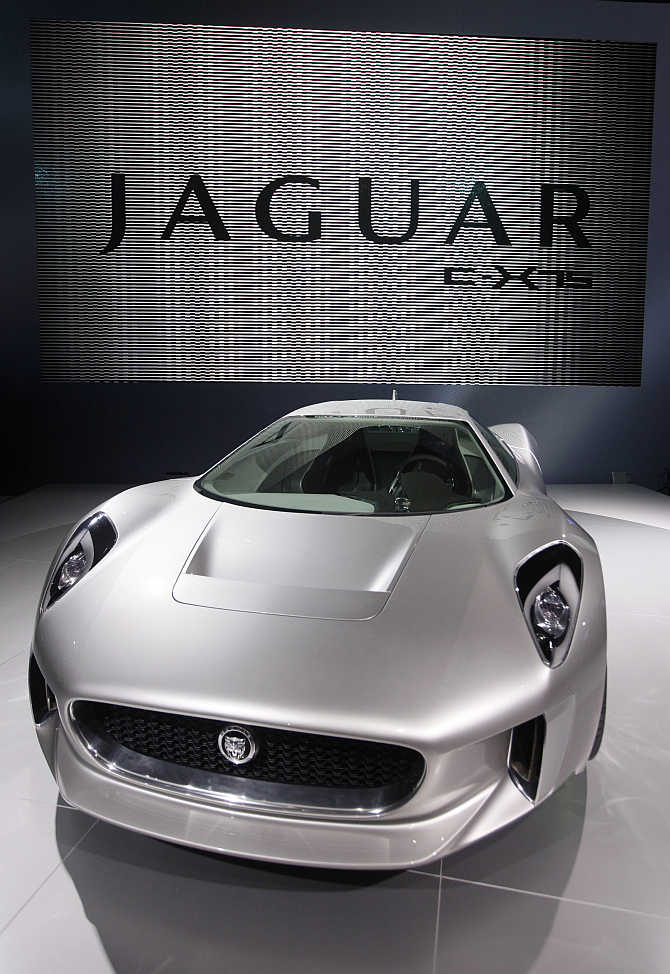

Photographs: Jacky Naegelen/Reuters

Tata Motors’ scrip is up six per cent in October on expectations of a better volume performance and product pipeline of its United Kingdom-based subsidiary, Jaguar Land Rover. This takes the total gains to 18 per cent since early September, which can be partly attributed to upgrades by some brokerages and strong JLR volumes in August and September.

The upgrades have come on an expected improvement in margins and volumes for JLR. Margins for JLR are likely to improve from 14.7 per cent in FY13 to 16.6 per cent in FY15, as new products aid favourably to the product mix. “JLR's margins could expand 200 basis points over FY14-15, given the success of new Range Rover and RR Sport," say Jamshed Dadabhoy and Arvind Sharma of Citi Research.

...

JLR keeps Tata Motors in cruise control

Image: BMW i8 Concept Spyder hybrid gas/electric car on display in New York.Photographs: Chip East/Reuters

The continued shift in geographical mix to China is likely to be beneficial for margins if prices do not correct, they add. While China accounts for a fifth of the volumes, revenue contribution is a third.

Led by the jump in growth from China, the US and the UK, most analysts have pegged FY14 volume growth at 12-15 per cent over the FY13 number of 372,000. Analysts expect JLR to do better than its global peers and grow its volumes at 10-15 per cent over FY13-16.

Audi, Daimler and BMW are expected to grow at half that number. Higher volume and margin estimates and an improved outlook in the US and China (45 per cent of revenues) has led analysts to give a higher valuation to JLR.

Audi, Daimler and BMW are expected to grow at half that number. Higher volume and margin estimates and an improved outlook in the US and China (45 per cent of revenues) has led analysts to give a higher valuation to JLR.

...

JLR keeps Tata Motors in cruise control

Image: A model poses with a Jaguar XF in New Delhi.Photographs: Adnan Abidi/Reuters

At Rs 354, the stock is trading at 7.6 times its FY15 estimates. Most analysts have a one-year target price of Rs 390-400. Money managers though advise investors to accumulate the stock for the longer term.

Manish Sonthalia, Senior Vice-President and Fund Manager at Motilal Oswal AMC-PMS, says: “While near-term gains are priced in, the triggers for the stock will come from the JLR side (domestic business will take time to recover) on the product launches and higher monthly volumes. The second half of FY14 is expected to be strong and my estimate for FY14 JLR volumes is at 425,000.”

...

JLR keeps Tata Motors in cruise control

Image: A model poses beside the Jaguar XF in Beijing, China.Photographs: Victor Fraile/Reuters

Echoing this view, Mehraboon Jamshed Irani, principal and head of private client group at Nirmal Bang, who has a target price of Rs 500 over an 18-month period, says investors ought to take a longer-term view.

“Investors will get a good price appreciation over that period given JLR is launching a slew of models in multiple new geographies (in addition to China, Russia). Given JLR accounts for almost all the profits, this is the best global play to own for Indian investors.”

...

JLR keeps Tata Motors in cruise control

Photographs: Source, Business Standard

Outperforming peers Nomura analysts Kapil Singh and Nishit Jalan say launches, improved product mix, higher share of China and better operating leverage will help JLR outperform its peers in a few years.

Volumes in China are expected to go up on a rise in dealerships by two-thirds to 200 and sales of RR Sport model. A slew of launches has meant JLR's model launches, according to Barclays Research, are at the highest in 20 years. Among the products lined up is a smaller version or baby Jaguar, which will help plug the gap in the portfolio at the lower end of the luxury spectrum.

...

JLR keeps Tata Motors in cruise control

Image: Jaguar XF Sportbrake model on display in Geneva, Switzerland.Photographs: Denis Balibouse/Reuters

Platform consolidation will help improve margins by increasing the number of models a platform from 1.3 to 2.5 by FY17 in line with other luxury car makers. Domestic volumes continue to disappoint with September numbers down 33.5 per cent year-on-year and 26 per cent fiscal year-to-date.

While discounts and weak demand have been the key negatives in the commercial vehicle space, higher diesel prices and cut in discretionary spends have weighed on passenger vehicles.

...

JLR keeps Tata Motors in cruise control

Image: Models pose beside a Jaguar XJ in Bangkok, Thailand.Photographs: Chaiwat Subprasom/Reuters

The company at the consolidated level, however, is expected to be among the few to be posting a strong growth in revenues (estimated to be up 26 per cent year-on-year) in Q2 led by JLR.

Revenue growth for JLR is expected on the back of a 29 per cent growth in volumes while margins are expected to increase by 127 basis points to 13.6 per cent, both due to operating leverage and better product mix. Consolidated net profit is expected to rise 37 per cent year-on-year.

article