| « Back to article | Print this article |

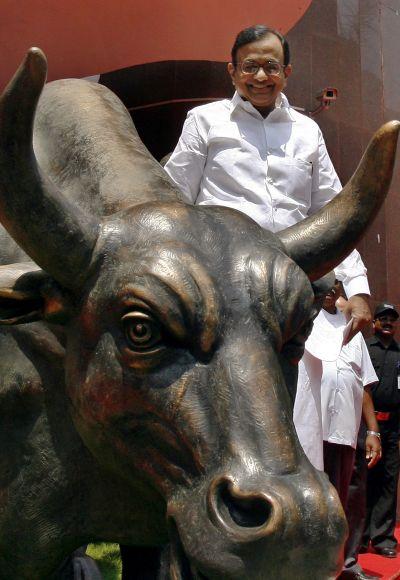

Chidambaram's third innings as FM goes for a toss

In many ways, Chidambaram has been grappling virtually alone with the economic emergency since he became finance minister for a third time 13 months ago.

Late last month, with their doors shut to the mounting market panic outside as investors fled the country, India's cabinet ministers gathered to give final approval to a cheap food scheme for the poor.

It was hardly a difficult decision for a government that needs to shore up its sagging popularity before elections due by next May. But officials familiar with the discussion say there was one dissenting voice over what is now destined to become one of the world's largest welfare programmes.

Finance Minister P. Chidambaram, already struggling to convince doubters that he will keep the country's hefty fiscal deficit under control, made a last-minute attempt to trim the huge cost of the plan, estimated at about $20 billion a year.

Chidambaram's ultimate failure to win colleagues around - despite his famed eloquence - is emblematic of the predicament he faces: he must stop investors heading for the hills as economic growth skids to its slowest pace in a decade, but he is surrounded by politicians who haven't grasped that there is a crisis at hand and want to spend their way to the ballot box.

Click NEXT to read more...

Chidambaram's third innings as FM goes for a toss

In many ways, Chidambaram has been grappling virtually alone with the economic emergency since he became finance minister for a third time 13 months ago.

Cabinet colleagues, wayward allies of the UPA and an obstructive opposition have together stood in the way of bold steps that might have averted this year's collapse of confidence in the India story.

It is a crisis within a crisis.

With elections looming, that won't change anytime soon, which means Chidambaram will find it difficult to take robust policy action if the situation goes from very bad to worse.

"If parliament is not able to point to the direction in which the country's economy will go, parliament is not able to agree on, say 10 steps which the government should take today ... what kind of a message will it send to the rest of the world?" he asked members of parliament (MPs) in frustration last week as the rupee tumbled ever-lower into uncharted territory.

"The fact is, the polity of this country is divided on economic policies and that is understandable ... My plea to everyone, despite our differences: can we agree upon some measures which have to be taken in order to lift the country's economy from what it is today?" he said.

Chidambaram was not available for an interview for this story.

Click NEXT to read more...

Chidambaram's third innings as FM goes for a toss

Authorities "still don't get it"

An almost comic spectacle of the country's policy deadlock played out in parliament last month as the monsoon session of the legislature got under way.

MPs were so busy bawling at each other over issues that might sway voters - a corruption scandal, the partition of Andhra Pradesh and communal violence - that over its first seven days the Lok Sabha spent just 12 minutes on legislative work and there were 11 sittings before a single bill was passed.

While New Delhi appeared nonchalant at the economy's bind, investors were not: they fled. The rupee has tumbled more than 20 percent since May and the fall in August was the biggest for any month on record.

In a matter of a few years, India has turned economic expansion of 8-9 percent into growth now struggling to reach 5 percent. The current account, the broadest measure of a country's international trade, has a record deficit, the manufacturing sector is shrinking, and credit ratings agencies are hovering.

"Our primary concern is that the policy authorities still don't 'get it' - thinking this is a fairly minor squall which will simmer down relatively quickly with fairly minor actions," said Robert Prior-Wandesforde, head of Asia economics research at Credit Suisse.

Click NEXT to read more...

Chidambaram's third innings as FM goes for a toss

For sure, India is one of several emerging markets from Brazil to Indonesia hit by a flight of capital due to rising U.S. interest rates ahead of an expected tapering of the Federal Reserve's massive bond-buying programme that unleashed liquidity across the world. It is doubtful that any policy action in New Delhi could do much to turn the tide.

Nevertheless, India's response has been less decisive than other emerging market economies.

Most steps taken so far to address the problem have been small, such as lowering the cap on transfers of money abroad and slapping import duties on flat-screen TVs, measures aimed at reining in the world's third-largest current account deficit that is approaching $90 billion.

Some proposals have smacked of desperation. One minister last week suggested curbing diesel consumption by the railways, a bigger economic lifeline than in most countries, and the armed forces to cut import costs, an idea that got no traction.

The Economic Times reported on Saturday that the Reserve Bank of India (RBI) wants Hindu temples to deposit their hoards of idle jewellery for conversion into bullion to meet demand for gold in the world's biggest consumer of the precious metal. The idea is that such a measure would reduce import demand for gold.

Click NEXT to read more...

Chidambaram's third innings as FM goes for a toss

Cabinet Wrangling

The last time Chidambaram was finance minister, in 2004-2008, growth was motoring at a near-double-digit clip: he used to call himself a "lucky finance minister" because of the neat timing. But fortune has hardly been on his side since returning to the job last year.

Aides say he has come under huge stress in recent weeks, but in public he has kept his cool, not surprising for the Harvard-educated lawyer who sharply told an interviewer earlier this year: "When did self-confidence become a vice?"

Financial markets have long had just as much faith in the smooth-talking politician as he has in himself. They remember his pro-business 'dream budget' of 1997 that brought taxes down, and when he returned to the finance ministry last year investors were thrilled, anticipating a new push for economic reform to end years of policy drift and an economic slowdown.

A short burst of reforms, including the opening up of retailing and aviation to foreign investors, followed. Chidambaram also succeeded in bringing down the fiscal deficit to 4.9 percent of GDP in fiscal 2012/13 from 5.8 percent, helping avert a sovereign credit rating downgrade.

However, the reform drive soon lost momentum, in part because of the main opposition party's recalcitrance in parliament.

But resistance within the Congress was as much to blame.

Click NEXT to read more...

Chidambaram's third innings as FM goes for a toss

Two senior ministers leaned on Prime Minister Manmohan Singh earlier this year to reverse a decision allowing 100 percent foreign direct investment in domestic pharmaceutical companies, a finance ministry source said. But Chidambaram pushed back, saying that if they had objections they should take them to the cabinet rather than surreptitiously lobbying the prime minister.

At a meeting in July, three ministers got together to push through extra funding for roads in the far-flung northeast and Jammu and Kashmir, overriding cost concerns raised by the finance ministry.

And last month, Chidambaram wanted his colleagues to stick to the original version of the food security bill under which 18 out of 29 states would get less wheat and rice than allotted to them under an existing public distribution system because of a drop in the number of poor there.

But other members of the cabinet resisted him, warning that the opposition could block the landmark bill - which guarantees 810 million Indians grain at a fraction of market prices - when it got to parliament. Their argument carried the day, at an additional cost of 50 billion rupees a year.

"There is no point fighting it beyond a point," said a finance ministry official, recalling the wrangling over the legislation. "What we have said is that it's fine: you do this because that is the demand of the constituents, but you will have to cut somewhere."

Many in the left-leaning Congress led by Sonia Gandhi believe that the fruits of fast growth since India unshackled the economy from the grip of the state in the early 1990s were not shared with the country's millions of poor, and that electoral success lies in more distribution.

Click NEXT to read more...

Chidambaram's third innings as FM goes for a toss

Critics say the problem is that a new group of aggressive second-rung leaders in the Congress, pushing for 'inclusive growth', are setting out new principles of economic policymaking, creating further dissonance within government.

"Individual ministers and ministries are all running on their own. Nobody is looking at the national interest," said former Home Secretary G.K. Pillai, who served with Chidambaram when he was brought in to fix homeland security after the 2008 attack by militants on Mumbai.

"Everyone has his own view, which is why you have different interpretations of cabinet decisions. The lack of leadership is telling."

Political Constraints

The criticism may seem odd. Prime Minister Singh took bold steps in 1991 as then finance minister to set India on a high growth path after a balance of payments crisis, earning himself a place in history as the architect of India's emergence as a global economic power.

Now, he is routinely derided by the opposition and media for the policy drift of recent years. The 80-year-old broke his silence on Friday after weeks of market turmoil, telling parliament that whatever critics might say he still enjoys wide respect around the globe.

But when it comes to dealing with the currency crisis, markets will be hanging on every word of Chidambaram, not the prime minister.

Congress insiders say the finance minister plays a dominant role in cabinet meetings, often calling the shots even as the prime minister sits by.

The stakes are high for Chidambaram himself, who has been talked about as a potential successor to Singh if his party wins the election and Rahul Gandhi, the heir to the Nehru-Gandhi dynasty's mantle, insists on a behind-the-scenes party role for himself - like his mother, Sonia.

Click NEXT to read more...

Chidambaram's third innings as FM goes for a toss

The baby-faced Chidambaram, who is from a wealthy business community in Tamil Nadu, has a reputation for intellectual prowess, but also for arrogance that has made him enemies within his own party and on occasion alienated public opinion.

Political constraints ahead of the election have so far made potentially unpopular policy steps difficult to take, but if Chidambaram is indeed eyeing the premiership he may be reluctant to press for them himself.

Sanjaya Baru, a former media adviser to the prime minister, wrote in the Indian Express that the political climate has made Chidambaram less enterprising than he was in his first stint as finance minister in the 1990s and less confident than he was in the second.

"Now placed firmly in a potential line of succession to the top and with his hands constrained by the party's need to prevent any political mishap before an election, P. Chidambaram Mark-3 has proved to be more risk-averse," he said.

(Additional reporting by Rajesh Kumar Singh, Manoj Kumar; Writing by John Chalmers and Sanjeev Miglani; Editing by Neil Fullick)

© Copyright 2025 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.