| « Back to article | Print this article |

Aussie cyclone batters India's steel producers

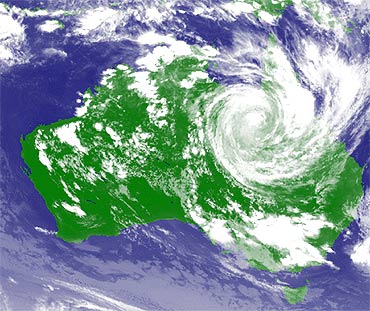

The economic impact of last week's cyclone Yasi and late December floods in Australia's major coal producing state of Queensland has washed up on Indian shores.

Raw material costs have escalated in the last two months for domestic companies heavily dependent on imported coal to fire power and steel plants.

Steel producers have already increased prices by 3-5 per cent, which will consequently hit the construction and automobile industries.

"Not only will some sectors be adversely affected due to the rising prices, there will be a snowball effect on other sectors as overall costs rise.

This will, in turn, further fuel inflation," said Sushil Maroo, director & group CFO, Jindal Steel & Power.

Click NEXT to read further. . .

Aussie cyclone batters India's steel producers

Steel Authority of India Limited, imports 10.5 million tonne of coking coal for its 13-million tonne steelmaking capacity.

"Around 70 per cent of the imported coal is from Australia. Our suppliers declared force majeure on December 24," lamented SAIL chairman C S Verma.

Other producers like Bhushan Steel depend entirely on imported coal.

Australia's Queensland accounts for 40-45 per cent of the world's export of coking coal. Supply disruptions because of the floods have driven up coking coal spot prices by $40-50 a tonne to $280-290 a tonne.

The added cost will squeeze the margins of India's non-integrated steel producers by 400-500 basis points in the next quarter, when increased spot prices result in higher contract rates.

"Coking coal accounts for about 45 per cent of the raw material costs of non-integrated steel producers in India," said Manoj Mohta, head of Crisil Research.

Click NEXT to read further. . .

Aussie cyclone batters India's steel producers

| COSTLY COMMODITIES | |

| DOMESTIC PRICES | |

| Commodity | % chg |

| Copper wire bars | 14.62 |

| Soy bean-Indore | 13.67 |

| Thermal coal-Chennai | 12.84 |

| RBD palmolein | 12.34 |

| Lead ingots | 10.19 |

| Zinc slabs | 8.00 |

| Wheat-New Delhi | 3.17 |

| Sugar S30 | -3.30 |

| INTERNATIONAL PRICES | |

| Commodity | % chg |

| Wheat-CBOT | 23.15 |

| Lead | 16.64 |

| Copper | 16.52 |

| Zinc | 14.75 |

| Coal-Richards Bay fob | 14.70 |

| RBD palm oil-Malaysia | 14.69 |

| Sugar-NYBOT | 14.29 |

| Soybean-CBOT | 11.93 |

| Iron ore-China cfr | 11.47 |

| Between Dec 1, 2010 and Feb 3, 2011 | |

Click NEXT to read further. . .

Aussie cyclone batters India's steel producers

To make matters worse, iron-ore prices have shot up by 11.47 per cent in the last two months.

While rising ore prices may not have a direct impact on steel producers who have captive mines, those who don't face substantially higher costs.

National Mineral Development Corporation has already raised iron-ore prices by 5.22 per cent for the January-March quarter and indicated that from the April quarter, prices would be raised further.

India's steel industry has more reason to worry, as there is no clarity on coal supplies beyond this quarter.

Uttam Galva director Ankit Miglani says if supplies from Australia don't resume soon, steel production would be hit.

Click NEXT to read further. . .

Aussie cyclone batters India's steel producers

Most Indian steel plants use blast furnaces, which require coking coal.

"Prices of coking coal have nearly doubled over the last few months and this has put immense pressure on costs," said Miglani. Uttam Galva has been buying coal in the spot market.

"India is increasingly becoming dependent on imported coal, even though we have the third-largest coal deposits in the world. Domestic coal prices largely have long-term linkages, but any change in international prices will have a bearing on domestic prices," explained Ajit Ranade, chief economist at the Aditya Birla Group.

Click NEXT to read further. . .

Aussie cyclone batters India's steel producers

Several power players like Tata Power, which has so far depended on coal supplies from Indonesia, are in talks with coal mines in Australia to augment supplies of coking coal.

But that does not seem like a possibility now.

The price of thermal coal, which is used by power plants, is also going up due to the damage at Australian mines.

International negotiations for annual supply contracts are expected to begin next week and prices for 2011-12 could settle at $130-145 a tonne, compared with $98 for the current financial year, industry sources claim.

Nickel and copper mines in Australia too have seen partial or total shutdowns. Cyclone Yasi shut Australia's QNI nickel refinery, Century zinc mine and Mt Isa copper refinery, as the cyclone began pounding the northeast coast last Wednesday.