| « Back to article | Print this article |

Why these reforms can't address India's problems

Much sound (by government spokesmen and talking heads of the electronic media, with a feeble intervention Friday night by the Prime Minister) and fury (by opposition parties and some government allies) has surrounded the so-called big bang reforms announced on September 13-14.

What, if anything, do they signify? This needs to be answered in view of the objective of the measures, namely to help meet the current year's targets on deficits and growth, and restoring the country to a desirable growth trajectory thereafter.

First, the much-delayed increase in diesel price. That it was needed is not in question, but the way to do so and its impact certainly are. This hike would reduce the oil subsidy by Rs 20,000 crore (Rs 200 billion).

Click NEXT to read more...

Why these reforms can't address India's problems

That leaves the elephant of the deficit very much in the room, especially since excise on petrol has been cut.

Even accounting for the Rs 15,000 crore (Rs 150 billion) to be realised through divestment in selected public sector units, the government would be straining to hold the fiscal deficit at the target of Rs 5,10,000 crore (Rs 5,100 billion) this year. Yashwant Sinha has rightly said that had the prices been decontrolled, increases would have been gradual and more acceptable.

Further increases now appear far more difficult to manage. The only way left is to cut government expenses across the board, including entitlement programmes such as the National Rural Employment Guarantee Scheme. That would not go down well with the Congress leadership.

Click NEXT to read more...

Why these reforms can't address India's problems

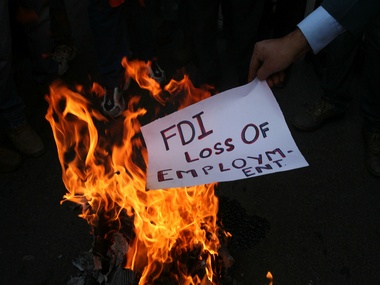

So on to foreign direct investment (FDI) in airlines. Kingfisher is too far go#8800 Air India, Jet and IndiGo do not want it. That leaves only SpiceJet.

At a very generous premium of 60 per cent over its current share price, 49 per cent foreign equity would bring in $200 million, if any cash-strapped international carriers are contemplating entry into the uncertain high-cost Indian airline business with a non-controlling interest. Compare this to the current account deficit which now runs to over $70 billion.

That leaves FDI in multi-brand retail up to 51 per cent in cities of 1 million-plus population, subject to a minimum of $100 million, half of which must be in back-end facilities, the lynchpin of the reform package.

Click NEXT to read more...

Why these reforms can't address India's problems

This is subject to the approval of concerned state governments. Champions of this much-awaited measure led by Commerce Minister Anand Sharma (who was more eloquent than Manmohan Singh) would have us believe that it is nothing short of a panacea for all that ails agriculture commodity marketing.

It would reduce the market spread by eliminating extortionate middlemen; farmers will get higher prices even as consumers pay less; supply chains will be modernised with packing centres in producing areas linked to urban markets through a cold chain, creating jobs in plenty. The enormous post-harvest losses would be sharply reduced.

Click NEXT to read more...

Why these reforms can't address India's problems

Dilip James had perceptively argued last year in these pages (Business Standard, June 14, 2011, July 29, 2011 and December 3, 2011) that most of these claims cannot withstand a reality check. Given the restrictions, policy flip-flops and the fact that state governments with a combined population of more than half of India will not opt for it, how many multi-nationals will take the bait and how quickly is the key question.

Market spreads in Europe and America are comparable to those in India. Indian middlemen, while no saints, operate on thin margins after factoring in high risks inherent in the feast-or-famine fresh produce #8482 the likely new investment would be a fraction of what is needed for a modern cold chain from farm to fork.

Click NEXT to read more...

Why these reforms can't address India's problems

A senior manager of a leading retail chain has estimated the cost of operating such a chain to be multiples of the present distribution expense, defeating the main purpose.

And the actual losses are not as high as the guesses, since off-grade produce also finds uses, albeit at a lower price.

Click NEXT to read more...

Why these reforms can't address India's problems

(Since the prime minister has put his imprimatur on the estimate of post-harvest losses in his address to the nation, a back-story on its origin is in order: I met the late Gopi Arora, then secretary to Prime Minister Rajiv Gandhi, on a Sunday in December 1986. Having disposed of our main business rather quickly, Mr Arora asked me what else I did. I told him about a study on food processing we had just finished.

He asked me about the extent of wastage of fresh produce. I pleaded that I had no estimates. He said he had powers to detain me in North Block until I came up with a number. I replied that while the absolute loss may not be high, the produce suffered a value loss of about a third due to mishandling and loss of quality. He requested a one-page note on what I had told him.

I found two paras from that note, containing the loss estimate and suggestions to eliminate cascading taxation and to create a ministry of food processing, were part of the 1987 Budget speech of Rajiv Gandhi. The estimate has stuck, even through the subsequent McKinsey and Rabo Bank studies, although now everyone including Dr Singh equates value destruction to physical loss. P Murari, the first secretary of the new ministry, often joked that I should face the blame for the ministry's mistakes.)

Click NEXT to read more...

Why these reforms can't address India's problems

The main question is cui bono (who benefits)? Mr James says "the promoters of existing domestic retail chains...creaking under mounting losses are the likely immediate beneficiaries...The much-touted benefits to the...farmer or consumer seem far removed from the picture" (BS, December 3, 2011).

His succinct summing up in July 2011 was prescient: "Accused of policy paralysis, the government seems to have picked FDI in retail as [a] clarion call to dispel this notion...At the same time...[the addition of] other...inconsequential...guidelines...may neither enthuse the foreign investor nor placate the domestic investor."

Click NEXT to read more...

Why these reforms can't address India's problems

How should we judge the efficacy of these measures? Dr Singh himself provided two criteria while addressing the Planning Commission.

He said that without breaking the logjam, the growth rate in the Twelfth Plan could fall to 5 per cent. He also said that India needed investment of $1 trillion to get back on a high-growth path.

The Prime Minister's Economic Advisory Council recently listed steps needed to revive India's growth: policy predictability, quick project clearances and payments, encouragement to investment, containing inflation, fiscal consolidation, and improving the current account deficit.

Click NEXT to read more...

Why these reforms can't address India's problems

The new measures are at best pot-shots at the devils that hobble the economy, not in themselves surefire means of taming them. They have come at 23:59 on the clock.

The government has survived, but only just. It is rid of its most troublesome ally, but is hostage to other, equally capricious, supporters. It has no wiggle space any longer for even whimpers of reform. How is that going to inspire investor confidence?

Will this be Dr Singh's High Noon, the classic Western film in which the laconic, about-to-retire sheriff Will Kane fights off the bad guys coming to town? Or will it be more like Custer's Last Stand, a real battle in 1876 at Little Big Horn in which a rather vain General George Custer perished with his men while mounting a pre-emptive strike on a vastly larger force of Native Americans besieging him?

The writer taught at the Indian Institute of Management, Ahmedabad, and helped set up the Institute of Rural Management, Anand.