which only a fraction have seen actual investments.

On STT, a broker said, “Globally, STT isn't levied in the derivatives segment.We want removal of STT in the segment.”

In the 2012-13 Union Budget, the government had cut STT by 20 per cent for delivery-based trades in the cash segment, while keeping it unchanged for other types of transactions.

...

Dalal Street readies wishlist for the new finance minister

Image: Stock market participants also want the government to take measures for allowing retirement funds in capital markets.Photographs: Reuters

STT levied in the derivatives segment is anywhere between 0.017 and 0.25 per cent, depending on the nature of transaction.

Market players have suggested that stamp duty be made uniform across states.

Stock market participants also want the government to take measures for allowing retirement funds in capital markets.

Sebi has already made a proposal to the finance ministry to allow up to 15 per cent of the corpus of the Employees’ Provident Fund Organisation in equity and equity-oriented schemes.

...

Dalal Street readies wishlist for the new finance minister

Image: Brokers want the stock exchanges to be more vibrant.Photographs: Hitesh Harisinghani/Rediff.com

Market intermediaries believe in order to make the exchanges more global it would be advisable to allow foreign exchanges to have higher holdings in Indian stock exchanges.

“Currently foreign exchanges can hold 5 per cent stake in bourses and domestic exchanges can hold 15 per cent.

It would help Indian stock exchanges to be more vibrant if the shareholding of foreign and domestic exchanges in Indian bourses is brought on a par,” said Alok Churiwala, vice-chairman, BSE Brokers Forum.

article