Photographs: Navesh Chitrakar/Reuters. Nitin Desai

The finance minister has to present a Budget that will revive investor confidence, restore fiscal balance and rescue the electoral prospects of his badly battered party.

Corporate leaders, the domestic and foreign commentariat (including yours truly) and the finance minister's party colleagues will be marking his performance from these perspectives. Here is a score sheet for what we can reasonably expect in the Budget tomorrow in pursuit of these three goals.

First, take this business about restoring investor confidence. Capital formation in the corporate sector rose from 10.3 per cent of gross domestic product (GDP) to 17.3 per cent in 2007-08, and that is a big part of the story of high growth since 2003-04.

...

Budget 2012: A big test for the UPA govt

Image: Howrah Bridge.But since then there has been a sharp downward trend, and in 2010-11 this had fallen to 12.1 per cent of GDP.

The chances are that the numbers for this financial year, when they come out, will show a further decline - going by the 2.2 per cent decline in investment (gross fixed capital formation) revealed by the GDP numbers for the first three quarters of the year.

Anecdotal evidence suggests that corporations are postponing planned projects, diversifying into overseas investments or just sitting on cash.

This fall in investment has to be reversed if confidence is to be restored in the prospects of high growth at the levels projected by the Planning Commission. One test for the Budget is whether it does enough towards this end.

...

Budget 2012: A big test for the UPA govt

Image: India's longest tunnel stretches across 11 kilometres connecting Qazigund with Banihal is constructed within a year.The one instrument totally under the finance minister's control is the direct public investment included in the Budget; but given the compulsions about restoring fiscal balance, it would be unreasonable to judge his performance by the scale of effort on this score.

A more reasonable expectation would be some measures to boost corporate incentives to revive mothballed projects and step up their pace of investment by 50 per cent or thereabouts over the next couple of years, so that we get back to the 2007-08 ratio of corporate investment to GDP.

...

Budget 2012: A big test for the UPA govt

Image: Indian rupee notes.The interest rate is not a Budget measure, and the finance minister can signal intentions, but not much more than that.

He can and probably will fiddle with depreciation rates and some other bits that affect the incidence of corporation tax - but not on a scale that could lead to the sort of investment boost suggested here.

In the minds of corporate leaders the big issue that needs to be resolved is the logjam in investment clearances.

...

Budget 2012: A big test for the UPA govt

Image: Linemen set up high tension power lines on the outskirts of Ahmedabad.Photographs: Amit Dave/Reuters.

This is a matter that is only partially under the control of the central government; many of the clearances involve state governments.

Many pious statements have been made about the need for speeding up clearances.

What the Budget will have to present is something more than that; for instance, an empowered committee of central and state ministers to prepare proposals for decision by the National Development Council so that here is a buy-in by all the authorities concerned.

How can one judge the adequacy of the scale of effort on this score?

...

Union Budget 2012-13: Complete coverageBudget 2012: A big test for the UPA govt

Image: ONGC workers.Photographs: Reuters.

Perhaps with two indicators: the enthusiasm with which the corporate sector receives his proposals (suitably discounted for their usual grumpiness about governments) and the stock market's response.

The latter also has some direct instrumental relevance for boosting investment by reviving the moribund market for initial public offerings and the confidence of overseas portfolio investors, and for the Budget deficit by helping to ensure that disinvestment is smoother than the recent ONGC fiasco.

The restoration of fiscal balance is the second major head in the scorecard. It could be argued that the economy does not face a major inflation risk and, in the interests of stimulating growth, the Budget should be expansionist and delay the deficit adjustment.

...

Budget 2012: A big test for the UPA govt

Image: Reserve Bank of India headquarters, Mumbai.However, if the primary requirement to revive growth is to boost investment, then a lower deficit is necessary to allow a reduction in interest rates, and to maintain sovereign ratings that influence the rates charged on external commercial borrowings.

This last concern is particularly important as a safety measure, given the volume of external commercial borrowing that has to be rolled over this year.

The government's fiscal deficit widened from 2.5 per cent of GDP in 2007-08 to a budgeted 4.6 per cent – and a likely actual closer to 5.5 per cent – in the current fiscal year.

This is based on the Government of India's definition, which counts capital receipts like 3G licence fees and disinvestment sales on the revenue side.

...

Budget 2012: A big test for the UPA govt

Image: Dollar notes.Initially, the widening was due to the fiscal stimulus deemed necessary after the global financial crisis hit in 2008. But the deficit overshoot now is really because of over-optimistic revenue projections and serious underestimation of the revenue burden.

In absolute terms, this year's fiscal deficit may be of the order of Rs 5 lakh crore, about 20 per cent higher than the Budget projection.

The minimum that the commentariat expects is to hold it at this year's projected level with some expectation that at least a beginning will be made to move back to the rate required by the medium-term fiscal projections of the Finance Commission.

...

Budget 2012: A big test for the UPA govt

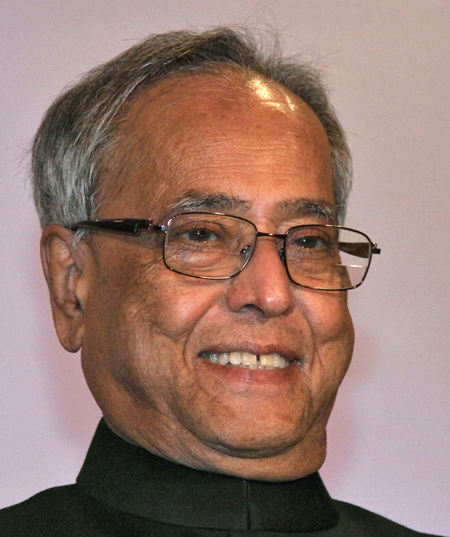

Image: Finance Minister Pranab Mukherjee.The real issue, however, is not just the projected reduction, but the credibility of the expenditure and revenue projections that underlie it.

As far as the latter is concerned, any projection above a 12 per cent increase (GDP growth seven per cent and inflation five per cent) will have to be justified in terms of built-in buoyancy, special receipts or additional mobilisation.

The biggest challenge for the finance minister is the third part of the scorecard - the stuff that he has to do to revive the electoral prospects for his party.

The biggest mistake would be to respond to his party's poor performance in Uttar Pradesh and Punjab by trotting out yet another round of cash for rural uplift.

...

Budget 2012: A big test for the UPA govt

Image: Tax sops for the middle classes likely.The Samajwadi Party swept the polls because Akhilesh Yadav came across as a person who wanted to provide young people with opportunities such as better education, English in schools, computers and so on.

A more inspired electoral response would be to do something special as regards education and skill development.

A more conventional but still acceptable response would be to provide some income tax sops for the middle classes. So let us wait and see which way the finance minister and his party move.

Mr Mukherjee will undoubtedly seek to address all three concerns. The big test is where he tries to do just what is required to get pass marks, and where he tries to ace it. That will tell us whether this government still has the will to govern.

Union Budget 2012-13: Complete coverage

article