Photographs: Ajay Verma/Reuters Krishna Kant in Mumbai

With many large firms on the brink of financial insolvency and the strain on India Inc’s balance sheet the most in five years, one might be impelled to think that stock markets are waiting to see a collapse.

But that might not be true.

The impact on the bourses would be minimal because the companies with high debt on their books matter little to the markets now.

The 10 most indebted firms currently account for only 1.3 per cent of the combined market capitalisation of BSE-200 companies (ex-banking and financial firms). In March 2008, these firms accounted for six per cent of the combined market wealth of BSE 200.

BSE-200 firms together account for 90 per cent of the market cap of all listed companies.

. . .

Bourses won't have to pay for India Inc's debt

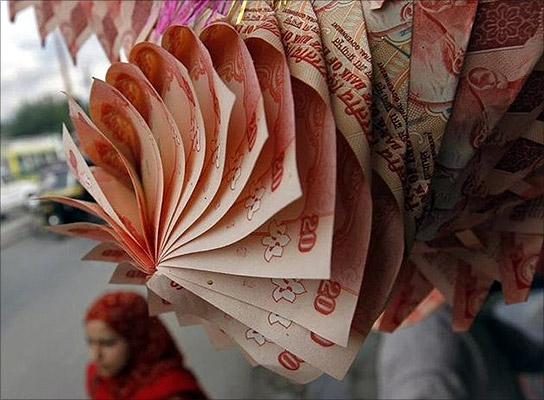

Image: A Kashmiri woman walks under a garland made of rupee notes on display at a market in Srinagar.Photographs: Fayaz Kabli/Reuters

As of March-end, nearly half the BSE-200 companies by market value were not only debt-free but sitting on a combined Rs 2.53 lakh crore ($42 billion) worth of cash and equivalents.

Another 22 per cent companies had only marginal debt on their books and were nowhere close to balancesheet issues. In other words, nearly three-fourths of market capitalisation of BSE 200, minus financial firms, is miles away from the financial stress in the news lately.

This might explain why benchmark indices have remained largely resilient, despite gloomy economic and corporate news.

Analysts say the only risk these companies face is of growth.

“The surplus cash on their books actually points to the lack of investment opportunity in the economy right now.

. . .

Bourses won't have to pay for India Inc's debt

Image: An employee counts rupee notes.Photographs: Reuters

“You can’t expect companies to take up new projects when asset utilisation has been falling every quarter due to demand destruction,” says Dhananjay Sinha, co-head, institutional equity, Emkay Global Financial services.

India Inc seems to agree.

“We don’t borrow to invest.

“Our capital expenditure is largely funded through internal accruals.

“So, interest rates don’t play a role in our investment planning.

“What matters is the economic vibrancy and demand growth for products,” says Ashok Bhandari, chief financial officer, Shree Cement.

A debt-free company, Shree Cement was sitting on cash and equivalents of nearly Rs 2,500 crore (Rs 25-billion) as of June-end.

. . .

Bourses won't have to pay for India Inc's debt

Image: Artists in traditional attires perform during the Republic Day parade in New Delhi.Photographs: Reuters

The view at consumer durables major Havells India is similar.

“Interest rates play only a minor role when we draw our capex plans.

The most important variable for us is the demand scenario.

If we see strong demand for our products, we will most likely go ahead with a new project, regardless of the interest-rate cycle,” says Anil Gupta, joint managing director, Havells India.

The company, with a debt-to-equity ratio of 0.4x at the consolidated level and no plans so far to postpone or defer growth plans, seems equipped to handle economic slowdown.

For the companies that are financially comfortable, macroeconomic headwinds and tight monetary policy are, in fact, an opportunity to further consolidate market position.

“Slowdown and high-interest-rate regime are an opportunity for us to push capital expenditure in a cheaper and faster way.

. . .

Bourses won't have to pay for India Inc's debt

Photographs: Reuters

“In a downturn, plant and equipment are cheaper and suppliers are willing to deliver much quicker than during boom periods,” says Shree Cement’s Bhandari.

Analysts say the biggest risk for the stock market is from the banking sector, which is likely to take a direct hit from stress on companies’ balance sheets. “Many banks, especially the government-owned ones, might be forced to write off their exposure to highly-indebted firms.

This would trigger a sharp fall in their market value, bringing the entire market down,” says G Chokkalingam, executive director & chief investment officer, Centrum Wealth Management.

As of March-end, BSE-200 companies (excluding banks & financial firms) had a total debt of over Rs 12 lakh crore ($200 billion).

. . .

Bourses won't have to pay for India Inc's debt

Photographs: Reuters

The ten most vulnerable companies accounted for nearly a fifth of this. And, the top 25 per cent of indebted firms in the sample accounted for half of India Inc’s total debt. This highlights the risk corporate indebtedness poses to the banking sector.

The impact seems to have started to show, with the NSE banking index, Bank Nifty, declining nearly 15 per cent over the past one-and-a-half month.

However, the slide also means that the share of banking firms in the total comes down, limiting the impact on the broader market.

On an average, banking & financial firms’ stocks account for 18 per cent of the market cap of BSE 200.

This is down from 20 per cent at the peak, but higher than the 15 per cent in March 2008.

. . .

Bourses won't have to pay for India Inc's debt

Image: Kathakali dancers perform during the annual temple festival at Tripunithura, Kerala.Photographs: Sivaram/Reuters

The bulk of the banking share is accounted for by private-sector lenders like HDFC Bank, ICICI Bank, Axis Bank and IndusInd Bank.

These account for 45 per cent of the entire financial-sector market capitalisation and eight per cent of BSE-200 companies’ combined market value.

According to analysts, this suggests a soft landing for the market -- not a hard crash like the one seen in 2008.

Besides, this also limits the likely impact, positive or negative, of an RBI monetary policy on the earnings of top companies.

“Monetary tightening is here to stay. But it is not likely to reverse the course of India Inc’s earning cycle. It will, in fact, trigger the long-awaited adjustment and force banks to clean up their books,” says Emkay Global’s Sinha.

article