| « Back to article | Print this article |

It's not Greek, Mr. Mukherjee

"The crisis in our economy is growing. Are we heading towards 1991?", asks Mr. Murali Manohar Joshi (BJP) to Mr. Pranab Mukherjee in the Parliament on Wednesday, 16th May. The reply consisted of statements like "Indian growth story is intact", "The rupee fall arising out of the weakness in Euro", "India's growth story has not come to an end. I have confidence in people and political system of this country".

The problem is, apart from Mr. Mukherjee himself, and a few other Congressmen, nobody else believes in his words any more. Not denying the role of Euro zone crises in the fall of the rupee, one still needs to look inwards and ask the question, "where is the government machinery?"

Seems like they are just biding time for the innings to get over, without getting all out before the time is up. There hasn't been a single confidence boosting measure by the government in the recent years.

Reforms are announced, Mamata squirms, reforms are rolled back, back to status quo. She is the villain, government is bechaara (poor thing) and lachaar (helpless).

Click on NEXT for more...

It's not Greek, Mr. Mukherjee

Impact on importers and overseas investments

The rupee has fallen to an all time low of Rs55/$ (on May 21). The CEO of a company, which is looking to invest close to $20 million in land and equipment abroad in the coming year, was clearly a worried man when he said, "Desh ki to batti lagne waali hai (the country is going to get ruined). The government does not have the balls to protect the economy. They should stop the flight of dollars. Take tough stands. My cost of capital has just gone up by 20% in a year! How do I compete with the Chinese, the Koreans, the Malays and the Indonesians? I am going to withdraw from the project if this continues."

Similarly, the importers are concerned about the increase in their cost of buying goods and services.

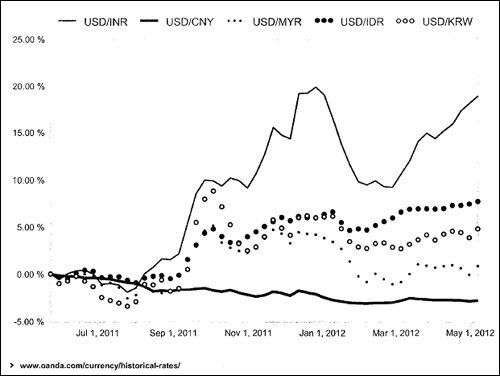

Till Friday (May 18), the dollar has appreciated by 18.8% against the rupee. In the same period, the dollar has appreciated 0.82% against Malaysian ringgit, 7.67% against the Indonesian rupiah, 4.76% against the South Korean won and has depreciated by 2.84% against the Chinese yuan.

Except China, all the other currencies have suffered due to the flight to dollar. But they are still faring much better.

Click on NEXT for more...

It's not Greek, Mr. Mukherjee

Impact on exporters

The IT companies would have benefitted from the slide in rupee if they had not hedged their positions.

Those who did not hedge, are sure to benefit. But, only as long as their customers do not start demanding for discounts, which they already have.

The micro, small and medium enterprises, which contribute to exports in a big way in sectors like jems and jewellery, textiles, handicrafts, etc are already badly hit due to the global economic crisis.

Their concern is that the falling rupee might further accentuate their financing constraints, due to rise in borrowing costs.

Click on NEXT for more...

It's not Greek, Mr. Mukherjee

The reasons

Euro zone tried to save a country which was living beyond its means as a result of which euro is all over the place.

This has resulted in the flight towards dollar, which itself is a fundamentally weak currency. But what is the alternative? Gold?

An already gold obsessed nation has more reasons to buy gold now. The money spent on importing gold does not have any multiplier effect as it just gets hoarded.

For the year 2011-12, the import bill of gold accounted for about 25% of India's trade deficit.

Click on NEXT for more...

It's not Greek, Mr. Mukherjee

Oil is another commodity which forms a large percent of the import bills.

Subsidising it is not helping matters. Not for the oil marketing companies, not for the economy.

Removing the subsidies might upset didi, but it will reduce the fiscal deficit and lower consumption will result in lower imports, hence lower trade deficits.

Click on NEXT for more...

It's not Greek, Mr. Mukherjee

Inflation (consumer price index) has once again gone up in April to 10.36% on an year-on-year basis, versus the 9.47% in March.

GDP growth rate has come down, Index of industrial production is down, food bill and subsidies are the highest ever, and Mr. Mukherjee says, "I have confidence in the ...political system of this country".

Click on NEXT for more...

It's not Greek, Mr. Mukherjee

The culprit

The slide of the rupee is the consequence of a spineless government, not Greece.

No steps by the RBI can stop the fall in the rupee, if the investor confidence is not restored in the economy.

If the current team at the centre, the team which is credited with putting India on the growth trajectory, cannot do it, it would be a shame. Because then this very team would be blamed for the slowdown or rather the downward slide!

The author is senior researcher, Centre for Investment, Indian School of Business, Hyderabad, and can be reached at Nupur_bang@isb.edu.