Photographs: Reuters Business Standard

Given recent tendencies, it was only a matter of time before the rupee fell below its previous low, touched a little under a year ago. When the downward trend first began in August 2011 and then intensified later that year, there was a strong opinion that the Reserve Bank of India should take on the responsibility of containing the decline.

Many stakeholders, including, prominently, companies that had borrowed large sums abroad, were taking a beating because they had not hedged their foreign currency exposures. The costs of a large depreciation are unquestionably high - but, as the experience of several countries teaches, probably not as high as the costs imposed by a failed defence of the currency.

...

Address the current account deficit with concrete steps

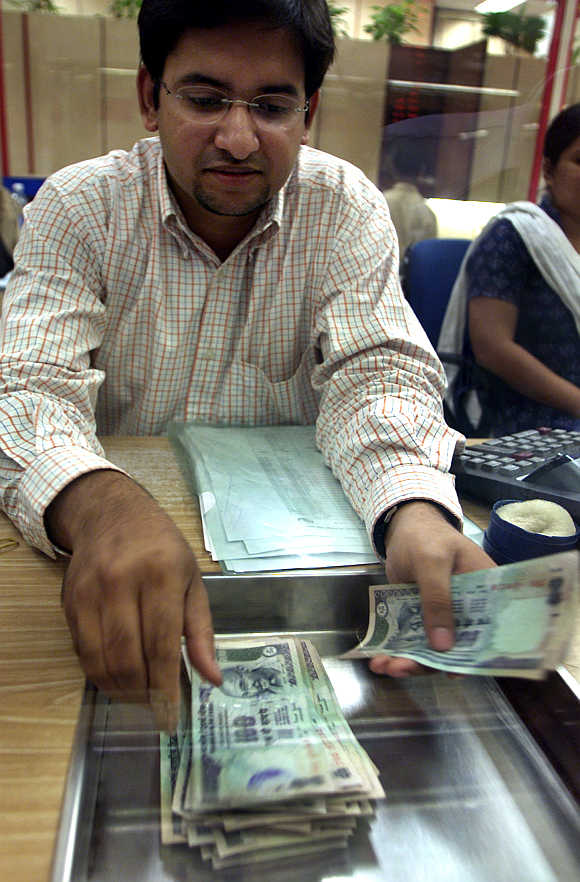

Image: A forex dealer counts rupee notes in Mumbai.Photographs: Punit Paranjpe/Reuters

This was the RBI's position during that episode and remains its stance during the current one, as articulated by RBI Governor D Subbarao recently. And it is a legitimate one.

The trigger for the recent bout of depreciation was the statement by the Chairman of the US Federal Reserve Ben Bernanke that they would have to start thinking of rolling back liquidity now that macroeconomic conditions were showing signs of improving.

In a global marketplace buoyed by successive infusions of liquidity over the past four years, this statement signalled a return to normalcy in the US monetary policy stance and a consequent revaluation of the dollar.

...

Address the current account deficit with concrete steps

Image: A cashier counts currency notes inside a bank in Lucknow.Photographs: Pawan Kumar/Reuters

All currencies were devalued by the markets as a consequence. There is absolutely no case for any country to draw down its foreign exchange reserves to defend its currency against the dollar in these circumstances.

This would simply add to the vulnerability of the currency to persistent pressure. And stakeholders seem to have accepted this: there is far less clamour to resist the depreciation. However, even though there are global forces at work here, the contribution of domestic factors should not be underplayed.

While all currencies are depreciating against the dollar, the ones that have declined the most are from countries with large current account deficits. India is, unfortunately, a leader in this category and looks like it will remain so for a while.

...

Address the current account deficit with concrete steps

Image: An employee counts rupee notes at a cash counter inside a bank in Agartala, Tripura.Photographs: Jayanta Dey/Reuters

Despite all the public handwringing about the size of the current account deficit, very little has actually been done to rein it in. While domestic fuel prices are gradually being corrected, consumers are yet to pay the full rupee price of diesel and liquefied petroleum gas for domestic use.

Measures have been taken to dampen demand for gold, but these are widely perceived to be misdirected and unlikely to have any real impact. And on the mineral front, little has been done to revive the once substantial iron ore exports, while the country's power sector will remain dependent on imported coal for some time to come.

...

Address the current account deficit with concrete steps

Image: A shopkeeper counts currency notes inside his shop in Jammu.Photographs: Mukesh Gupta/Reuters

All of these will combine to keep the current account deficit at dangerous levels, with the inevitable downward pressure on the rupee. The risks of a spiral between currency depreciation, a widening current account deficit due to more expensive critical imports and declining capital inflows due to lower dollar returns are tangible.

Rather than trying futilely to talk the rupee up, the government needs to take credible actions to address each of the threats of the current account deficit. Even if they take some time to have an impact, the signalling effect will be worth something.

article