| « Back to article | Print this article |

Commodities turn attractive as prices rise

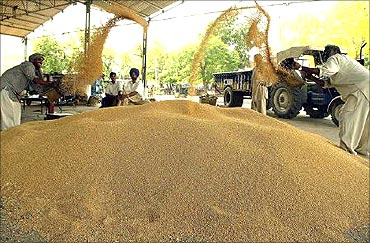

Among agriculture commodities, cash crops like cotton and castor are now emerging as asset classes. With online mandis or spot exchanges gaining ground on volumes, organised investment tools are coming in handy for commodities, too.

Sample this: Mohammed Barejiya, a resident of a small village in Surendranagar district of Gujarat, has been buying castor seed stocks for the past two years. After holding stocks for a few months, he offloads these to unlock the value.

There are many like Barejiya who have seen potential in investing in agriculture commodities in the wake of spiralling prices. Buying agri commodities for short to medium term is an old practice. The difference now is that traders like Barejiya will be able to invest in commodities through online exchanges and even store them in demat form.

The National Spot Exchange Ltd has introduced e-series contracts. Here, an investor can buy a commodity (currently gold, silver, copper and zinc) in small denominations, hold it in demat form and sell it when he gets expected returns.

Commodities turn attractive as prices rise

"Our daily volume will go up to Rs. 2,000 crore (Rs. 20 billion) after the introduction of new commodities, from Rs. 900-1,000 crore (Rs. 9 billion-10 billion) at present. Normally, 25 per cent of daily volume translates to delivery."

This means, investors will take or give delivery of Rs. 500 crore (Rs. 5 billion) worth of commodities through e-series products by the end of the year. Investors can also buy these commodities in physical markets, but an investor not conversant with physical market practices will find it easy to invest through online exchanges.

Sinha says many high net-worth individuals have been investing crores at a time on the exchange.

For example, if they buy silver worth Rs. 1 crore from physical market, taking delivery, making payment and storing it will never be as easy as in case of buying through online exchanges and holding it in demat form without any storage cost. Storage cost is being borne by the exchange, which is already factored in while charging transaction fee.

There is more potential in investing in commodities than meets the eye. With a warehouse regulator in place, investors will be able to invest and trade in warehouse receipts - a safer and easier tool for investment.

Warehouse receipts are proof that goods mentioned (as stored with a recognised warehouse) can be delivered to the bearer of the receipt. Being a negotiable instrument, these receipts can be traded and transferred.

Commodities turn attractive as prices rise

He indicated that even asset management companies could be considered for commodities, in line with mutual funds.

Many institutional players are also expected to be allowed in commodities, besides new tools like index trading, options, etc.

The investment orientation in commodities is getting stronger with rising prices and people are also trading/investing in new commodities. This could also be seen in the unprecedented rush to obtain cotton export quotas from the Directorate General of Foreign Trade.

Apart from traditional export houses, cotton trading companies and individuals have also applied for quotas. Some of them have even received allocation from the government. This includes the exporters who are not active in cotton business. These individuals sell the quotas to traditional exporters at a premium, like in share issues.

"Many individuals have started investing in the white gold," said Arun Dalal, owner of Arun Dalal & Co, an Ahmedabad-based cotton trading firm, while referring to cotton exports.

Amid soaring inflation and food prices, some agri commodities are emerging as lucrative asset classes. This could be gauged from the fact that many agricultural commodities have outperformed traditional asset classes like bullion, base metals and equities by several times over the past one year.

With contributions from Rutam Vora and Rajesh Bhayani