You say the role of corporate houses and their governance, particularly in the financial sector, has become relevant. What's your take on allowing entry of companies in the banking space?

The first lesson from the global financial crisis is that financial conglomerates are too big; you should avoid them. Now, you are talking of financial and non-financial conglomerates. These would be bigger. If you don't want large financial conglomerates, how can you have both financial and industrial ones?

The risks seem to be real and the benefits are yet to be established. Globally, it's not that all are allowing industrial houses. Many countries are not. The empirical evidence is mixed, even globally. In our country, what are the capacities for regulatory supervision? Should India be doing this? You should ask these questions and establish the benefits and risks, and whether risks are worth taking.

If the benefits of allowing conglomerates into banking are not established, how will the Reserve Bank (RBI) weigh the risks vis-a-vis the benefits of allowing corporates in the banking space?

That is the whole point. You have to take a call. If the benefits are uncertain and risks are less uncertain, then we are taking more risks than getting benefits.

Click on NEXT for more...

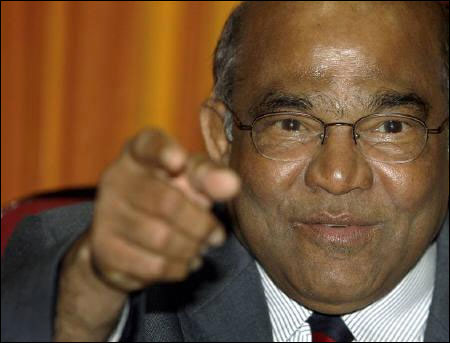

It isn't bad news if successive governors think alike. In fact, (C) Rangarajan, (Bimal) Jalan, me and Subbarao all think alike and it is good for the country. For 20 years, governors of the central bank, by and large, have thought the same way. So, we will have good financial stability and a good financial sector. You should be happy. You should always have a mutual admiration among successors and predecessors and not a mutual hate society.

Globally, after the crisis, wherever there was fiscal vulnerability, say in Greece, it expresses itself in financial sector problems. In some countries like Ireland and Iceland where they did not have fiscal problems, financial sector problems turned into fiscal problems - sovereign debt problems. So, the two are related. After the crisis, with a greater realisation of uncertainties, there should be more fiscal headroom.

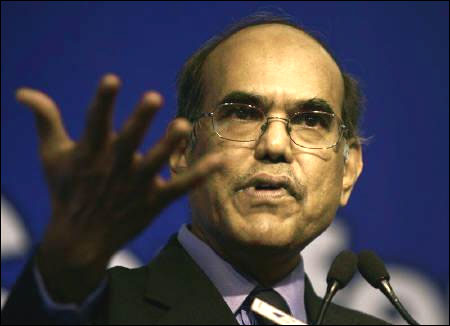

In a way, Governor Subbarao is more right in pointing out fiscal problems than I was. The whole point Subbarao is making is, if you want the economy to grow and the private sector wants more money, it can happen if the government reduces its borrowing.

If the government takes more money and the private sector still wants to grow, you have to draw foreign savings, which will widen the current account deficit. The logic is not different; in fact, it is more valid after the crisis than before.

What is your take on RBI's 0.25 per cent reduction in the repo rate?

Why should I monitor what is happening today? I am an academic.

In the context of fiscal consolidation, how convincing do you find the five-year roadmap from the government on the fiscal deficit?

I only make analysis, I don't give opinions.

You said India needs to re-calibrate its reforms in the context of new thinking on globalisation, post-crisis. What does it mean, basically? Should we moderate reforms, should we accelerate reforms or should we contextualise it as we did in foreign direct investment in multi-brand retailing?

I am saying these are global happenings. Once you apply your mind, in some sectors you might go faster, in some you might go slower but the whole issue is, are we learning from global experience? Once you do, you re-calibrate; re-calibrate does not mean no calibration.

Click on NEXT for more...

The book also said while framing international policies, India should establish in a greater way its links with emerging market economies. Does it mean bilateral relations should take precedence over the WTO kind of multilateralism?

The limited point I am making is that globally, the share of emerging market economies will increase, their rate of growth will be higher, the opportunities for exports and imports would be higher.

So, our policy should concentrate on development opportunities in the emerging market economies.

Will these facts on fiscal consolidation, their impact on financial markets, a greater degree of consensus on the Goods & Services Tax be taken into account when the 14th Finance Commission (which Reddy heads) recommends on sharing of the divisible tax pool between the Centre and states?

The first meeting is on February 1. When the first meeting has not happened, what can one say what the Commission will do? It is not a one- man panel; I will only chair.

How seriously should India take warning signals from some rating agencies?

Analytically, credit rating agencies happen to be discredited after the crisis. Some countries like the USA and France need not take these very seriously; even so, they are responding. Unfortunately for emerging market economies and developing economies, if financial repercussions take place, central banks and governments will have to take note of it.

It is not whether it is true or false. What we are worried about is effects. Therefore, you give enough information to credit rating agencies; if there is disagreement, then counter them but take corrective measures.

You said in the book that after the global financial crisis, there is a global debate on whether the ambit of economics as a subject needs to be changed. What are your views on which side of economics failed -- science and mathematics-based or humanities?

I was not referring to any of my opinions. Globally, after the crisis there is a feeling that economics in terms of growth models, management of money and finance did not take into account institutional complexities, the consequences of inequalities, social factors and behavioural aspects. Now, economics is giving importance to the behavioural sciences and trying to find how interactive processes in evolutionary biology are important.

Considerations that govern economic activities have to go beyond traditional economics. I was putting the setting, then tried to explain in the book in greater detail a rethinking on economic policies. In this backdrop, the certainty of models on which economic policies are based have been slightly moderated, less certain than before.

In this light, economic policies are now being re-calibrated. I tried to say what are the economic policies being re-calibrated, particularly in regard to fiscal, money, finance and their implications on the real sector. These are one set of developments which the Indian reform agenda should take into account.

The second formulation is, many countries are changing their own policies. The global economy is going to be different after the crisis. The way we relate to the global economy has to reflect this. Therefore, we have to redefine India's own economic policies in relation to the global economy.

The third formulation is in managing our own economy, society; we also have to recognise how important inequalities play a role in aggregate demand. Therefore, we have to contextualise these to our conditions. I am not saying anything as to what should be done in reforms, except here and there, marginal inferences.

You said in the book that mood swings about global prospects in the Indian economy are sharper than in other countries. Why is it so?

I think policy circles, as well as academic debates, have not recognised the fact that there will be cycles. For example, two-three years earlier, Chinese policy makers said their growth rate was too high and wanted it constrained. Then, after some years, they said we don't want to go too slow, we want to increase the growth rate.

Whereas here in India, generally the feeling is if it is nine per cent, we should be nine per cent. If it goes down to eight per cent, we will say it is bad. The mood becomes very optimistic when it is nine per cent and very pessimistic when going down to, say, seven per cent.

At that level, a range is very large in any economy. In global economies, when there is a huge impact and 50 per cent of unemployment among the young from, say, five per cent, there is a debate but the mood is not that pessimistic.

You talked about the fact that deliberate moderation in cycles, both boom and bust, are now being recognised. Does it mean in-built stabilisers no longer work?

In some cases, there were not enough stabilisers inbuilt in the fiscal system. For instance, take our own economy. We did not have fiscal stabilisers of any considerable magnitude. Some countries did not have fiscal space. They were already running a fiscal deficit and the space to moderate the cycles was less.

Earlier, the financial sector felt that boom and bust are automatically adjusted. Policy need not counter these. We recognised after the crisis that thjis isn't so; you cannot say that markets will correct by themselves and fiscal stabilisers, even when these exist, are not enough.

The fiscal sector alone should not have stabilisers. The financial sector should also have counter-cyclical stabilisers; monetary policy should also have counter-cyclical stablisers.

We have to recognise that some people will benefit disproportionately during a boom and innocent people will be affected during a bust. That creates social tensions. This cannot be ignored in public policy. That I have come out with in the book.

Click on NEXT for more...