| « Back to article | Print this article |

How Pranab will be remembered as finance minister

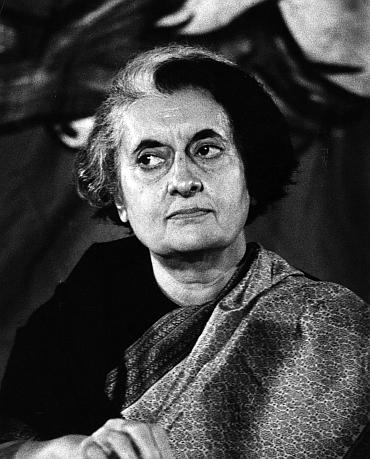

While Indira Gandhi was Mr Mukherjee's political mentor, Dr Singh's equation with him was different, writes AK Bhattacharya.

How will Pranab Mukherjee be remembered as a finance minister?

Note that Mukherjee had two different terms as finance minister -- one from January 1982 to December 1984, and the other almost 25 years later from January 2009 to June 2012.

For most of his first stint as finance minister, he had Indira Gandhi as his prime minister. In his second stint, the prime minister was Manmohan Singh.

That was a key factor.

While Indira Gandhi was Mr Mukherjee's political mentor, Dr Singh's equation with him was different.

When Mr Mukherjee ran the finance ministry from North Block in the 1980s, Dr Singh was the Governor of the Reserve Bank of India.

Different roles in different capacities 25 years later left their mark on the relationship between the two.

Click NEXT to read further. . .

How Pranab will be remembered as finance minister

Their relationship may not have been strained, but it was clear Mr Mukherjee ran the finance ministry in the last three years with far greater independence than he did when he worked with Indira Gandhi as finance minister in the 1980s.

The character of the economy when he became finance minister in 1982 was also vastly different from what it was when he took charge of the same ministry -- initially in January 2009 as additional charge, and then in May 2009.

In 1982, the Indian economy was emerging from a major setback, partly because of the misrule of the Janata Party government in the late 1970s, which got aggravated by adverse global economic conditions.

It was a licence raj economy and the government did its best to preserve its discretionary policies and physical controls, in spite of the pressure from the International Monetary Fund, or IMF (which had granted India an SDR 5 billion extended fund facility loan), to open up the economy.

Click NEXT to read further. . .

How Pranab will be remembered as finance minister

Mr Mukherjee handled that pressure rather well.

Luck was on his side and his policies somehow worked.

The economy recovered, exports picked up and in his third Budget in February 1984, Mr Mukherjee announced triumphantly that the government had decided to return the last installment of the loan, estimated at SDR 1.1 billion, to the IMF.

This was hailed as a grand move to declare India's self-sufficiency and as an answer to the political critics of the loan that the government had the courage to return an IMF loan. But it also reflected a mindset of the era in which Mr Mukherjee operated as a finance minister.

There were two other features that marked Mr Mukherjee's Budgets between 1982 and 1984.

Click NEXT to read further. . .

How Pranab will be remembered as finance minister

In his first Budget, he announced an attractive package of incentives for non-resident Indians to encourage them to invest in India.

One of those incentives allowed NRIs to acquire shares in existing companies from the secondary market.

When the guidelines on the scheme were made public, they led to independent India's most controversial takeover battle.

London-based Swraj Paul of the Caparo Group acquired significant chunks of shares in Escorts, then controlled by H P Nanda, and DCM, which was run by the Bharat Ram family.

Click NEXT to read further. . .

How Pranab will be remembered as finance minister

The two promoters were on the verge of losing control of their flagship companies to Swraj Paul and all because Mr Mukherjee's Budget had allowed NRIs to acquire shares of Indian companies from the stock market.

It was a battle that lasted for more than a year and it is believed that Rajiv Gandhi, who had not joined politics then, intervened in this matter and bailed out the Nandas and the Bharat Ram family, with whom he had close ties.

If the relationship between Rajiv Gandhi and Pranab Mukherjee lacked warmth, it might not be just because of a conversation in an aircraft over who should succeed Indira Gandhi after her tragic assassination, but it could also be because of how Mr Mukherjee's policy had allowed NRIs to raid two Indian companies.

Click NEXT to read further. . .

How Pranab will be remembered as finance minister

The second significant feature of Mr Mukherjee's Budgets in the 1980s was a substantive package of duty changes for various textile industry items.

These measures usually favoured domestic industry, but the market leader was invariably the biggest beneficiary of many specific measures.

Did Mr Mukherjee undertake reforms through his Budgets? Not really.

For instance, he would not show the courage to abolish the policy that allowed lenders to convert their loans compulsorily into equity, but would only tinker with its clauses to allow some concessions.

Click NEXT to read further. . .

How Pranab will be remembered as finance minister

Twenty-five years later, Mr Mukherjee must have found it a little strange to be in North Block, occupying the same room, while his RBI governor of 25 years earlier had now become the prime minister.

This may not be the reason, but the finance ministry under Mr Mukherjee soon chose to assert its independence, and observers began noticing the absence of the rapport that usually marks the relationship between the Prime Minister's Office and the finance ministry.

The global economic climate got worse and the finance ministry failed to take charge as the primary agent for economic reforms to revive growth.

Click NEXT to read further. . .

How Pranab will be remembered as finance minister

It was a mystery that, in spite of his sharp political skills, Mr Mukherjee failed to create political consensus among states and the opposition political parties on the need for taxation reforms like the goods and services tax and the direct taxes code.

As a result, neither of the proposals has as yet been implemented.

It is a pity that Mr Mukherjee's second term as finance minister will be remembered largely for the various retrospective amendments he introduced to tax laws and his attempt to create a super-regulatory body that had the potential to undermine the independence of the central bank.

This is, perhaps, something that he could have done without.