| « Back to article | Print this article |

The curious case of a quashed Qualcomm

The battle for Broadband Wireless Access (BWA) spectrum gets murkier by the day. Even as the Department of Telecommunications (DoT) seeks to justify the quashing of bids made by the US-based technology multinational Qualcomm for four telecom circles (or geographical areas), Reliance Industries Limited (RIL), through its subsidiary, Infotel Broadband Services Limited, has apparently moved in for the kill with a letter to the DoT suggesting that the delay in clearing the Qualcomm application would indeed give the American corporation's Indian affiliates a benefit in terms of prolonged spectrum assignment to its own detriment.

"In true spirit of justice and fairness, (the) DoT should ensure that the effective date for all spectrum holders is the same and, accordingly, the effective date of our spectrum assignment should be shifted and deemed to be the effective date in which Qualcomm's spectrum is assigned", wrote Kapil Dev Kumar, senior vice-president, Infotel, in a letter to the secretary, DoT, R. Chandrashekhar, on September 22, 2011.

To demystify what the last sentence in the letter quoted means, two stories will have to be told. The first is a rather straightforward story of how the auction for BWA spectrum took place and what transpired thereafter.

There is a second story that lies in-between the lines of the fine print of the letter of the law, a story of an unseen hand that makes a bid for supremacy in the hapless proceedings that are taking place at the Telecom Disputes Settlement & Appellate Tribunal (TDSAT) nearly one year after the bid for four circles was won by Qualcomm.

On February 25, 2010, the government of India's Department of Telecommunications (DoT) invited bids from qualified parties for the rights to use certain specified radio spectrum frequencies in the 2.1GHz band (also known as "3G" or third generation spectrum) and in the 2.3GHz unpaired band or the BWA spectrum for various telecom service areas.

Click on NEXT for more...

The curious case of a quashed Qualcomm

BWA, according to the International Telecommunication Union or ITU (the United Nations specialized agency for information for information and communication technologies), is technology that is capable of delivering download speed of 100 mbps (megabytes per second) to one gbps (gigabytes per second) - although download speeds of 70 mbps have been achieved in laboratory conditions.

In India, the sale of two 2.3 GHz blocks of spectrum were slotted for April 11, 2010, to provide two blocks of 20 MHz spectrum in each of the country's 22 telecom circles.

The 11 announced bidders were: Bharti Airtel, Reliance Wimax Ltd (Anil Dhirubhai Ambani Group or ADAG), Idea Cellular, Aircel, Augere (a Mauritius based company), Qualcomm, Infotel Broadband Services (part of the RIL group headed by Mukesh Ambani), Spice Internet Service Provider, Tata Communications, Tikona Digital Networks and Vodafone Essar.

(Incidentally, Qualcomm Incorporated is a Fortune 500 company and claims to be a world leader in 3G and "next-generation" mobile technologies.

According to the company's website, headquartered in San Diego, California, Qualcomm was established in July 1985 and holds 12,600 US patents and pending patent applications for CDMA - code division multiple access - and related technologies. Qualcomm has 16,100 employees spread across 146 locations worldwide. Qualcomm established its India operations in 1996 with Qualcomm India Private Limited).

Click on NEXT for more...

The curious case of a quashed Qualcomm

The 3G and BWA licensed spectrum auctions were among world's biggest auctions of its kind in recent times with the Indian government getting in excess of Rs 1,00,000 crore from the dual offers.

The government had promised to use the auction process to obtain not just a market determined price but to pursue a transparent process that would ensure "efficient use of spectrum and avoid hoarding; stimulate competition in the sect#8744 and promote rollout of 3G and broadband services".

The auctions, held in virtual space, were conducted by a team of the auctioneers and monitored by the DoT.

In recent months, there has been much talk about the deployment of "superior", "better" and "best" technologies using 3G and BWA spectrum.

One of the bidders, Qualcomm (reportedly with verbal support from the Sweden-based multinational Ericsson), indicated that they would opt for TD-LTE (time-division long-term evolution) technology for deployment in the BWA band.

Hitherto, WiMAX was synonymous with BWA in India and it was believed that the 2.3GHz spectrum winners would deploy WiMAX because the two public sector companies, Bharat Sanchar Nigam Limited (BSNL) and Mahanagar Telephone Nigam Limited (MTNL) were already doing so.

It was also said that TD-LTE, or TDD-LTE (time division duplexing-long-term evolution), could offer peak download speeds of 100 Mbps on mobile devices, which had prompted one of the world's biggest mobile operators to opt for LTE. China too had committed to TD- LTE.

The current battle is not around technology though. It is about who emerges most powerful in the BWA space.

Click on NEXT for more...

The curious case of a quashed Qualcomm

The notice inviting applications by the DoT had stated that the successful bidders would have to provide details of the technology proposed to be deployed for operation of its services prior to launch of commercial operations.

The technology should be based on standards approved by the ITU or the DoT's Technology Engineering Centres or any other international standards organization, body or industry.

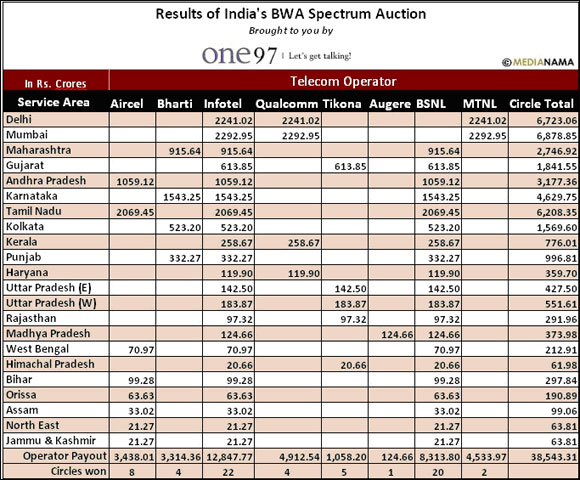

The provisional results announced by the DoT indicated that Infotel Broadband Services had won bids for all 22 telecom circles, Aircel had won in eight circles, Tikona in five, Bharti Airtel and Qualcomm four each Augere in one (see chart 1).

The public sector players, BSNL and MTNL, had already been given spectrum but would have to pay the equivalent of the winning bid in each service area.

After the auction, on June 11, 2011, Qualcomm stated from its San Diego headquarters that it was a provisional winner of the BWA unpaired spectrum in the 2.3 GHz band - in four telecom circles in India; winning one, 20 MHz slot of spectrum each in the circles of Delhi, Mumbai, Haryana and Kerala. Its final bid was Rs 4,912.54 crore (around US$1.045 billion).

Kanwalinder Singh, president, Qualcomm India and South Asia and senior vice-president, Qualcomm stated: "Qualcomm congratulates the Indian government on the successful completion of the 3G and BWA auctions and is pleased with the opportunity to now enable the entire addressable market in India with its advanced wireless solutions.

LTE offers a seamless consumer experience by complementing 3G HSPA (high-speed download packet access) and EV-DO (evolution data-optimised) networks, protecting the significant investment Indian operators have made in securing 3G and BWA spectrum".

"Our bidding objective was to secure an enabling role in the continued success of Indian operators with 3G and beyond and we are extremely gratified we met that objective. With its ecosystem partners, Qualcomm will now foster the deployment of LTE, so Indian consumers can enjoy the benefits of 3G now and 3G plus LTE in the future," said Singh.

Click on NEXT for more...

The curious case of a quashed Qualcomm

Today, however, he is a worried man because his licence is in jeopardy because others are equally worried about the "ecosystem" that Kanwalinder Singh talked about.

That ecosystem would obviously have partners from within the big players in the telecom sector in India competing with whom would not be easy for those that would not be a part of that "ecosystem".

According to the stipulations, Qualcomm paid the first $one billion as soon as the auctions got over for four circles, Delhi, Mumbai, Kerala and Haryana.

The government, then in dire need of greenbacks, had allowed foreign players to participate in the auctions without FIPB (Foreign Investment Promotion Board) clearance or preparations.

The stipulation was that the international companies would incorporate local partners, who would apply for an internet service provider (ISP) license because only locally incorporated companies were entitled to ISP licenses necessary for running BWA services.

As per the NIA (Notice Inviting Applications), the winning company had to apply for ISP (internet service provider) licence within three months of the auctions.

Qualcomm had, in the mean while, put in place four Indian entities, Wireless Business Services Private Limited (for Maharashtra), Wireless Business Services (Delhi) Private Limited, Wireless Business Services (Kerala) Private Limited, and Wireless Business Services (Haryana) Private Limited, for the four circles in which it had won.

The NIA document had a clause that said that nominee of the winning bidder should apply for an ISP license within three months of being declared winner.

Accordingly, Qualcomm applied for ISP licenses within the three-month window through its locally incorporated companies. Therein lay the rub although each of these companies was a subsidiary of Qualcomm Asia Pacific Pte Ltd, which was a wholly owned subsidiary of Qualcomm Inc.

Click on NEXT for more...

The curious case of a quashed Qualcomm

The government gave Qualcomm no indication of any problems with its bids during many meetings its representatives had with DoT officials between August 2010 and November 2010.

After the nominees applied for ISP licences on August 9, 2010 as Qualcomm's nominees, the DoT asked them clarificatory questions on November 30, 2011 for processing applications and sought proof that they were indeed Qualcomm's nominees.

Qualcomm wrote back to DoT on December 20, 2010, informing them about these nominations. In any event, when it had applied for the ISP licenses, Qualcomm had made four individual applications for the four circles that it had won.

Qualcomm also followed up on the status of the applications with the DoT from January 2011 onwards through written and verbal communications, including four letters from its CEO, Paul Jacobs, seeking expeditious issuance of the license. The DoT chose to be quiet. It was not till Augere (from Mauritius that had won the BWA spectrum for Madhya Pradesh) received its ISP license in June 2011 that Qualcomm got really worried.

Sources claim Qualcomm learnt unofficially that the DoT was unwilling to give it four ISP licenses, even though its four firms had paid four times the licence fees. Company representatives were reportedly was told that the NIA mandated only one ISP licence.They also learnt that the DoT was considering invalidation of the ISP license because Qualcomm Inc had not informed the Department about the nomination of the local companies within the three- month window.

Click on NEXT for more...

The curious case of a quashed Qualcomm

The company went by the simple logic that since the auction was circle wise, the applications should also be made circle-wise and these aligned quite well with the 3G auctions (each and every service area has a different company).

On September 7, 2011, Qualcomm explained its position to the DoT and offered to secure one licence in place of four. In response, it received a faxed communication on September 19 that the DoT had rejected its ISP application.

By September 22, Infotel Broadband, had got into the act and sent the letter (quoted earlier) to the DoT which was received the same day.

Significantly, certain other telecom operators have more than one ISP licence under the same promoter group running concurrently with which no one seems to have any problem. Spice and ADAG have three ISP licences each, the Bharti/Airtel, Shyam, HCL (formerly Hindustan Computers) and VSNL (formerly Videsh Sanchar Nigam) groups have two each while the Tata group has six (see chart 2).

| No | Promoter Company | No. of ISP Licenses | Name of Company | Category | Service Area | License Issued |

| 1 | Bharti | 2 | Bharti Airtel Ltd | A | All India | Yes |

| Bharti Aquanet Ltd. | A | All India | Yes | |||

| 2

| HCL | 2 | HCL Comnet Systems & Services Ltd. | A | All India | Yes |

| HCL Infinet Ltd | A | All India | Yes | |||

| 3

| Reliance | 3 | Reliance Communications Infrastructure Ltd. | A | All India | Yes |

| Reliance Engineering Associates Pvt. Ltd. | A | All India | Yes | |||

| Reliance Wimax Limited | A | All India | Yes | |||

| 4 | Shyam | 2 | Shyam Essel Communication Ltd. | A | All India | Yes |

| Shyam Internet Services Ltd. | B | Rajasthan | Yes | |||

| 5 | Spice | 3 | Spice Communications Ltd. | B | Karnataka | Yes |

| Spice Communications Ltd. | B | Punjab | Yes | |||

| Spice Innovative Technologies Private Limited | A | All India | Yes | |||

| 6

| Tata | 6 | Tata Communications Limited | A | All India | Yes |

| Tata Internet Services Ltd. | A | All India | Yes | |||

| Tata Net Services Limited | A | All India | Yes | |||

| Tata Tele Services Ltd. | A | All India | Yes | |||

| Tata Teleservices (Maharashtra) Ltd. | A | All India | Yes | |||

| The Tata Power Company Ltd | A | All India | Yes | |||

| 7

| VSNL | 2 | VSNL Broadband Ltd. (Earlier Tata Power Broadband Company Ltd.) | A | All India | Yes |

| VSNL Internet Services Ltd | A | All India | Yes | |||

| 8

| Qualcomm Inc.

| 4 | Wireless Broadband Business Services (Delhi) Pvt. Ltd. | A | All India | No |

| Wireless Broadband Business Services (Mumbai) Pvt. Ltd. | A | All India | No | |||

| Wireless Broadband Business Services (Kerala) Pvt. Ltd. | A | All India | No | |||

| Wireless Broadband Business Services (Haryana) Pvt. Ltd. | A | All India | No |

Click on NEXT for more...

The curious case of a quashed Qualcomm

Qualcomm then filed a case in the TDSAT to secure a stay on its money being forfeited by the DoT. The DoT's knee-jerk reaction was a letter dated October 10, 2011, offering Qualcomm one ISP license provided it complied with four conditions.

Three were financial in nature and the fourth condition required Qualcomm and all its partners to provide certificates that there were no dues pending against them or their associates. Qualcomm's local nominees were new and could have no pending dues with DoT, neither did Global Holding Corporation, Qualcomm's Indian partner in this venture.

However, Tulip Telecom, a 13 per cent partner of Qualcomm, had an ISP license since 2005 and furnished a no-dues certificate, which was submitted along with other documents to the DoT within ten days of receiving the letter.

The DoT wanted time to check if Tulip had any pending dues. On November 30, 2011, the DoT raised a demand on Tulip for dues of Rs 146 crore for the assessment years 2009-10 and 2010-11.

A shocked Tulip then filed a representation with the DoT to re-evaluate these demands. Tulip's argument was that the revenue emanating from its non-licence business had been added to its licence revenues for calculating licence fees.

Tulip had encountered a similar problem in 2009 when the DoT had raised a similar demand on the company form an amount of Rs 192.5 crore (Rs 1.92 billion) for financial years 2006-07 and 2007-08. This was, however, reduced drastically to Rs 2.42 crore (Rs 24 million) after Tulip's representation on October 15, 2009.

Even at that time, the DoT had aggregated the revenues emanating out of Tulip's non-licence business with its licence business for calculating its fees.

Click on NEXT for more...

The curious case of a quashed Qualcomm

Qualcomm waited for Tulip to settle these issues with the DoT but, after a while, offered to clear Tulip's dues by giving an undertaking or a bank guarantee to pay in case Tulip did not cough up the money. Qualcomm's new offer was made through a fresh petition filed on January 23, 2012.

The DoT was supposed to respond to the Qualcomm offer within seven days and discuss the issue on January 31 this year.

The DoT's counsel informed the TDSAT that he had no instructions and would require more time to reply. The matter to be heard on February 6, when the DoT's counsel said that he still had no instructions from his client (the DoT) and got an extension till February 13, 2012.

Curiously, on the day of the TDSAT hearing, on February 6, the DoT faxed a fresh demand of Rs 264 crore (Rs 2.64 billion) to Tulip for the financial years 2005-06, 2006-07, 2007-08 and 2009-10. Tulip had presumed that the dispute had been settled for at least three of these four financial years.

Before the hearing, on the night of February 10, the DoT sent an email to Qualcomm that it had rejected its offer of the bank guarantee on behalf of Tulip. Matters stand adjourned till February 21.

Click on NEXT for more...

The curious case of a quashed Qualcomm

Meanwhile, the Reliance/Infotel Broadband representative Kapil Dev Kumar reminded the DoT: "We recall that, as part of the BWA auction bid application, prospective new entry bidders were required to give an undertaking that if the licence application by the bidders nominee is not made within three months if declaration of auction results, or if the licence application is rejected, its spectrum could be revoked."

Clearly, this is one company that is not happy with Qualcomm. What is also apparent is that there is something spectral in the kingdom of spectrum. A question that could be legitimately asked: Who stands to gain if Qualcomm is forced out of the BWA race? No prizes for guessing the name.

Whether the potential Indian consumer of broadband wireless services will gain from this unseemly tussle is another question that remains unanswered.