| « Back to article | Print this article |

Automobile sales: Who's the winner in India?

Very often, companies are flogged by the market for not being innovative enough. As far as India's auto sector is concerned, the Street is cheering those that have stuck to doing what they do best.

Auto volumes over the last few months suggest that demand is slowly shifting towards brands which have a "low propensity to experiment," claim some analysts.

This trend is apparent even in the September sales figures.

While most companies have seen double-digit decline in the month, players like Maruti Suzuki and Mahindra & Mahindra (M&M) have managed to clock growth in volumes.

Click NEXT to read more...

Automobile sales: Who's the winner in India?

Undoubtedly, with the festive season setting in later this year, volumes have declined in September on the high base of last year.

However, this does not explain the growth seen by players like Maruti and M&M.Analysts say demand trend seen this year clearly suggests that products which are relevant to the Indian market will continue to do well.

This explains the steady progression of consumers towards larger utility vehicles and their preference for diesel vehicles.

Click NEXT to read more...

Automobile sales: Who's the winner in India?

According to Elara Capital, the market is showing strength for relevant products and demand is gravitating towards leaders indicating low propensity to experiment.

Analysts say new products in both two-wheeler and four-wheeler space have failed to generate good response, while the leading brands across segments continue to see growth.

Also, in the current environment where demand is collapsing, the market derives comfort from visibility.

Click NEXT to read more...

Automobile sales: Who's the winner in India?

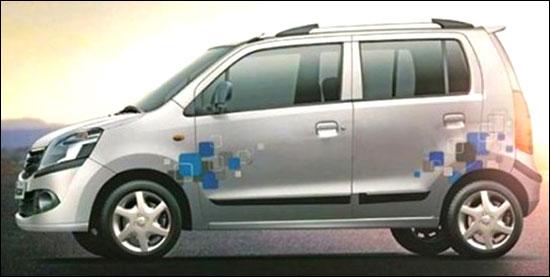

Maruti Suzuki, the biggest player in the passenger vehicles space, offers this visibility through its 130,000-vehicle order backlog.

Deepak Jain of Sharekhan says investors would be better off focusing on those automobile companies that are able to hold and protect their market share when the broader industry slows down.

These companies would be better off in the medium-to-long run once demand revives, he says. Maruti is the preferred play for many as it is equipped to ride the diesel car boom as also is M&M.

According to Jain, the company would deliver strong growth in the medium-term as Quanto and Rexton would make it the most entrenched player in the utility vehicles space.

Click NEXT to read more...

Automobile sales: Who's the winner in India?

The two-wheeler space is also seeing a churn of sorts as consumers are delaying purchase decisions on the one hand and focusing on fuel efficient models.

Unlike other two-wheeler players, Honda Motorcycle and Scooter India (HMSI) is seeing robust demand even as the overall environment is slowing and this is directly impacting Hero, believe analysts.

Hero MotoCorp's September volumes fell 26.4 per cent Y-o-Y, while TVS Motors saw a fall of 22.5 per cent and Bajaj Auto's total vehicle sales declined 13.8 per cent.