Photographs: Reuters Nitin Desai

Prudence requires that we take the predictions of eight and nine per cent growth in the medium term with a pinch of salt, writes Nitin Desai

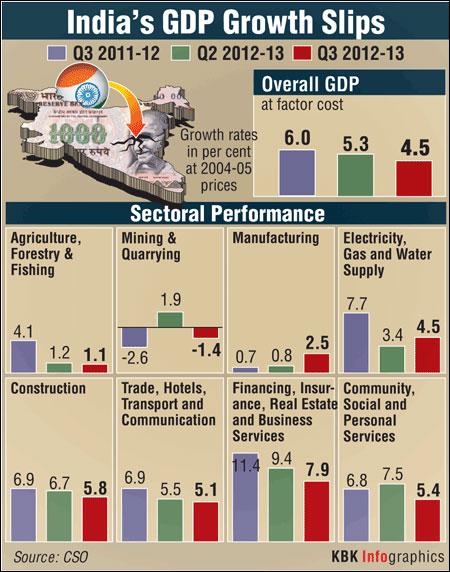

The finance minister and his chief economic adviser believe that the economy has bottomed out, that growth is now on an upswing and that inflation is coming under control.

The prime minister assures us that in two or three years we will be back on a high-growth path.

How plausible are these statements?

The plausibility of the prognosis about growth and inflation in 2013-14 depends on three things: whether the Union Budget numbers will pan out as projected; whether the current account deficit will continue to be financed by foreign direct investment and inflows from foreign institutional investors; and whether business sentiment has recovered enough to revive investment.

. . .

India's growth story: Is the worst over?

Photographs: Reuters

That brings us to the Budget numbers.

The projected deficit for 2012-13 is lower than what was anticipated a few months ago, but that is largely on account of a drastic cut in Plan expenditure in this fiscal year.

The projected deficit of 4.8 per cent is as proposed by the Kelkar Committee; but it rests on a 19 per cent increase in revenues, which is more than what can be justified by the projected 12 or 13 per cent increase in nominal gross domestic product.

The expenditure projections for the Plan seem high only in comparison with the revised estimates and not against what was budgeted last year.

. . .

India's growth story: Is the worst over?

Photographs: Reuters

This matters because a large reduction in Plan expenditure may become necessary halfway into the year if the revenue and deficit numbers look like going off course.

This will be much more difficult since departments have been held down to only a modest increase.

Moreover, electoral compulsions will pose a political constraint on major cuts in the big social welfare schemes.

Other Budget numbers such as the spectrum auction proceeds and subsidy estimates could also be questioned.

. . .

India's growth story: Is the worst over?

Photographs: Reuters

The other big problem is the current account deficit, which is the difference between gross national expenditure and gross national income -- in effect, our national dissaving, which is financed through borrowings or drawing down reserves.

Containing the current account deficit means reducing dissaving within the country, and the main culprit here is the dissaving of the government as reflected in the revenue deficit.

This has not come down much in the Budget, and so there is no real prospect of getting to grips with the five per cent-plus current account deficit and bringing it down to the manageable 2.5 per cent figure.

. . .

India's growth story: Is the worst over?

Image: Workers fasten iron rods together at the construction site of a bridge on the outskirts of Jammu.Photographs: Mukesh Gupta/Reuters

At a more instrumental level, there is no sign of any special effort at raising exports or containing imports, except for gold imports where some steps have been taken but more needs to be done.

Turmoil in the oil market or a ratings downgrade and the consequent flight of foreign capital would push us beyond the brink and require measures so drastic that not just short-term but even medium-term growth will suffer.

The assurances about the prospects of high growth in the medium term rest on two factors.

The first is the rate of investment that, even now, is over 32 per cent of GDP.

. . .

India's growth story: Is the worst over?

Photographs: Reuters

Even with a capital-output ratio of four, this translates into eight per cent.

However, one must recognise one big difference between the kind of high growth in the 2004-09 period and the nature of growth in the years ahead.

The past period of high growth involved a huge expansion of services that are not as capital-intensive as manufacturing.

The next phase will have to depend more on manufacturing and related infrastructure, and those have much higher capital-output ratios.

Thus, some downward adjustment in the growth potential associated with any given level of investment is necessary.

. . .

India's growth story: Is the worst over?

Photographs: Reuters

The other factor that leads to a belief that we are somehow predestined for high growth is the so-called demographic dividend -- the growth in the proportion of working-age people in the population.

But realising this dividend involves major shifts in the growth process.

First, the locus of growth has to shift from the south and the west to the north, where the bulk of the increase in the working-age population will take place.

Second, high growth will have to generate more jobs proportionately than it has done in the past.

Third, the new workers will have to be imparted the skills needed for these jobs.

. . .

India's growth story: Is the worst over?

Photographs: Reuters

Fourth, employment-intensive growth may require a much greater emphasis on small and medium enterprises, which have not done too well lately.

Fifth, sustaining employment-oriented growth in a non-inflationary manner requires adequate food availability underlining the importance of boosting agricultural growth. Sixth, this sort of growth also means more rapid urbanisation, and that will generate a huge demand for urban infrastructure investments.

So, the next phase of growth will be very different from the corporation-focused growth in established industrial centres that drove the 2004-09 growth process.

. . .

India's growth story: Is the worst over?

Much also depends on the outcome of the next Lok Sabha election.

A clear victory for either the United Progressive Alliance or the National Democratic Alliance will help revive the policy reform and growth process.

But a cobbled-together coalition of regional parties supported from outside by the Congress or by the Bharatiya Janata Party, an outcome that seems possible right now, would mean a continuing policy paralysis and hence would be quite inimical for the growth process.

What, then, does the evidence suggest?

. . .

India's growth story: Is the worst over?

Photographs: Reuters

Borrowing the language of the Indian Evidence Act, one can say that a reasonable man would consider it prudent to act on the supposition that the revival of growth will be more tentative, the control on inflation more tenuous and the pressures on the exchange reserves and the rupee will be more acute than what the official pronouncements suggest.

Prudence also requires that we take the predictions of eight and nine per cent growth in the medium term with a pinch of salt, await the outcome of the next election, and live with uncertainty about our economic future till then.

article