| « Back to article | Print this article |

Is inflation GOOD for growth?

Nupur Pavan Bang points out a little bit of inflation is good, but too much is bad; as he talks about interest rates, growth and markets.

In a G-24 Policy brief 2012, Anis Chowdhury, senior economic affairs officer at the United Nations Department of Economic and Social Affairs and Iyanatul Islam, a Cambridge- educated economist, who is currently chief, Country Employment Policy Unit, Employment Policy Department, ILO, sum up the inflation targetted as well as non-targeted)-growth debate.

From their brief, it can be said that monetary policies targetting inflation may not result in better growth than countries that do not have a policy of targetting inflation.

They quote Friedman -- "Historically, all possible combinations have occurred: inflation with and without [economic] development, no inflation with and without [economic] development".

Click NEXT to read more...

Is inflation GOOD for growth?

A little bit of inflation is good. But too much is bad. Empirical analysis of inflation and growth over the past 50 to 60 years, in multiple nations, has concluded every possible combination of the two variables is possible, which ratifies Friedman's statement.

The monetary policy announced on Monday, left the interest rates unchanged at 8 per cent.

However, in a surprise move, the cash reserve ratio (CRR) of scheduled banks were reduced by 25 basis points from 4.75 per cent to 4.50 per cent of their net demand and time liabilities (NDTL) which according to RBI is expected to infuse approximately Rs170 billion of primary liquidity into the banking system.

Click NEXT to read more...

Is inflation GOOD for growth?

While the move will give greater freedom to the banks to lend, the unchanged policy repo rate, may not bring in many takers for the loans.

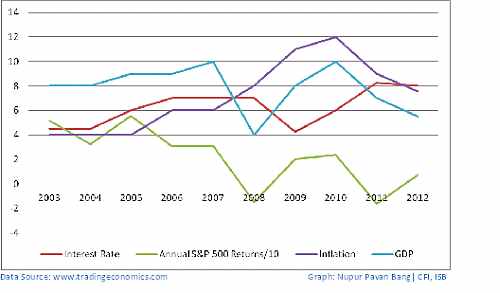

The Reserve Bank of India has maintained that inflation is too high for their comfort. The point to note here is that the correlation between interest rate and inflation, in India, in the past 10 years, taking September to September rates, is a very small 0.16 only.

On the other hand, they are highly correlated with GDP (-0.31) and stock market performance (-0.60).

Click NEXT to read more...

Is inflation GOOD for growth?

In a research done by Muneesh Kapur and Harendra Behera in 2012, who were both with the RBI at the time of doing the research, they concluded, 'the evidence for both India and other countries suggest that the impact of monetary policy actions on inflation is modest and subject to lags...

Despite the monetary tightening by Reserve Bank of India during 2010 and 2011, inflation remained high and this could be attributed to the structural component of food inflation as well as the surge in international commodity prices starting from second half of 2010 and continuing into the first half of 2011'.

Note: Image is used for representation purpose only.

Click NEXT to read more...

Is inflation GOOD for growth?

Inflation can be contained by controlling budget deficits and by easing bottlenecks to improve supply.

But burgeoning subsidies expenditure by the government and inefficiencies has resulted in an expected fiscal deficit of more than 7 per #162 and if the government fails to raise money by divesting the proposed public sector undertakings in the coming year, it will be a reality.

Click NEXT to read more...

Is inflation GOOD for growth?

As a result of which, the entire onus of controlling the inflation has fallen on the RBI. This in turn has an impact on the growth rate.

The stock market rejoiced on Friday, with the benchmark index (SENSEX) moving up by 443 points as the government, led by Dr Manmohan Singh, announced a subsidy cut on diesel and easing the FDI norms for the retail and aviation sectors. However, Monday was not to be the icing on the cake.