| « Back to article | Print this article |

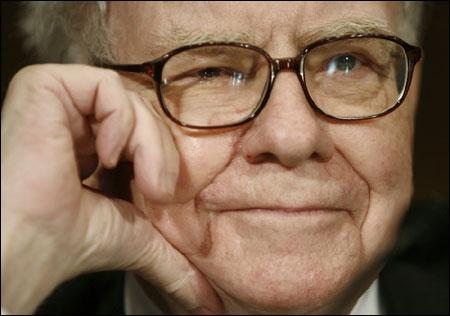

Chances of US slipping into recession 'very low': Buffett

Billionaire Warren Buffett has said that the chances of the United States going back into recession are very low unless the Eurozone crisis escalates further.

"There won''t be a recession in the U.S. ''unless events in Europe'' develop in some way that spills over here big-time," The Telegraph quoted Buffet as saying.

Click on NEXT for more...

Chances of US slipping into recession 'very low': Buffett

The chairman of Berkshire Hathaway also criticised the 'half in, half out'' European Union structure and called for greater fiscal union.

"They''re in on a common currency, but they''re not in on a common fiscal policy or a common culture or common labour practices," Buffett said.

"It can''t be half slave and half free. European leaders need to resolve some of the union''s weaknesses," Buffet added.

Click on NEXT for more...

Chances of US slipping into recession 'very low': Buffett

The 17 eurozone members share the same central bank, currency and interest rate policies, but have national sovereignty over tax and budget policies.

The members do not have a system of internal transfers from strong to weak states as in the US.

Buffett has been building Berkshire''s portfolio of shares and making capital investments at the company''s railroad and utility units as he bets on growth in the US.