| « Back to article | Print this article |

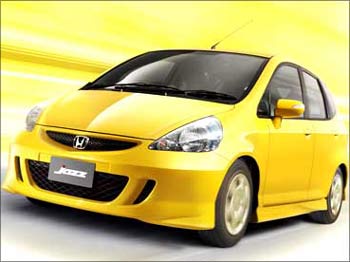

India, world's 2nd largest maker of small cars

Ford unveils the small car that it will make in India from next year; Renault announces fresh Indian plans, adding Nissan as a partner after having already selected Bajaj for a joint venture; Volkswagen in turn will introduce its small car next year.

By all accounts, the car industry in India is about to acquire serious scale, as new car plants start dotting the maps of Maharashtra, Tamil Nadu, Haryana, Gujarat and Uttaranchal.

An astonishing 40 new car models have been introduced in the market over the past year, half a dozen by Maruti alone.

Along the way, India has become the second-largest maker of small cars, overtaking Brazil (Japan is No. 1, of course).

India, world's 2nd largest maker of small cars

Overall, the country's car industry now ranks seventh in the world, with a 4 per cent share of the 50 million global car market. A decade from now, that share might well be 10 per cent.

When global giants start investing in plants with scale, in preparation for entering the market to take on the existing domestic champions (Maruti, Hyundai, Tata), it should be obvious that the action is just beginning.

The Society of Indian Automobile Manufacturers says that a staggering Rs 78,650 crore (Rs 786.50 billion) will be invested by car companies in the four-year period between 2007 and 2011, more than has been done in the first six decades after Independence.

India, world's 2nd largest maker of small cars

Today's three market leaders lead the pack with close to Rs 10,000 crore (Rs 100 billion) each, followed by Mahindra and a dozen or more others. Among them must now be counted Fiat-Tata, Volkswagen, Renault-Nissan, Honda and Toyota (which is expanding only in India).

Component manufacturers, who have failed to keep pace with soaring demand (necessitating imports from Thailand, China and elsewhere), seem to be changing gear too.

So the R word is long forgotten, thanks in large part to the series of 'stimulus' measures announced by the government from last December -- starting with interest rate deductions and going on to successive tax cuts, better depreciation rates for trucks and substantial car buying by government departments.

India, world's 2nd largest maker of small cars

Other factors that have helped are the pay-out following the implementation of the Pay Commission report, and the fact that state-owned banks stepped up to the plate after private banks began de-emphasising car finance.

Domestic car sales will grow 15 per cent this year, despite having started slowly. Exports will grow much faster, with April-August clocking 37 per cent growth over last year -- the cars going mostly to Europe, whose own car production has been falling.

Domestically, the market is deepening -- 22 leading towns and cities used to account for more than two-thirds of all car sales; that figure is now down to less than a half.

India, world's 2nd largest maker of small cars

The fresh lease of life being given to the highway programme and the new momentum in the smaller towns mean that the car market has a long way to go. In a parallel development, two-wheelers are doing well too, with production expected to zoom to perhaps 9 million this year, up about 20 per cent from 7.4 million last year.

A million out of those will be exported, mostly to Asia and South America.